High Frequency Trading Doesn't Harm Investors and Other Absurdities

From Nanex:

From the 1990's through the end of 2006, electronic trading increased transparency which

attracted liquidity, leading to to narrower spreads and greater market stability.

The graphic in this recent

New York Times article shows the steady reduction in trading costs

up until about 2006. Since that time, trading costs have

not changed significantly

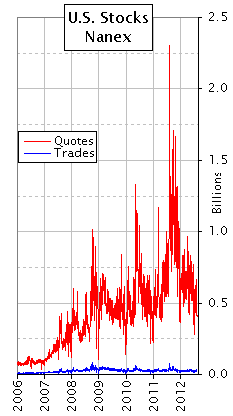

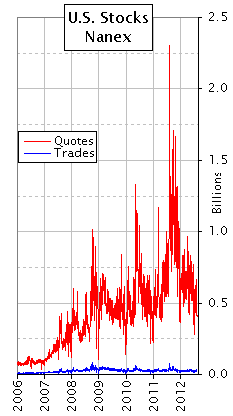

on the execution side but on the analysis side (not factored into the New York Times

article), both the number of quotes

and the cost

of receiving and processing them has exploded.1 Spreads

have also become considerably

less stable.

The benefits, but not the higher costs, are claimed by

High Frequency Trading (HFT) proponents, who paint

HFT critics as Luddites. This is often accompanied by hysterical charges of wanting to take

the industry back

to specialists and floor trading, and comparisons to buggy whip manufacturers. Nothing can be further from the truth.

The choice is not between HFT and floor trading, the choice is between HFT and transparent

electronic trading.

Transparency means having more (accurate) information to make informed decisions. For

example, you can determine the stability of a stock quote by comparing the price

quoted with the price received. Transparency also means having more choices and knowing

the consequences of those choices: such as the choosing which exchange to send your

stock order and then knowing how the order was executed. As far as the investor is concerned,

market transparency has a long way to go. Consider:

Amazon gives you more information about a $20 order than your broker

gives you about a $20,000 stock trade.

And if you only knew where your stock order went....MORE