Bernanke has investors stretching for yield so they go to the utes. Unfortunately it is a trap for the unwary.

First off these are equities which means they are: a) residual claims on the cash-flow b) the longest dated paper

(what's the difference between a bond and a fund manager? A bond matures)

Any uptick in interest rates creams the common hardest. Sure the preferreds and the bonds take the rates up/price down teeter-totter hit, with variations based on maturity, covenants, convertibility etc., like the great Tolstoy quote "All happy families resemble one another, each unhappy family is unhappy in its own way" each unhappy instrument reacts in its own way but in the case of the common the move is magnified by a and b, above.,

I'll do a post on the math somewhere down the road, for now, on to the charts.

From Dragonfly Capital:

Does it surprise you that as the broad indexes are making new highs, utilities are starting to look attractive again? It shouldn’t. After massive runs higher through 2011 they have all corrected back toward their 50 and 100 day Simple Moving Averages through a combination of price pullbacks and time. This has also left many of them sporting dividend yields over 4% again. Whether these foretell of a market pullback or just a rising tide lifting all boats, they provide a good core to your portfolio. Here are 3 that are ready to head higher.

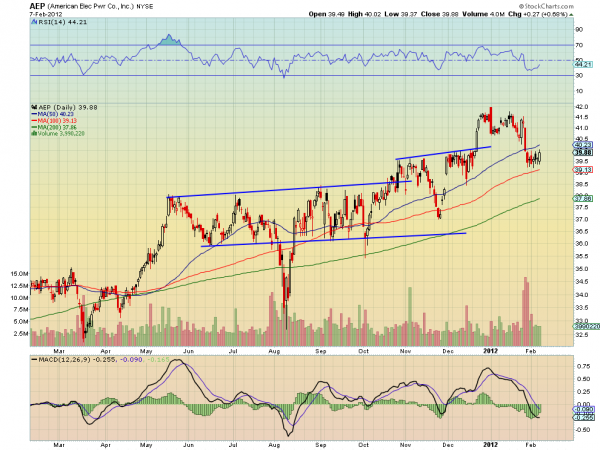

American Electric Power, $AEP

American Electric Power, $AEP, was nearly 10% above it’s 100 day Simple Moving Average (SMA) at its peak on January 1. Now it has pulled back between the 50 and 100 day SMA’s and is building a base. Tuesday it printed a strong bullish candle and it has support for more upside from a Relative Strength Index (RSI) that has turned back higher and an improving Moving Average Convergence Divergence (MACD) indicator. The dividend yield on this one is currently 4.7%....MORE