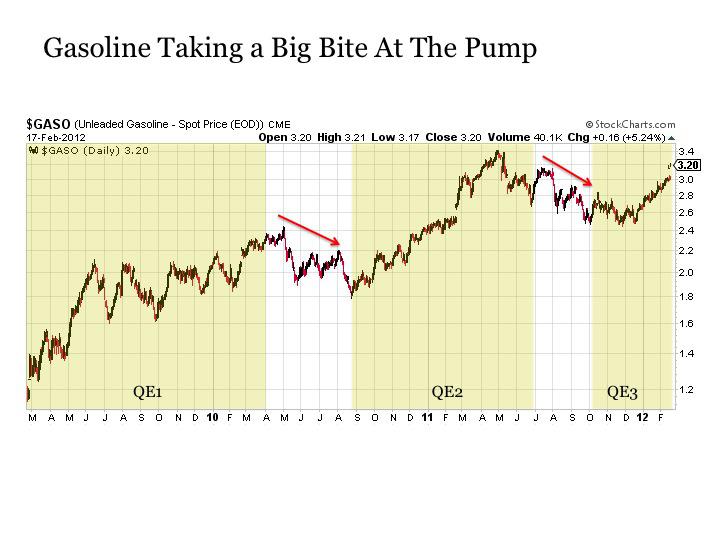

A couple charts from Eric Parnell posted to Seeking Alpha:

click to enlarge

And:

...Gasoline

prices have followed a predictable trend since the first days of Fed

stimulus. During QE1, gasoline prices skyrocketed by +118%. Once QE1

ended in April 2010, gasoline prices immediately dropped by -27% in a

matter of months, and this occurred during what is typically the strong

summer driving season. Once QE2 was delivered to the market in August

2010, gasoline prices jumped another 92% by the end of this stimulus

program in June 2011. Once again, the moment QE2 ended, gasoline prices

retreated another -28% in a matter of months. Finally, since the latest

Fed stimulus program along with the European Central Bank's own LTRO

program, we've seen gasoline prices skyrocket another +30%. What is even

more irksome is that much of this rise in gasoline prices has occurred

during a time when gasoline consumption has been falling. Have the laws

of supply and demand been repealed? No, they've just been severely

distorted by policy action....MORE

...Gasoline

prices have followed a predictable trend since the first days of Fed

stimulus. During QE1, gasoline prices skyrocketed by +118%. Once QE1

ended in April 2010, gasoline prices immediately dropped by -27% in a

matter of months, and this occurred during what is typically the strong

summer driving season. Once QE2 was delivered to the market in August

2010, gasoline prices jumped another 92% by the end of this stimulus

program in June 2011. Once again, the moment QE2 ended, gasoline prices

retreated another -28% in a matter of months. Finally, since the latest

Fed stimulus program along with the European Central Bank's own LTRO

program, we've seen gasoline prices skyrocket another +30%. What is even

more irksome is that much of this rise in gasoline prices has occurred

during a time when gasoline consumption has been falling. Have the laws

of supply and demand been repealed? No, they've just been severely

distorted by policy action....MOREMandatory correlation ≠ causation disclaimer,