October should provide a very interesting Q3 earnings season. We have been very bullish on the past nine earnings seasons. We have our concerns about the tenth one. We won’t be surprised if there are more negative earnings surprises this time and lots of cautious guidance about Q4’s outlook. The biggest negative is likely to be that sales and earnings in Europe slowed significantly during the quarter, and are likely to worsen over the rest of the year.

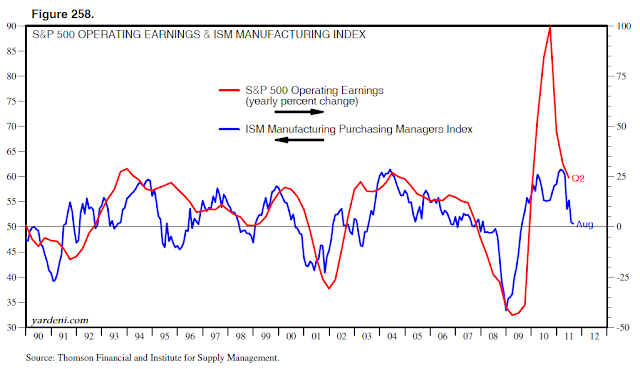

US domestic sales and earnings could also be disappointing given the weakness in all the Fed and ISM surveys of business during July and August. There is a strong correlation between S&P 500 operating earnings on a year-over-year basis and the ISM purchasing managers index (PMI) for manufacturing. This index dropped from the most recent cyclical high of 61.4 during February to 50.6 during August. This suggests that the year-over-year growth rate in S&P 500 operating earnings is heading towards zero, unless there is a surprising rebound in the PMI over the rest of the year....MORE

Friday, September 16, 2011

Earnings Heads Up: The Purchasing Managers Index-Manufacturing and Q3 S&P 500 Earnings (SPY)

From Ed Yardeni's Dr. Ed blog: