The government's dealings with AIG are foul, from the first $85 Billion tranche of bailout loot two years ago to this latest.

From Kid Dynamite via Felix Salmon at Reuters:

A second look at the AIG deal

Well done to Kid Dynamite for doing the math on the way that we taxpayers are swapping our AIG debt for equity in the company. There are three big problems here:

KD has a query in with Treasury about all this; it’ll be interesting to see how they respond.

- The fact that we’re doing this conversion in the first place. The preferred stock we currently own pays a regular coupon, while the equity we’re swapping it for was described as worthless by AIG itself not so long ago.

- The fact that as part of the deal we’re giving current AIG shareholders free warrants to buy stock at $45 per share. Which is very generous of us, but what have they done to deserve this?

- Most importantly, the fact that the stock we’re swapping into is worth less, at current valuations, than the preferred stock we’re swapping out of. To the tune of about $6.6 billion.

The only thing I’d note here is that there isn’t a secondary market for the preferred stock we’re swapping out of. So while its face value might be $72.1 billion, its actual market value might well be 10% or more below that figure. In which case it can be argued that the government is getting a good deal here, assuming that it’s actually able to sell its stock into the secondary market at something approximating current levels.

Still the government strategy here does seem to be based on the theory that “the market can remain irrational longer than you can remain insolvent-”...MOREI'll come back to AIG on Monday. For now I'll riff on that cute little play on the quote attributed to Keynes:

"Markets can remain irrational a lot longer than you and I can remain solvent."If he did utter the line it was probably due to his disatrous attempts at commodity and foreign exchange trading:

John Maynard Keynes: Money Manager (Couldn't Trade Lard to Save His Life)I prefer:

Keynes on Economists

The study of economics does not seem to require any specialised gifts of an unusually high order.

Is it not, intellectually regarded, a very easy subject compared with the higher branches of philosophy and pure science? Yet good, or even competent, economists are the rarest of birds. An easy subject, at which very few excel! ...We have more. In the lard post I mentioned that J.M.K. probably traded on material non-public information.

He underperformed the roaring British market in 1928 and '29.

He underperformed the collapsing British stock market from 1929 through 1932.

I re-ref'd on the thought in:

Investing Tips from the World's Richest Economist

No not Paul Krugman. The columnist and Laureate knows how to earn money as exemplified by his lending his name to Enron for $50,000 for four days work.

Judging by his temperament on the Sunday talking head circuit (there's that earnings power/branding again), I would think he's more of a hoarder rather than an investor, speculator or gambler.

And no, it's not John Maynard Keynes.

We had a look at Keynes' investing style in "Keynes The Money Manager". After a disastrous start in currencies, which led to the observation attributed to him by A. Gary Shilling: "Markets can remain irrational a lot longer than you and I can remain solvent."

The performance of the Chest Fund (a sidecar of the Kings College endowment) was indeed impressive.

However, it now appears that Keynes only achieved positive results starting in 1932.

It is probable that this timing indicates he was trading on inside information, knowledge of the British government's abandonment of the gold standard. He was an adviser to the gov. and pushed the policy....

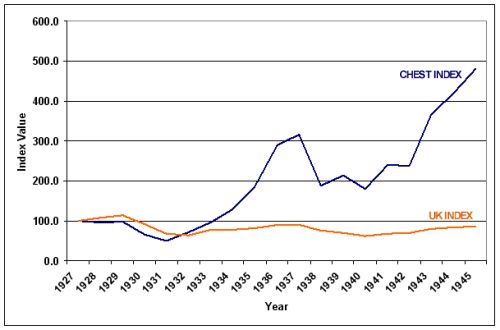

Here is a chart of his record with the college:

The performance of Keynes’s fund from 1927 to 1946 is shown below. During these years the Chest grew at an annual compounding rate of 9.1 percent while the general British stock market fell at an annual compounding rate of slightly under 1 percent.

Chest Fund Performance 1927 to 1946

The whole thing is worth a read.

It is estimated that Keynes' fortune would translate into $35 million in 2010 buying power.

Here's the big dog, presented by professor Mark Skousen via The Daily Reckoning:

How David Ricardo Became The Richest Economist in History...