From ZeroHedge:

With the dollar surging, and with correlation momos no longer having a clue what to do courtesy of all correlations having recently broken down, here comes Albert Edwards to pour even more cold water on the rally, prophecying that the next leg of the bear market is just around the corner.

At this time of year I normally get requests for year-end forecasts. My erstwhile colleague, James Montier, always used to tell me never to offer pin-point forecasts as they are a hostage to fortune (in addition, he felt passionately that investing should not be based on what he termed the folly of forecasting).

But when I do give forecasts in a moment of weakness, often they appear extreme. Some clients have taken such umbrage that they try and get me fired! With that pressure not to stray too far from consensus, most sell-side analysts? forecasts end up as consensus mush ? and if they do deviate from consensus it is almost always on the bullish side. The industry quickly forgives a bull who is wrong whereas an erring bear must be hunted down, hung, drawn and quartered. Hence the industry gets what it deserves: economic and market forecasts that either call for mean reversion or which stick close by the current spot rate (with their usual bullish bias). But in reality the world is seldom ever like that.

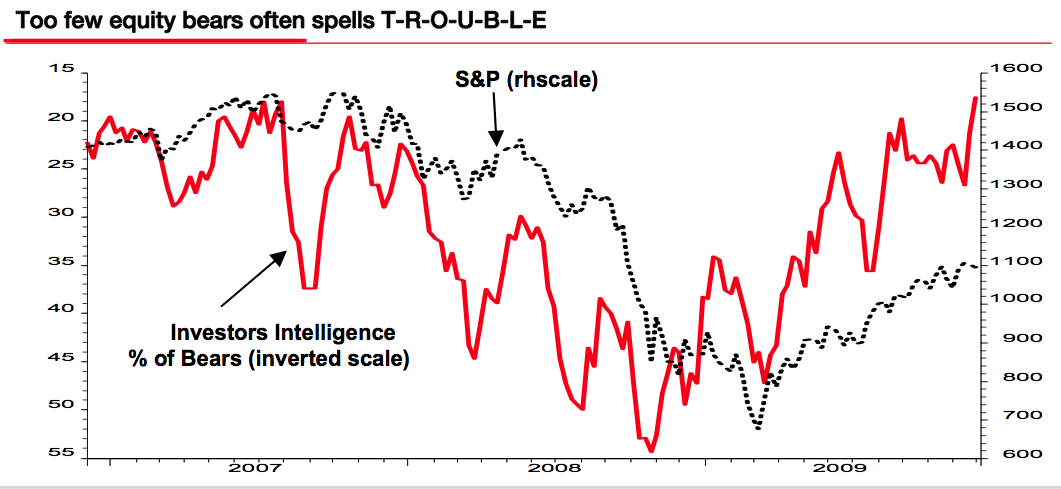

Regular readers will know that many of my more extreme predictions have had an annoying habit of eventually coming true, albeit with the usual heavy dose of poor timing. Certainly when I see the current extremely low number of equity bears (the lowest since the market top of 2007 - see chart below), the likelihood is that the next leg of the long-term structural valuation bear market is closer than people might realise.

Next on plate: poor technicals and an H2 rally that has been running almost exclusively on fumes and liquidity rebate seekers.

The very weak German new orders and production data for October has certainly put a dent in the cyclical optimism that has abounded for most of this year. My own view is that the markets will march to a very different drumbeat next year. Chartwise, the S&P seems to be stuck close to its 50% retracement level from the October 2007 peak. In addition, many technical analysts are noting the poor volume and the divergence of the Relative Strength Index (RSI) which has made lower highs through the rally in the second half of this year (see chart below). This is seen as the H2 rally lacking strong technical underpinnings.

And even as the secular trend is ever lower (think Japan), the likelihood of such bear market rallies is always present (again, think Japan)....MUCH MORE

The Big Picture also picked up on the report, focusing on a point dear to our hearts:

Too Few Bears Spells T-R-O-U-B-L-E

Albert Edwards of Société Générale makes the simple contrarian arguement that the low number of equity bears is a bad sign for equities:

“The current extremely low number of equity bears (the lowest since the market top of 2007 – see chart below), the likelihood is that the next leg of the long-term structural valuation bear market is closer than people might realise.”

Here is Edward’s chart:

Source: Datastream, SG Cross Asset Research

A point we've tried to make since the bears were crushed in the 2008 oil market:

October 20, '09: "Short Interest Declines Again (and Why it Matters)"

October 2, 2009 "Dow Jones on a Knife Edge":

My best guesstimate is that the downtrend over the last few weeks is a shakeout fakeout. The declines in short interest last month* means there is less buying power from short-covering, which would mean faster and deeper down-moves....

June 2, 2009: "Markets: What Happened to the Bears?"

...After talking to some folks who had been mauled [cute -ed] I decided that the short-sellers had just given up. It is no fun to be selling into the buying of Goldman and their long-only index clients, CalPERS, the universiy endowments et al.

So they said to hell with it. Oil continued to rise for another 33 days before peaking on July 9.

On July 29 I had this comment at Environmental Capital:

Mike @ 4:13,I am hearing the same things, almost word for word, this time about equities. It may be a tell from the market.

Two separate thoughts in that first post.

As best as I’ve can tell approx. 40% of the move from $80 to $147 (25-28 bucks) came from “speculation”. I use quote marks because of the terminology problems most of the talking heads have when the subject is commodities. Speculators in commodity parlance take the other side of a hedgers trade, thus performing a societal good.

The problem was, until last week, the shorts had been beaten up so bad by the relentless flow of “investor” money that were out of the game. The $10.75 uptick on June 6 was their capitulation.

They covered and said screw it.

.

I personally don’t see any reason to allow the “investors” in markets for consumables. If they want an inflation hedge, let them run gold to a bazillion per ounce.

I don’t want to be pedantic but the use of the term speculator when talking about the index investors is confusing, so I get overly precise.

The fact that final demand didn’t move fast enough to maintain VLO’s margins is very telling in the “speculation vs. demand” argument.

.

When as accomplished a commodities trader as Paul Tudor Jones says oil is a bubble, I don’t need to hear the opinions of apologists or economists and other amateurs.

When he’s backed up by Wilbur Ross, who bought into a decrepit Indian airline as the most leveraged bet he could find on falling oil, I tune out the chatter.

.

The public pension funds said they were long term investors.

They just passed 20% in declines. The next 20% will test their mettle

So where are the bears? Yves at Naked Capitalism may have had a sighting.

They appear to be on R&R, getting ready to go back to work: