...Nobody - and I do mean nobody - is talking about what this sort of volume pattern means. Well, I will: this is the sort of pattern that precedes an all-on equity market collapse. It strongly implies that the only volume support that the market has is from "hot money" speculators. Lest you think this is sustainable let me point out that just a few weeks ago the very same so-called "commentators" said the same thing about China's market. Here's what happened:

(Go to MT for larger view)

The white box down below is the target on the break downward out of that flag last night - the top of the box is the critical "must hold" level from the first retrace off the bottom and the bottom of the box being the the start of the entire move. If they're lucky the market holds around the 250-275 level, but I wouldn't bet on it....

Monday, August 31, 2009

China: Market Chart of the Day

Economy: "Our quarter-century penance is just starting"

Never in modern times has there been such a flat contradiction between the euphoria of markets and the stern warnings of officialdom at central banks and financial watchdogs.

Corporate credit has seen the steepest rally in almost a hundred years, according to Morgan Stanley. Hedge funds are reviving the final bubble play of early 2007, writing put options on long-dated "volatility" contracts to wring out extra profit.

It is as if the Great Contraction – as the Bank of England now calls it – was just a random shock, as if we should naturally expect "V-shaped" resurgence to take us back to where we were. Yet that is what precisely we are being told will not and cannot happen.

"The current financial crisis is unlike any others," says the Bank for International Settlements. Lasting damage has been done. The "cumulative output loss" is likely to reach 20pc of GDP in the major economies.

The message is the same at the International Monetary Fund. "The world is not in a run of the mill recession. The crisis has left deep scars. In advanced countries, the financial systems are partly dysfunctional," said Olivier Blanchard, the Fund's chief economist.

Mr Blanchard said an IMF study of post-War banking crises led to an unpleasant finding. "Output does not go back to its old trend path, but remains permanently below it."

Then the sting: we are exhausting the limits of fiscal stimulus. "The average ratio of debt to GDP in the G-20 economies was high before the crisis, and is forecast to exceed 100pc in the next few years".

We cannot add debt, so the IMF says we must draw down our future pensions and future health spending to keep today's economy afloat. "A modest cut in the growth rates of entitlements can buy substantial fiscal space for continuing stimulus."

Shouldn't bulls be sobered that the bastion of hard-nosed orthodoxy feels the need to talk in such terms, or that White House officials are preparing the ground for another round of emergency spending even as it reveals that fiscal deficits will reach $9 trillion over the next decade. This is $2 trillion worse than feared in March, and based on rosy growth assumptions.

It has certainly alarmed US retail tycoon Howard Davidowitz. "As a country we are out of control, we're in a death spiral," he said....MORE

"As hybrid cars gobble rare metals, shortage looms". And: "California mine digs in for "green" gold rush" (GS)

Most of our prior posts on rare earth elements can be found linked in last week's "Wind: "World faces hi-tech crunch as China eyes ban on rare metal exports" Two from Reuters:

The Prius hybrid automobile is popular for its fuel efficiency, but its electric motor and battery guzzle rare earth metals, a little-known class of elements found in a wide range of gadgets and consumer goods.That makes Toyota's market-leading gasoline-electric hybrid car and other similar vehicles vulnerable to a supply crunch predicted by experts as China, the world's dominant rare earths producer, limits exports while global demand swells.

Worldwide demand for rare earths, covering 15 entries on the periodic table of elements, is expected to exceed supply by some 40,000 tonnes annually in several years unless major new production sources are developed. One promising U.S. source is a rare earths mine slated to reopen in California by 2012.

Among the rare earths that would be most affected in a shortage is neodymium, the key component of an alloy used to make the high-power, lightweight magnets for electric motors of hybrid cars, such as the Prius, Honda Insight and Ford Focus, as well as in generators for wind turbines.

Close cousins terbium and dysprosium are added in smaller amounts to the alloy to preserve neodymium's magnetic properties at high temperatures. Yet another rare earth metal, lanthanum, is a major ingredient for hybrid car batteries.

Production of both hybrids cars and wind turbines is expected to climb sharply amid the clamor for cleaner transportation and energy alternatives that reduce dependence on fossil fuels blamed for global climate change.

Toyota has 70 percent of the U.S. market for vehicles powered by a combination of an internal-combustion engine and electric motor. The Prius is its No. 1 hybrid seller.

Jack Lifton, an independent commodities consultant and strategic metals expert, calls the Prius "the biggest user of rare earths of any object in the world.">>>MORE

Privately held MolyCorp sports Goldman among it's investors. [go figure -ed]

The future of wind farms and hybrid cars may well hinge on what happens to a 55-acre (22.3-hectare) hole in the ground at the edge of California's high desert.

The open-pit mine at Mountain Pass, California, holds the world's richest proven reserve of "rare earth" metals, a family of minerals vital to producing the powerful, lightweight magnets used in the engines of Toyota Motor Corp's Prius and other hybrid vehicles as well as generators in wind turbines.

Seeking to replace China as the leading supplier of these scarce materials, Colorado-based Molycorp Minerals LLC plans to reopen its long-idled quarry to resume extracting and refining thousands of tons of rare earth ore in the next few years.

Last month, Molycorp reached a joint venture deal with Arnold Magnetic Technologies Corp. of Rochester, New York, to make "permanent" magnets from rare metals at Mountain Pass.

Backed by hundreds of millions of dollars from equity investors, including Goldman Sachs, Molycorp aims to avert a looming rare-earths supply crunch that threatens to muffle the green-technology boom.

"The world has been looking for an alternative to these rare-earth permanent magnets for over 20 years, and one has not been found," Molycorp chief executive Mark Smith said. "What Molycorp is proposing as a business strategy is to fill that supply chain and go all the way from mining to magnets."

Success hinges on Molycorp's ability to operate the mine and its processing facilities much more efficiently than in the past.

At the peak of its operations two decades ago, the mine produced 20,000 tonnes of rare earth oxides a year, accounting for the entire U.S. supply and about a third of the world's total. Most of the rest came from China.

CHINA FACTOR

But as Chinese production and exports grew through the 1990s, rare earth prices worldwide plunged, undercutting business for Molycorp, then owned by oil company Unocal....MUCH MORE

Insider Selling in August Soars to 30.6 Times Insider Buying,

SAUSALITO, Calif., Aug. 28 /PRNewswire/ -- TrimTabs Investment Research reported that selling by corporate insiders in August has surged to $6.1 billion, the highest amount since May 2008. The ratio of insider selling to insider buying hit 30.6, the highest level since TrimTabs began tracking the data in 2004.

"The best-informed market participants are sending a clear signal that the party on Wall Street is going to end soon," said Charles Biderman, CEO of TrimTabs.

TrimTabs' data on insider transactions is based on daily filings of Form 4, which corporate officers, directors, and major holders are required to file with the Securities and Exchange Commission.

In a research note, TrimTabs explained that insider activity is not the only sign the rally is about to end. The TrimTabs Demand Index, which tracks 18 fund flow and sentiment indicators, has turned very bearish for the first time since March.

For example, short interest on NYSE stocks plummeted by 10.3% in the second half of July and margin debt on all US listed stocks spiked 5.9% in July, while 51.6% of advisors surveyed by Investors Intelligence are bullish, the highest level since December 2007.

"When corporate insiders are bailing, the shorts are covering and investors are borrowing to buy, it generally pays to be a seller rather than a buyer of stock," said Biderman....MORE

Here are the conditions that the TrimTabs minions have to endure, from our post "Obama Stimulus Slow to Buoy ‘Real Economy’ as Marin Awaits Cash":

Pity poor Marin. Caught between Sonoma and San Francisco.

Scraping by on a median income of $83,870 (highest in Cali.).

The squalor of Sausalito:

tiny small medium large original Image from Geoffrey Mainland

Okay, sarc off....

Elliott Wave pulls plug on stocks (and Obama)

The Elliott Wave Financial Forecaster was roundly hated by many MarketWatch readers because of its irritating pessimism throughout the late, lamented bull market.But the letter was also one of the very few to make money in during the Crash of 2008. ( See Dec. 17, 2008 column.)

In fact right now, it looks like pessimism has paid off. Over the past 12 months through July, EWFF is up 11.4% by Hulbert Financial Digest count, versus negative 20.03% for the dividend-reinvested Wilshire 5000 Total Stock Market Index.

Over the past three years, the letter has achieved an annualized gain of 3.58%, against negative 5.78% annualized for the total return Wilshire 5000. Over the past 10 years, the letter has achieved a 1.2% annualized gain, compared to negative 0.26% annualized for the total return Wilshire.

It's easy to sniff at this modest return. But considerably more than half the 180+-plus letters followed by the HFD lost money over the last 10 years. That's what happens when you have a crash.

And EWFF achieved this return with notably low risk. Indeed, on a risk adjusted basis, it has beaten the market over the nearly 30 years that the HFD has been following it -- a remarkable achievement given its radical stands. (Both ways. Presiding Elliott Waver Bob Prechter was controversially bullish in the early 1980s, contrary to his image among a later Wall Street generation.)

But here's the problem: Over the year to date, EWFF is up just 0.1% versus 12.5% for the Wilshire.

This is ironic, given that EWFF was an early proponent of the view that a rally, albeit probably a bear-market rally, was coming. ( See June 29 column.)

True to the Elliott Wave tradition, EWFF is responding by boldly calling a market turn rather than submitting to the trend.

Its current issue, dated Aug. 27, says: "The stock market is poised to complete the bear-market rally from March. Besides achieving to price objectives originally forecast in March, the five-month push has generated optimistic extremes that exceed those that were recorded at the October 2007 all-time high.">>>MORE

Indian Moon Mission "Terminated". And: The Congolese Space Program (off-topic)

From ScienceInsider:

India’s maiden moon mission, Chandrayaan-1, has come to a shuddering and unexpected halt. On 29 August, the Indian Space Research Organization lost all contact with the spacecraft after a catastrophic failure of its electronics, said ISRO Chair G. Madhavan Nair.In announcing the mission’s “termination” at a press conference yesterday, Nair declared Chandrayaan-1 “a complete success” on the grounds that the spacecraft had gathered some 70,000 images and met “more than 95%” of its scientific objectives....MORE

From Foreign Policy's Passport blog:

The Congolese Space Program

Wed, 08/26/2009 - 4:55pmFun stories from the Democratic Republic of Congo are pretty hard to come by, but the third launch of the Congolese Space Program is pretty cool, even if "Troposphere 5" didn't get very far. I feel kind of bad for the rat astronaut on board, though. (Video in French.)

Infrastructure Stocks: The Next Bubble of "Mammoth Proportions," Says Altucher (ASTE; LNN; NUE;TIE; VMC)

From Yahoo Finance:

Brace yourselves. Only a year after the housing and credit bubble officially burst with the Lehman Brothers bankruptcy, a new "bubble of mammoth proportions" is starting to grow, says James Altucher, managing partner, Formula Capital.

Bubble 3.0 (Internet and housing being bubbles 1.0 and 2.0, respectively), comes thanks to the stimulus bill. "We have a trillion dollars coming. Only 10% of it's been spent. Interest rates are near zero." Altucher's advice: follow the stimulus dollars and invest in the infrastructure stocks that are rebuilding America.

Topping his 'buy' list:

- Vulcan materials

- Astec Inudstries

- Lindsay Corporation

- Nucor Steel

- Titanium Metals (Disclosure: Altucher owns Titanium Metals)

But what about the growing government debt that funds these projects?

Altucher isn't concerned....MORE

Ladies and Gentlemen: The Richter Scales!!

When doing a search on Google for Warren Buffett's quote:

He lied like a Finance Minister on the eve of a devaluation.you'll see Climateer in the #2 position and Mr. Altucher in #4. Here are a couple of our posts that link to him:

James Altucher on Really Smart Investing

10 Ways the World Could End and How to Play Them

China Stocks ‘In Deep Bubble,’ May Drop 25%, Xie Says

China’s economy isn’t “sustainable” and the benchmark Shanghai Composite Index may fall another 25 percent, former Morgan Stanley Asian economist Andy Xie said in an interview.“The market is in deep bubble territory,” Xie, who correctly predicted in April 2007 that China’s equities would tumble, told Bloomberg Television.

The Shanghai index plunged 6.7 percent to 2,667.75 today, the most since June 2008 and entering a bear market, on concern a slowdown in lending growth may derail a recovery in the world’s third-largest economy. Xie said the index “should be 2000 or less.”

The Shanghai gauge slumped 22 percent this month, the worst performer among 89 benchmark indexes tracked by Bloomberg, as banks reined in lending to avert asset bubbles and policy makers advised industries such as steel and cement to curb overcapacity. The decline stopped a rally that had sent the measure up 103 percent from a November low on prospects the government’s 4 trillion yuan ($586 billion) stimulus program and a record amount of new credit would ensure the economy grows at least 8 percent this year.

“The local market bears are convinced that tightening is already underway,” said Howard Wang, head of the Greater China team at JF Asset Management, which oversees $50 billion. Only “a very strong set of macro numbers in August” or “stronger statements from central authorities” would change this trend, Wang said.

Global Tumble

The tumble in China stocks send the MSCI World Index of 23 developed nations down 1 percent at 10:17 a.m. New York time. The Bank of New York Mellon China ADR Index, tracking American depositary receipts, lost 2.6 percent, led by commodity producers.

At least 150 stocks on the 898-member Shanghai index dropped by the daily 10 percent limit. Industrial Bank Co. and Aluminum Corp. of China Ltd. tumbled by the permitted cap after Caijing magazine reported new loan growth this month may be almost half that of July. Lower profits dragged Baoshan Iron & Steel Co., the nation’s biggest steelmaker, and China Southern Airlines Co. down at least 7 percent....MORE

Climateer Line of the Day: Venture Capital Edition

"Fundamentally VCs are risk adverse – they want no risk in the deal, if we could handle risk we'd be entrepreneurs."

– Victor Westerlind, General Partner at Cleantech VC firm Rockport Capital

Bove On Banks: Short-Term Bear, Long-Term Bull

...The best news, surprisingly, comes with home equity lines of credit, where

many homeowners seem willing to pay “even when their homes might be upside down in value.” Big upside to the tune of 300%-500% earnings growth coming for

banks…but not until 2011-2015, Bove concludes....MORE

From Clusterstock comes a slightly more detailed version:

Bove: What Was All That Hysteria About Banks About?

...OK. So things are still a little bit on the eh-side, but give it some time,

and bank earnings will grow by 300% to 500% from 2011 to 2015, he says.

“The swing factor in bank earnings has always been and will always be loan quality.

In recent years, the deterioration in loan quality has destroyed bank earnings

and management credibility. This pressure will continue through the remainder of

this year. By the second half of 2010, loan quality could begin to improve based

on an expected improvement in the economy and some signs that unemployment has peaked. Banks earnings will begin an unusually rapid climb at that time. The expectation is that earnings will grow by 300% to 500% from 2011 to 2015.”

Also, could people please come to an agreement for valuing banks? When that whole

“hysteria” gripped the nation, everyone was all about that tangible common equity business. Then, when people started to relax a bit, valuation metrics changed and banks were to be valued on their normalized earnings. But that didn't help either....MORE

Wind Farms Set Wall Street Aflutter

After nearly a six-month lull, Wall Street is getting back into the business of financing new wind farms.

Morgan Stanley and Citigroup Inc. have invested $100 million each to finance separate wind farms this month, taking advantage of a brand-new federal program that is paying substantial cash grants to help cover the cost of renewable energy investments.

Bankers say this is the beginning of an active pipeline of new wind-farm financing, as well as investment in large solar installations and geothermal facilities. Project developers and Wall Street appear to be viewing the federal cash grant program as such a good deal, industry experts say, it may grow much larger than its Washington creators expected.

"The money is coming back," says Ethan Zindler, head of North American research at consultant New Energy Finance Ltd.

Under the program, the government will give a cash rebate for 30% of the cost of building a renewable-energy facility, awarded 60 days after an application is approved. Investors are also given valuable accelerated depreciation deductions, which help offset taxes.

The Energy and Treasury departments have said they expect to spend $3 billion on the program, which started July 31 and runs through the end of 2010, and was part of the stimulus bill. But a government spokesman says requests for $800 million in grants were submitted during the first four weeks.

Some Wall Street bankers say they expect applications to grow to $10 billion, based on projected wind-power installations.

"We see opportunities and we are pursuing them pretty actively," says Kevin Walsh, managing director of General Electric Co.'s GE Energy Financial Services division, which was a major financier of wind deals in the past.

The strong interest echoes the $3 billion cash-for-clunkers program that provided incentives to trade in older, lower-gas mileage cars, and which was quickly overwhelmed by demand. "We are concerned that this may evolve into a cash-for-clunkers version 2.0," says a spokesman for Rep. Darrell Issa, a California Republican....

![[wind energy markets]](http://s.wsj.net/public/resources/images/MK-AY062_WIND_NS_20090830184834.gif)

...But the new cash grants are offering the potential for attractive returns. Several bankers interviewed said they expected deals to provide an annual return of anywhere from 9% to 15%....MORE

HT: Environmental Capital who write:

Big Money Returns to Wind Power–For How Long?It seems that after a year in the wilderness, Wall Street has finally rediscovered the virtues of investing in clean energy—not out of altruism, but in search of double-digit investment returns.Our colleague Russell Gold reports today in The Wall Street Journal that the Obama administration’s plan to juice clean-energy investment by changing how federal subsidies are handed out is paying dividends: Big banks including Morgan Stanley and Citigroup are underwriting wind farms worth more than $100 million each.

That’s partly a result of new government policy: For the first time, wind-farm developers have the option of receiving 30% of the cost of the project in cash, rather than getting tax credits over the life of the wind farm. The upfront cash turns clean-energy investment into a no-brainer: Bankers told the WSJ the new plan offers returns of up to 15%.

The program could be really big: While the government figured it might spend $3 billion to spur new projects, bankers and other observers figure the tally could rise as high as $10 billion through 2010. Crunching the numbers, that kind of government support could theoretically mean the installation of 15 gigawatts of new wind power—or roughly half of the entire U.S. wind-power capacity today.

Does that mean that clean energy, and particularly wind power, is out of the woods? Not entirely....MORE

"No Fundamental Value" For Fannie Mae and Freddie Mac - Analyst (FRE; FNM)

(FRE; FNM)"

From StreetInsider:

FBR Capital is reiterating their Underperform rating on FannieMae (NYSE: FNM) and Freddie Mac (NYSE: FRE) following the recent run-up in the shares. The firm believes there is no fundamental value remaining in FNM and FRE, particularly since the government owns 80% of each company.

The analyst commented, "To date, Uncle Sam has invested $96.3 billion in the GSEs, and we expect more government capital injections in the coming quarters. FNM and FRE shares have moved materially in the last two weeks on speculation that a reverse stock split will take place. However, we would note that even in the GSE's regulatory filings, the companies point out that their management teams are not in favor of reverse stock splits, despite the potential for the shares to be delisted from the NYSE. However, the boards of directors and regulators will impact the decision, and to our understanding, the decision on a potential reverse stock split has not been made. In our opinion, the regulators will not want to create a false sense of value in FNM and FRE shares and will likely shy away from reverse stock splits." >>>MORE

Let’s Wind Down Fannie Mae and Freddie Mac (FRE; FNM)

From Breakingviews via the New York Times:

Fannie Mae and Freddie Mac shouldn’t be allowed to languish in Uncle Sam’s arms. But as the anniversary of their seizure by the government approaches, the mortgage financing giants remain the biggest black holes in the financial firmament.Lawmakers seem content to allow the two companies, whose combined value of holdings and guaranteed securities is $5.4 trillion, to slowly expand. That’s a shame because forcing them to wind down their portfolios of mortgage-backed securities would be a good first step toward eventually deflating them.

The Obama administration won’t release its recommendations for what to do with the companies until February. This gives it time to wage battles in areas ranging from climate change to health care. These issues are already drawing heavily on the president’s political capital.

That may leave little appetite to tackle the problems at the two companies, which are government sponsored enterprises, or publicly traded entities created by the government. The firms have the popular support of some lawmakers and play an increasingly dominant role in the mortgage market. The United States has already committed up to $400 billion to cover the firms’ losses, providing enough of a cushion to tempt politicians to let the issue slide.

The problem arises from the companies’ dual roles. They have a public policy mandate to increase lending to the housing market. And they are supposed to reward shareholders. The conflict between these two goals caused the companies to nearly collapse.

Fannie Mae and Freddie Mac’s principal business of guaranteeing mortgages caused economic distortions that helped drive the housing boom. As private mortgage lenders pulled in their horns, the two companies’ share of the market grew from under 50 percent to around 80 percent by the end of last year, despite the fact that their aggregate portfolios have only increased by about 3 percent since their conservatorship.

Their success is the sticking point. Society benefits from the efficiency and lower costs derived from the standardization of mortgage pools, which allows them to be easily securitized. The government sponsored enterprises scale this advantage up significantly. Fannie alone has $2.8 trillion of guarantees on mortgage-backed securities....MORE

China's BYD says Buffett wants to raise stake (BRK.A: 1211.HK)

I'd have to guess that Warren and Charlie understand the economics of climate better than the punditocracy. They also know more about traders and trading. This knowledge might be what informs their thinking on cap-and-trad.

From Reuters:

* BYD expects to sell electric car in US in 2010

* BYD keen on mainland A-share listing, maybe in the next yr

* Multinational automakers in talks to buy BYD batteries

* Shares close up 8 pct in weak HK market (Adds details and analyst comments)

By Joanne Chiu

HONG KONG, Aug 31 (Reuters) - U.S. billionaire Warren Buffett intends to raise his stake in Chinese electric car and battery maker BYD Co Ltd (1211.HK), BYD's chairman said on Monday, sending shares in his company up 8 percent.

MidAmerican Energy Holdings, a unit of Buffett's Berkshire Hathaway (BRKa.N), bought 10 percent of BYD for $230 million or about HK$8 a share last September, sparking a massive rally in the stock. [ID:nN26317503]

"MidAmerican has always intended to raise its stake in BYD because it believes BYD has good prospects in the development of renewable energy, but we are still considering (whether to sell more)," BYD Chairman Wang Chuanfu told reporters on Monday.

BYD, Hong Kong's largest listed auto stock, also said it expects to sell its e6 electric car in the United States in 2010, a year ahead of schedule.

"BYD shares are not cheap at the current price level, but since the company's strategy is in line with Beijing's policy, and with the support of Buffett, the market is willing to pay a premium for that," said Ben Kwong, the chief operating officer of KGI Asia.

China's government has been encouraging local automakers to focus on more fuel efficient models and environmentally friendly technologies.

BYD shares rose 8 percent to close at HK$48.6 on Monday, more than six times what MidAmerican paid and valuing the company at about $13 billion. The benchmark Hang Seng index .HSI fell 1.9 percent.

AMBITIOUS PLANS

BYD has ambitious plans for its hybrid and rechargeable electric vehicles, aiming to sell as many as 9 million units by 2025 to take on heavyweights like General Motors [GM.UL] and Toyota Motor Corp (7203.T)....MORE

"Why Warren Buffett Is Wrong About Cap and Trade: Eric Pooley" (BRK.A)

There are others. Here's a quick overview of the Berkshire/MidAmerican position:

Warren Buffett on Cap-and-Trade (BRK.A)

Berkshire Hathaway's MidAmerican Energy on Waxman-Markey: "We Don't Much Care For It" (BRK.A)

UPDATE-- "Sokol: Markey seeks to intimidate" (BRK.A)

Climateer Investing on Carbon Trading and Traders

Friday, August 28, 2009

Recession Finally Hits Down on the Farm (CAT; DE)

HT: The Columbia Journalism Review's The Audit blog (column?) who write:The American farm, which has weathered the global recession better than most U.S. industries, is starting to succumb to the downturn.

The Agriculture Department forecast Thursday that U.S. farm profits will fall 38% this year, indicating that the slump is taking hold in rural America. Much of the sector had escaped the harsher aspects of the crisis, such as the big drop in property values plaguing city dwellers and suburbanites.

"It is safe to say that the global recession has finally shown up on the doorstep of the agriculture economy," said Michael Swanson, an agricultural economist at banking giant Wells Fargo & Co.

The Agriculture Department said it expects net farm income -- a widely followed measure of profitability -- to drop to $54 billion in 2009, down $33.2 billion from last year's estimated net farm income of $87.2 billion, which was nearly a record high. The drop in farm prices is likely to lead to a slower increase in food costs for American consumers, economists say.

The slump isn't affecting all farmers equally: Many are still reaping big profits while others are having a hard year. Farmers are accustomed to seeing their incomes swing widely, due to the vagaries of such things as Mother Nature and the oil market's impact on the price of corn-derived ethanol fuel.

For instance, sugar farmers are seeing the highest global prices in 28 years, in part because of harvest problems in India. But many dairy and hog farmers are barely holding on because of low prices and shrinking foreign demand.

The sector's expected profit decline is unusually steep, coming after two boom years. According to USDA calculations, its 2009 forecast is $9 billion below the 10-year average for farm profits.

Jay Roebuck, a 52-year-old dairy farmer in Turner, Maine, said he is falling behind on bill payments even though he has laid off two workers and reduced the rations of his cows. "This is by far the worst it's ever been," said Mr. Roebuck, who estimates he is losing $9,000 monthly.

For most Americans, the chill in the farm belt is related to one of the few positives they see in this economy: slowing inflation. Prices farmers are receiving for corn, wheat and hogs are down sharply from last year. Partly as a result, economists expect the Consumer Price Index for food to rise 3% this year, compared with 5.5% in 2008, which was the fastest annual rise in 18 years.

![[net farm income]](http://s.wsj.net/public/resources/images/P1-AR345_farmjm_NS_20090827190836.gif)

...Growers will probably cut back even more on their spending plans, making it harder for companies that sell such things as tractors, seeds and fertilizer to raise prices to farmers.

"There is likely to be more pressure on pricing," said Ann Duignan, an analyst at J.P. Morgan who follows farm-implement makers. She said Thursday that manufacturers will probably have the hardest time passing along higher costs to livestock operators, who are having the most financial difficulty....MORE

What’s Going Down on the Farm? Ask the Bankers

The devolution of The Wall Street Journal’s page one

Gawker had an interesting quote from an anonymous Wall Street Journal staffer this morning on the Mark Penn controversy.

“While the Mark Penn incident is as egregious as it is embarrassing, at this point, I think most of the newsroom is so emotionally numb that nothing surprises us anymore. Truly.”If you want a reason why, take a look at the paper’s storied page one these days, which reads more like Wikipedia than the WSJ page one of yore.

For instance, see today’s above-the-fold A1 story headlined “Recession Finally Hits Down on the Farm.” It has almost no reporting from the, you know, farm. In fact, it quotes more bankers than it does farmers: three to two. The farmers get 123 words.

So I searched “down on the farm” in Factiva to see how the Journal had covered this cliche on page one in recessions past....MORE

Natural Gas: "What Are the Odds?" (of a double on the Jan. contract)

Open interest in the $10 natural gas strike calls for this winter have ballooned over the last two weeks… from 1,783 to 11,051 in the January 2010 and from 881 to 8,848 in the February 2010. With the respective premiums trading in between $0.05 and $0.06 at the time of this jump, this “trade” amounts to a $9.5 million lottery ticket.See also:That is one way to look at it. Another way is to say, the trader(s) who wrote those calls just might think this is the easiest $9.5 million they ever pocketed. For instance, if you bought ATM January calls for $0.647 last night the $10 odds are greater than 6-to-1 against you. In other words, if you think there is better than a 16% chance January gas can move from $5.334 to $10 between now and December, then this trade is for you (16% × $4.019 payoff = $0.683 > $0.647 call premium).

Furthermore, if you go back seven years ago, to August 2002, the last time spot NYMEX Henry Hub gas traded below $3, you will see that six months later spot gas tied the previous high, $10.10. Therefore, you might surmise that the odds of a repeat of 2002 are better than 6-to-1. The only problem is, in February 2003 the market was rigged. It was mugged. It was hijacked by some thieving bastard(s). Thus, unless this/these same bastard(s) is/are back buying $10 strike calls with designs on rigging the gas market once again, we doubt the odds of a repeat are as short as 6-to-1.

So what happened back then in late February 2003? Spot gas (Mar’03) was trading in the low $6s on Friday morning, February 21st. Shortly after the NYMEX pits opened a propane barge exploded (within view of the NYMEX) at Port Mobil, Staten Island. This event provided a significant knee-jerk spike in the market, but by the time we went home for the weekend the market was well off its highs....MORE

Hedge fund bets millions that gas price will triple

Was that Hedge Fund Bet on a Triple in Nat. Gas Just a Bet on Cool Weather?

Energy Market and Economic Impacts of H.R. 2454, the American Clean Energy and Security Act of 2009

Performance of the Bailout Index (^QGRI)

| COMPONENTS FOR ^QGRI |

| Symbol | Name | Last Trade | Change | Volume |

| AIG | AMER INTL GROUP NEW | 50.23 | 130,483,161 | |

| AXP | AMER EXPRESS INC | 34.24 | 10,718,641 | |

| BAC | BK OF AMERICA CP | 17.98 | 187,664,659 | |

| BBT | BB&T CP | 28.39 | 8,395,506 | |

| BK | BANK OF NY MELLON CP | 28.93 | 6,491,285 | |

| C | CITIGROUP INC | 5.23 | 1,355,098,643 | |

| CIT | CIT GROUP INC (DEL) | 1.68 | 192,686,106 | |

| CMA | COMERICA INC | 26.73 | 2,075,366 | |

| COF | CAPITAL ONE FINANCIA | 36.73 | 4,755,515 | |

| FITB | Fifth Third Bancorp | 10.82 | 17,142,356 | |

| GM | ||||

| GS | GOLDMAN SACHS GRP | 164.42 | 7,026,525 | |

| HBAN | Huntington Bancshares Incorpora | 4.49 | 17,311,345 | |

| JPM | JP MORGAN CHASE CO | 42.92 | 27,231,069 | |

| KEY | KEYCORP | 6.68 | 14,537,226 | |

| MI | NEW M&I CORPORATION | 7.12 | 5,854,452 | |

| MS | MORGAN STANLEY | 29.51 | 14,205,869 | |

| NTRS | Northern Trust Corporation | 58.54 | 1,438,556 | |

| PNC | P N C FIN SVCS GR | 42.86 | 4,833,082 | |

| RF | REGIONS FINANCIAL CP | 5.97 | 27,694,594 | |

| STI | SUNTRUST BANKS | 23.68 | 10,319,805 | |

| STT | STATE STREET CP | 52.98 | 3,024,096 | |

| USB | US BANCORP | 22.43 | 12,394,651 | |

| WFC | WELLS FARGO & CO NEW | 27.30 | 35,370,319 | |

| ZION | Zions Bancorporation | 18.12 | 4,994,204 |

Here's the one-month chart, from Nasdaq:

QGRI

|

|

Gold War

Dennis Gartman, of the Gartman Letter - and who recently established a hedge fund, River Crescent, to put to work the buy and sell recommendations he publicises in his daily note - issued an interesting view on gold on Friday.

First, he presented the following chart of spot gold:

To which he commented (our emphasis):

According to Gartman, therefore, there’s a bit of a gold war being staged between some sizable but unidentified forces....MOREThe trading range is drawing down tighter and tighter as the bullish and the bearish forces face each other in the trenches at ever closer range. Soon one side shall have the other on the run; we’ll join the winning side, allowing others to be braver than we.

Fannie Mae, Freddie Mac: "Speculative Trading Lends Credence To “Rally Losing Steam” Thesis"

A disturbing recent trend has emerged in the U.S. equity market and many are pointing to it as a potential reason to worry that the massive market rally over the last six months may be running out of steam. Investment strategists are concerned that a recent rise in speculative trading activity is signaling that the market’s dramatic ascent is getting a bit frothy.

This kind of trading is typically characterized by lots of smaller capitalization stocks seeing massive increases in trading volumes and dramatic price swings, often on little or no headlines warranting such trading activity. Indeed, in recent weeks we have seen a lot of wild swings in small cap biotechnology stocks as well as some financial services stocks that were previously left for dead.

For instance, shares of beleaguered insurance giant AIG (AIG) soared 27% on Thursday on six times normal volume. Rumors on internet message boards (not exactly a solid fundamental reason for a rally) which proved to be false were one of the catalysts for the dramatic move higher, which looked like a huge short squeeze....MORE

HT: MarketTalk who relays another link:

To be sure, other observers believe the “casino action” in these stocks ultimately won’t change prospects for the overall market. If these stocks are mini-bubbles, and they end up bursting sooner than later, don’t expect them to also take down the entire market, notes LA Times’ Money & Co blogger Tom Petruno.

He argues the summer rally’s largely been based on economic data pointing to the recession bottoming, and unless that changes, the rally has potential to run higher. From Petruno:

So when Wall Street gets back to work after Labor Day, it seems reasonable to assume that most investors will be far more likely to care about the latest economic numbers — and what companies are saying about third-quarter sales — than whether August’s small band of rocket stocks come crashing back to Earth.

Dow’s down 64; S&P 500 off 6.

Mining Equities: "Copper and gold still top but lithium adds a bit of flavour" (SQM)

The most in-demand mining stocks among the world's 100 biggest miners, by value, feature most commonly connections to copper, gold, and also to coal, and specialties such as uranium and lithium. There is also a notable presence of stocks with connections to India, currently supported by a country equity market that ranks as one of the world's best-performing, having supplanted China earlier this month, where equities are cooling off from 12-month highs on fears that liquidity could be reined in.......Seen on a 12-month basis, copper stocks have for some months ranked as the most in-demand among mining subsectors. This has been especially the case since early June, when global mining stocks as a grouping dipped sharply, and then started to move steadily upwards to 10-month highs as seen over the past week or so.

Over the past three months, investor portfolio flows have been net-positive into all mining subsectors. Reflecting and confirming its leading 12-month status, the listed copper subsector has been most in-demand, followed by nickel, Tier II iron ore, zinc, iron ore, Tier I platinum, silver, aluminium, platinum and molybdenum. The least impressive flows have been noted for the oil sands subsector, followed by oil, potash, uranium, gold and diamonds.

STOCK GROUPS

Value

From

From

US$ bn

high*

low*

Top 100 global miners

1511.15

-29.6%

155.9%

Copper stocks

115.46

-28.6%

282.5%

Zinc stocks

32.14

-26.4%

253.3%

Nickel stocks

32.14

-39.9%

219.6%

Silver stocks

22.02

-24.8%

272.1%

Gold stocks

287.21

-21.5%

164.4%

Gold ETFs

47.25

-16.6%

29.3%

Uranium stocks

28.08

-24.5%

157.2%

Oil stocks

2439.64

-24.4%

57.7%

...The world's biggest lithium producer, Sociedad Química, has been in strong demand....MORE

Runaway Train: China’s Worried About Over-Heated Clean-Energy Sector

Like Casey Jones, China’s wind and solar industries need to watch their speed.That’s the word after the Chinese government said “redundant projects” have surfaced in the emerging sectors of wind power and polysilicon, the raw material for solar panels, according to Xinhua.

Analysts following China’s renewable-energy market said the government’s announcement could slam the brakes on what has been a massive buildup of clean-energy manufacturing resources.

Even as the global market for solar-power gear has collapsed, Chinese production has plowed ahead—China’s polysilicon production capacity will jump to 86,000 tons by the end of the year, according to a recent report from China Reality Research Ltd. That would put even more pressure on plummeting silicon prices which are wracking the solar sector.

But that’s a molehill next to the mountain of wnd turbines China’s been pumping out, after it jumpstarted a domestic industry with an eye on dominating the fast-growing market.....MORE

The Future of Batteries

Here are some of the stories and blogs you might have missed at this week’s annual Almaden Institute held by IBM at its Almaden labs in San Jose, Calif.

Batteries were on everyone's mind at this year's Almaden Institute conference.

IBM held its annual confab this week at its Almaden Labs in San Jose, Calif. to discuss the problems that have yet to be hurdled in creating scalable renewable energy storage. The electric grid might be getting smarter to handle the transmission and distribution of energy generated by renewable sources like solar and wind power, but society demands an energy storage network that can keep up with and anticipate energy supply demand.

Here's a round up of what went down at Almaden:

• Hydrogen: The Fuel for Losers

The present hydrogen fuel cell needs to back to the R&D lab, says Burton Richter, the Paul Pigott professor of the physical sciences and a Nobel Laureate.• Study: Batteries to Add $14,400 to EVs, $5,900 to Plug-Ins

Adding batteries to a plug-in will add $5,900 to the cost of a car in 2035, said Daniel Sperling, founder of the Institute for Transportation Studies at UC Davis.• Will Electric Cars Count as Three to the EPA?

The "super credits" for electric cars were one of the more discussed nuances of the revised CAFE standards proposed by the Obama Administration earlier this year. Under the new standards, automakers will be required to boost their blended mileage to 35.5 miles per gallon by 2016, a 40 percent increase.• What's Next in Lithium Batteries?

Researchers are looking into improving the safety and performance of lithium-ion batteries, even as they examine next-generation lithium-based battery chemistries.• The World's Best and Most Impractical Battery?

Advances in lithium chemistry might one day lead to batteries that provide 10 times the performance of existing batteries and cost one-tenth the price, said Winfried Wilcke, IBM Program Director at the Almaden Institute.• Photos: IBM's Lithium-Air Battery 'High Concept' Car

IBM is one of a number of companies touting lithium-air batteries as an alternative to standard lithium-ion batteries.• The Limits of Lithium-Ion Batteries, According to Ford Motor Co.

Lithium-ion is the best battery technology now available for vehicles, but could tap out its promise by the end of the next decade.• Could Electric Cars Eliminate Foreign Oil?

If everyone swapped their cars for electric ones, could we bankrupt OPEC?• Martin Eberhard Has New Auto Gig

Tesla Motors co-founder Martin Eberhard is not going to the auto junkyard. Instead Eberhard is working on a new project in the automotive market.

Analyst Dumps Agriculture & Fertilizers (MOS, POT, MOO)

This morning is looking a little rough for some of the farming, agriculture, fertilizer, and potash stocks. We have seen a downgrade in the sector from UBS this morning. Potash Corp. of Saskatchewan, Inc. (NYSE: POT) and Mosaic Co. (NYSE: MOS) were both downgraded to Neutral from Buy by the analyst team at UBS today. This broad call is also going to have an impact on Market Vectors Agribusiness ETF (NYSE: MOO).

This downgrade on the fertilizer and potash sector comes on the heels of a Department of Agriculture forecast that noted U.S. farm profits are going to fall by 38% this year. The belief is that the rural spending will continue to be tight at farmers manage expenses when food prices are not as high and while the value of their underlying land is getting pinched along with traditional real estate....

Thursday, August 27, 2009

Fannie Mae, Freddie Mac: "Once Troubled Financials Dominate Trading" (FRE; FNM)

Citigroup and Bank of America have been some of the most actively traded stocks for months. But recently, their financial sector colleagues Fannie, Freddie and AIG also shot much higher in trading volumes.

To wit, Citigroup, Fannie Mae, Freddie Mac, Bank of America, in that order, topped Wednesday’s list of most actively traded issues.

AIG didn’t make the cut yesterday. But its shares have been spotted at the top of the NYSE’s most active list regularly since the were reinvigorated in early August. On Aug. 4, some 7.9 million AIG shares changed hands. (That’s roughly in the ballpark of where a normal trading day had been.) The very next day traders swapped some 134.9 million shares of the stock as they shot up by more than 60%. There was little news to explain the move, but the conventional wisdom was that the runup stemmed from expectations that AIG’s quarterly results — due that Friday — wouldn’t be as bad as once thought. (There were plenty of other theories too.)

Volume in Fannie and Freddie also started to pick up around that time. Investors traded 7 million shares of Fannie on Aug. 4. The next day it was 117.1 million. Fannie trading has gone higher recently, hitting 831.4 million on Monday. The same day Freddie jumped to 386.5 million. For a bit of context, in late July and early August, Freddie volume was in the single-digit millions.

We asked our crack squad of Dow Jones math ninjas to crunch the numbers on these five stocks to find out exactly how much of the entire market action is made up by their trades. Since Aug. 5 — when we saw names like Fannie, Freddie and AIG reawaken — trading in those three stocks, plus Bank of America and Citi, has averaged about 31.5% of the NYSE consolidated volume. At their peak on Monday, these five stocks accounted for nearly 43% of the NYSE consolidated volume. That’s pretty remarkable.

So what’s behind all the action in these shares?>>>MORE

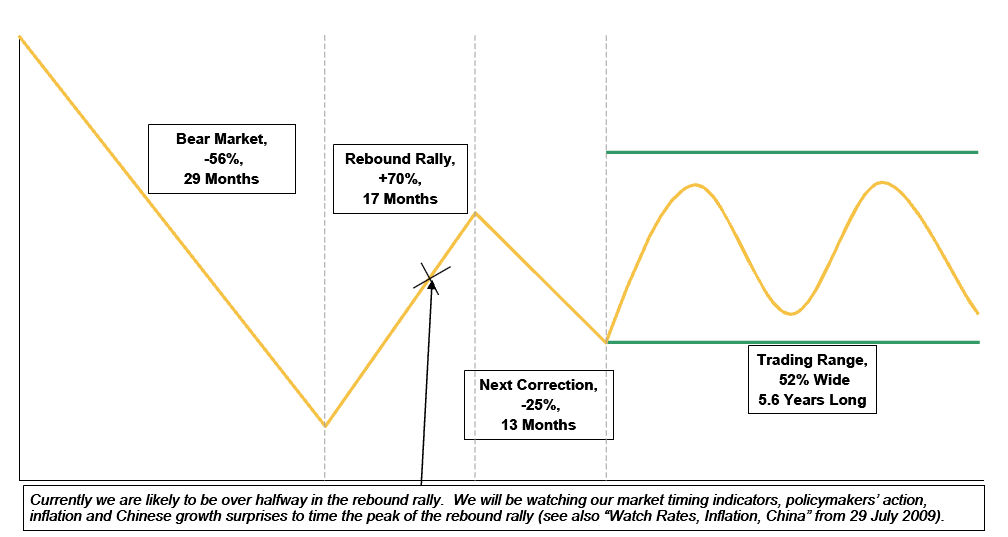

Four Stages of a Secular Bear Market

It is, for those folks who care about expected future equity returns. Morgan Stanley has put out a nice simple chart on what they look like. Via The Big Picture:

As promised earlier, I pulled up a chart showing the stages of Secular Bear Markets historically.

This fascinating composite chart below is courtesy of the Strategy desk of Morgan Stanley Europe. It shows what the average of the past 19 major Bear markets globally have looked like:

Typical Secular Bear Market and Its Aftermath

>

The Chart represents typical secular bear markets based on MS’s sample of 19 such bear markets as shown after the jump....MORE

Energy Conversion Devices: Results, Outlook Disappoint. China Sunergy Beats (ENER; CSUN)

Energy Conervsion Devices (ENER) this morning was the latest solar energy stock to post disappointing financial results.

For the fiscal fourth quarter ended June 30, the company reported revenue of $51.4 million, down from $66 million in Q3 and $82.4 million a year ago, and below the Street consensus of $56.8 million. The company lost $15.8 million or 37 cents a share in the quarter; that included 32 cents a share in special charges. Before those items, the company would have lost 5 cents a share, a penny less than the Street consensus estimate of a loss of six cents a share....MORE

Compare with:

China Sunergy Rallies As Q2 Revs, EPS Top Estimates

I'd have to say Advantage China on this head to head (I know, totally different technologies, business models etc., but still, the Chinese are reporting some rays of hope: see TSL)