We've been babbling about this for going-on five years, a couple links after the jump.

From The Economist, December 30:

Despite the best efforts of its social-media censors

Since 2021, as the Chinese property market has descended into crisis, analysts have paid close attention to its woes—a task that is now becoming increasingly difficult. In mid-December Beijing’s housing authority announced that it would stamp out social-media accounts responsible for negative posts; thousands have since been closed or suspended. Estate agents are being pressed to keep ugly intelligence under wraps. In November two of the country’s best private sources of property data stopped providing monthly home-sales figures, reportedly at the command of the government.

The official anxiety comes in response to unrelenting bad news. Vanke, a state-backed property giant, is teetering on the edge of default. New home sales by floor space have fallen by half since their peak in 2021. Fresh residential construction is down by nearly three-quarters; investment, by over a third. Yet it is house prices that are causing the most concern. Larry Hu of Macquarie, an investment bank, calculates that 85% of the gains seen in the decade to 2021 have been wiped out. By comparison, the American housing meltdown of 2007 erased a mere 47% of the increase in home prices between 1996 and 2006.

Through the floor

Investors are keen to understand how much further, and for how much longer, prices will fall, since the crisis has profound implications for China’s financial industry. Lots of collateral held by banks is in some form of real estate, meaning that as prices drop so does the value of their assets. State asset managers and insurance firms are also big investors in property.Answering such questions is hard both because of recent restrictions on information and because of flaws in existing data. The government’s benchmark is an index of house prices in 70 large cities. Its statisticians use a weighted average to calculate monthly and annual changes in prices. Although the resulting figures show a fearsome fall, they may underestimate the problem. Thousands of smaller cities, where the downturn has been most severe, are excluded. And whereas official figures suggest that Shanghai’s second-hand home prices have fallen modestly each year since 2023, anecdotal reports suggest they have fallen much more steeply, a pattern which may also be true of other big cities.

In the absence of reliable data, investors must rely on expert guesses. A recent report by Enhance International looks at the price-to-rent ratios of existing homes in four large, representative cities—and offers a grim outlook for the next five years. The consultancy’s analysts believe that prices for non-new homes have another 40% to fall, despite having already dropped to their lowest in a decade. Even more worrying, they reckon that China’s property crisis may continue until 2030.

What explains the drawn-out descent? One factor is meddling by local officials. They often limit discounts on new homes to avoid sudden price collapses and minimise social tensions (imagine the frustration of a recent buyer who paid full price only to discover that a flat across the hall has just sold at a 40% discount). But doing so distorts market signals, slowing the sale of China’s 30m unsold homes....

....MUCH MORE

The Chinese property experience is an example of the truth in the statement: Stimulus does not create demand, it only pulls it from the future to the present. The Chinese government - private developer partnership created the boom in the twenty-teens but it was phony. And it can be dated to Xi Jinping's rise to the top of the Chinese Communist Party in 2012 and the government in 2013.

Previously:

September 2021 - "Hong Kong Stocks Crash, Futures Slide As Markets Finally Freak Out About Evergrande Default Contagion"

October 2021 - Michael Pettis: «China Is Probably the Most Overvalued Property Market in the World. Evergrande is a Symptom of That»

November 2023 - "China’s property loan scheme may or may not work "

We'll have more on the Chinese government efforts to date next week but the TL;dr is: it's not enough. The property sector is so big that the hole in it is so big that it will take over a trillion dollars just to stabilize, much less return the asset class to a position of driving the economy.

Here's some background from a year ago thatt has stood us in good stead as far as understanding the economy of the Eastern Giant:

Thursday, December 1, 2022

What If Our Understanding Of China's "Zero Covid" Is 180 Degrees Wrong?

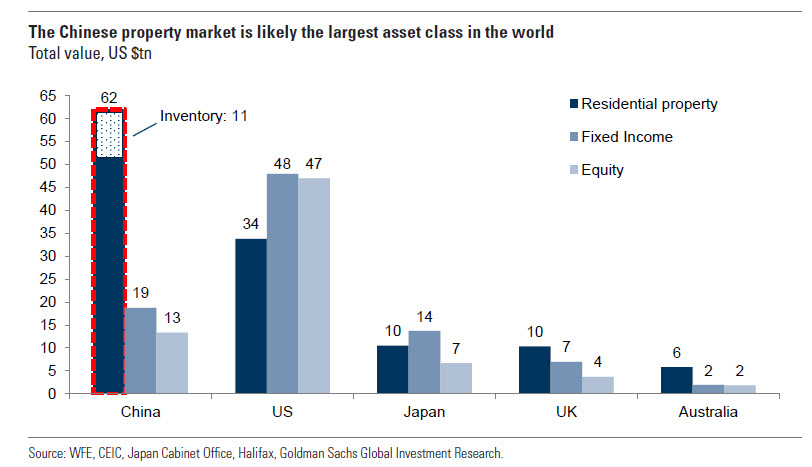

One story that has dropped from the headlines is China's property market, in part because the government has ordered the banks to open the nozzle on the liquidity fire hose. I think the official numbers are up to around $200 billion. But that's not even the amount of China Evergrande Group's debt ($300 billion), much less the rest of the sector, which itself is just a fraction of the total asset class which Goldman last year estimated to be the largest in the world at $62 trillion (but deflating fast)

What if the required rescue is 10 times the amount officially reported as being injected?

China would run into the same dilemma the U.S. faced when injecting $5 - 6 trillion into the American economy: If the powers-that-be allowed the economy to remain open as the liquidity poured in the resulting inflation would have been 40 -50% and would have hit the population within weeks. In China's case the rioting would have made the current protests look look like a convivial, collegial discussion group.

The lockdowns allowed the U.S. to bleed the inflation into the economy at a reduced rate, CPI is up 14% since January 2021, effectively deflating the Federal debt by a like amount or $4.2 trillion, equal to around 2/3 of the 2020 -2021 spending and liquidity injections.

The Chinese "zero covid" lockdowns make no sense from a public health standpoint and as one of my favorite China experts says, "Chinese are very smart people, there must be something else going on that you roundeyes don't see. And then he laughs when I tell him he is a racist.

On the other hand here is the causality as usually presented, from Time Magazine, December 1:

China’s Zero-COVID Trap

Protesters in China have demanded an end to the country’s draconian zero-COVID policy—a pandemic prevention strategy that President Xi Jinping claims has kept his people safer than less stringent measures taken by other nations—as the suffering it’s wrought is becoming increasingly unbearable.

Experts have said it’s unlikely the government will outright end zero-COVID anytime soon, though it may continue to tweak the policy. But even if Xi wanted to ditch the strategy altogether, as some localities are reportedly starting to do, that could bring about even more misery.

Zero-COVID—defined by city-wide lockdowns, mass testing, and enforced quarantines—was once a paragon of the containment approach toward the coronavirus pandemic. To this day, Johns Hopkins University data shows China to have the lowest COVID-19-related deaths per capita worldwide. The country’s death toll, according to the World Health Organization, is only at 30,205, compared to the more than a million deaths in the United States—though questions have been raised about the accuracy of China’s official data reports.

Over nearly three years, however, the same measures meant to protect China and its people have also exacted a devastating toll. Residents in some areas have found themselves scrambling for food and other resources, and others have blamed zero-COVID for deadly delays in emergency responses. Mental health in the country has plummeted, while the economic fallout, domestically and globally, continues to grow....

....MUCH MORE

If we can believe the 30,205 deaths number, we can probably believe the liquidity injections numbers.

If not, not.

And the headliner, from Asia Times....

And at least one hundred more posts, it has been, along with the hyper-Pareto distribution of profits in the West, one of our guiding principles of investing in the 2020's.