From ZeroHedge, December 10:

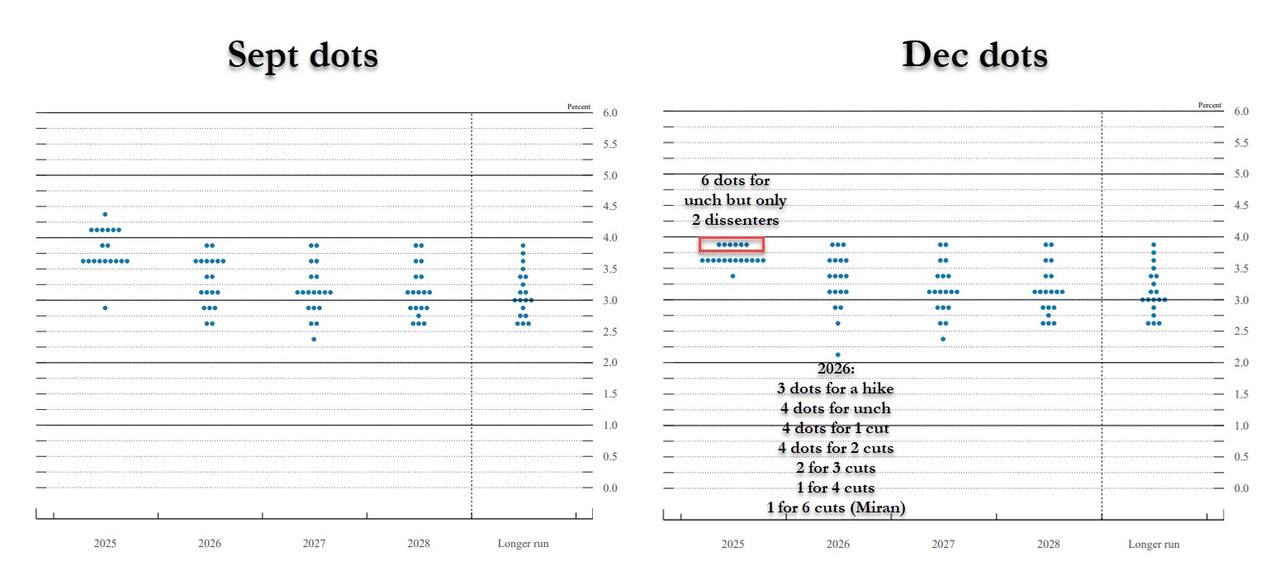

Consensus was expecting a hawkish rate cut, and while it got the cut, the hawkish elements - more dissenters, higher dots, a pushback by Powell during the presser - did not not materalize, and instead we have a low-grade revolt by the non-voters at the Fed (6 dots for unch today, only 2 dissents, more 3 dots expecting a rate hike in 2026), yet that will be promptly snuffed by whoever Trump picks to replace Powell next May.

In fact, one can say that today's meeting was much more dovish than expected when accounting for the $40BN in T-Bill purchases coming in two days (just as we said would happen) which was a very contrarian call. And not only was this announced by a NY Fed implementation, but Powell decided to put that right in the statement, something that has not happened since the liquidity crunch after covid in early 2020.

With that in mind, let's take a look at some kneejerk reactions from Wall Street traders and strategists:

David Mericle, Head of US Econ at Goldman Sachs:

- “A lot of little hawkish elements, but largely in line. Now we need to see what Powell says for the full read”

- 25bp cut - still 1 cut in 2026 and 1 in 2027, as expected

- Statement language changed to 'in considering the extent and timing of additional adjustments' as expected.

- Schmidt and Goolsbee hawkish dissents (in line - plus Miran for a larger cut, so 3 total)

- In the dot plot, have 6 hawkish dissents for next year – more than Goldman expected

- Fed have also announced resumption of purchases to keep balance sheet steady - they put that right in the statement

Mike Cahill, Macro FX Research at Goldman:

This all looks very close to GS expectations, so will come down to Powell's presentation in the press conference. I'm most interested in how he characterizes the debate on the Committee and risks to the labor market--what would it take for them to be ready to move again. Most notably to me in that context, they've kept their forecast for the Q4 unemployment rate average at 4.5%. That implies a much slower rate of increase than we've been seeing lately. The current rate is 4.44%, so this requires a little less than 5bp a month to meet the median. 7ppl expect it too move up to 4.6-4.7, which would be in line with the recent average. The GDP forecast for this year also implies they are penciling in a pretty big hit to growth in Q4 and a decent transfer into next year so a sizeable hit from the shutdown presumably. On net, I would characterize that labor market forecast as optimistic rather than obviously hawkish, but it will depend on how much weaker it would need to be to get the Committee to reconsider that "extent and timing" of additional easing. I expect Powell will convey that the hurdle is relatively high given the 6 soft dissents already, but will see whether he brings up some of those risks more than he did in October.

Anna Wong, Bloomberg Chief Economist:

“We assess the overall tone of the statement and updated projections as leaning dovish — though there are some hawkish undertones. On the dovish side, the committee sharply revised up the growth trajectory while lowering the inflation outlook, and kept the dot plot unchanged. The FOMC also announced the commencement of reserve-management purchases. On the other hand, there’s a signal in the policy statement that suggests the committee is inclined for an extended hold.

Even though the dot plot shows just one 25-bp cut in 2026 — markets are pricing two — our view is that the Fed will end up cutting by 100 bps next year. That’s because we anticipate weak payroll growth and currently see scant signs of an inflation resurgence in the first half of 2026.”....

....MUCH MORE