The GOOG is down a bit today, to $308.19 and like many other issues is trading just under the all-time-high from earlier this year.

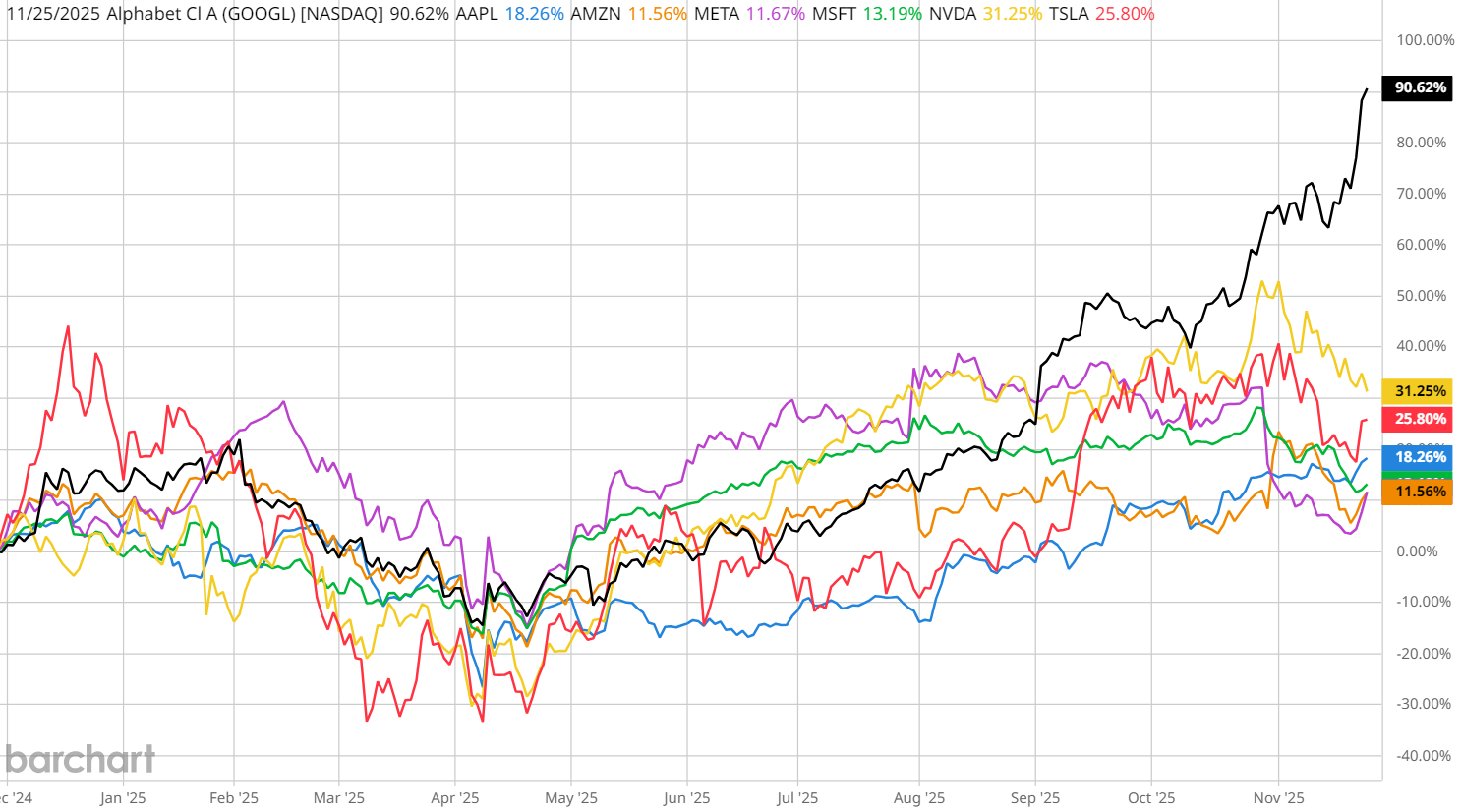

From Barchart, November 25:

Google is Winning the AI Race by Stealing Exxon's Business Model. Here's How

Alphabet (GOOG) (GOOGL) has been on a tear since the favorable court decision about monopolistic advantages. The chart below shows the percentage returns in Google stock compared to the other Magnificent 7 names – Apple (AAPL), Amazon (AMZN), Meta (META), Nvidia (NVDA), Microsoft (MSFT), and Tesla (TSLA) – over the past year.

There’s more going on here than just a court victory – and I mean besides the obvious point that Google is the only Mag 7 stock that is truly beating the tape.

The answer? Google appears to have won the finish line to artificial intelligence (AI) monetization. Not only that, they’ve won by a wide margin, and stock market capital is flowing out of the other hyperscalers to the victor.

Gemini Helps Blaze a Path to AI Victory

Google’s Gemini gained 8% user growth in the most recent quarter, with web traffic to the chatbot surging in September after the launch of new AI image generation tools. Rave reviews for Gemini 3, including from Salesforce (CRM) CEO Marc Benioff, have also pushed the stock higher this month.Google's tensor processing unit (TPU) demand is exploding as Gemini gains wide acceptance. More adept than traditional GPUs at handling complex AI workloads, and with a longer life cycle, Google delivers 50% productivity improvement with TPU than what is offered using NVDA hardware. As a result, developers are switching to Gemini midstream at an increased cost to substitute.

Plus, Google is already generating income across all spectrums, while relative newcomers like OpenAI (parent company of Gemini rival ChatGPT) are still burning through billions of cash.

Is Google the 'Big Oil' of AI?

In an industry where everyone is renting from each other, Google designs its chip; owns the data centers; runs the software; manages the pricing; manages the margins; and handles distribution.....

....MORE