If only the refiners would pass some of that decrease along to gasoline buyers, but they aren't really. So maybe the trade is to buy the Valero, Marathon, Phillips 66 triad of doom refining and make enough to pay the gasoline bill. Or trade the crack spread.

From ZeroHedge, December 9:

Echoing what has become a now daily refrain by commodity bears everywhere, Saad Rahim, chief economist of commodity-trading giant, Trafigura, said that the oil market faces a “super glut” next year as a burst of new supply collides with weakness in the global economy. According to Rahim, new drilling projects and slowing demand growth would weigh further on already depressed crude prices next year.

“Whether it’s a glut, or a super glut, it’s hard to get away from that,” Rahim said in remarks alongside the company’s annual results.

Brent crude has fallen 16% this year, on track for its worst year since 2020. Prices are expected to be further damped by major projects coming online next year, including in Brazil and Guyana.

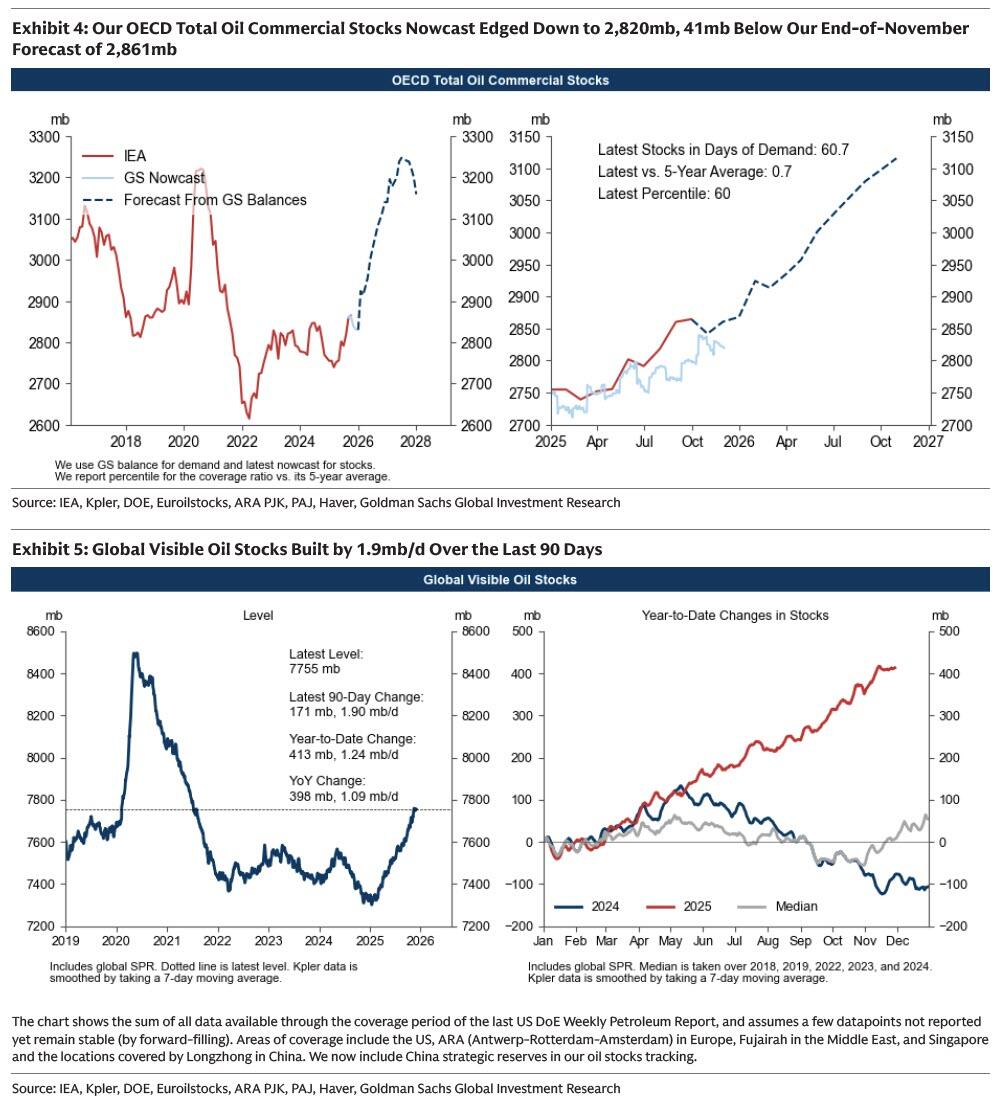

The glut thesis is hardly new, and has been popularized by banks such as Citi and Goldman for the past year. As Goldman analyst Daan Struyven wrote in his latest oil tracker note, "global visible oil stocks have built by nearly 2mb/d over the past 30 days." The banks expects them to grow significantly more in the coming years.

Meanwhile demand from China, which is widely seen as aggressively stocking its strategic petroleum reserve by 500kb/d (and as much as 1 mm/d according to some estimates) and is the world’s biggest oil importer, is expected to grow more slowly next year due to its huge fleet of electric vehicles, which have sharply reduced petrol demand. Low prices this year have prompted China to buy more crude to fill its strategic stockpile.

“China needs to keep buying at this rate, for that super glut to not show up even earlier,” Rahim added.

The US government has also been trying to keep oil prices low, and President Donald Trump has pledged to “drill, baby, drill” in a push to increase American production. There has also been speculation that the US will also refill its SPR which was largely emptied by Biden but since that will promptly drive prices higher, so far this has been nothing but speculation, and meanwhile the US barely has any reserves for a true emergency.

Ben Luckock, head of oil trading at Trafigura, said in October that he expected oil prices could fall below $60 a barrel before rallying. “I suspect we’ll go into the $50s at some point across Christmas and the new year,” he said at the time....

....MUCH MORE