GE Vernova was already on Goldman's "Conviction Buy" list (a/o April 1) so in GEV's case it is more of a reiteration. But for the other two and a host of others, here's ZeroHedge via OilPrice, August 25:

U.S. Power Sector Green Capex Projected to Reach $2 Trillion

- Goldman Sachs analysts reaffirm a bullish view on US power sector Green Capex, estimating $2.0 trillion in 2023-32, despite recent IRS clarifications on tax credit eligibility.

- Investment opportunities are highlighted across the power and water infrastructure supply chain, driven by the "Reliability Imperative" to meet rising power demand, replace aging infrastructure, and enhance resiliency.

- The article identifies specific "Buy-rated" green energy stocks and notes that meeting growing power demand, particularly from data centers, will involve a mix of green tech, nuclear, and natural gas, potentially delaying coal plant retirements.

team of Goldman analysts led by Brian Singer reaffirmed his bullish view on U.S. power-sector Green Capex after the IRS recently clarified eligibility rules for solar and wind tax credits under the One Big Beautiful Bill Act (OBBBA). The new "physical work" test replaces the prior 5% capex rule but is not expected to constrain utility-scale solar and onshore wind projects that much.

"While the OBBBA should meaningfully reduce government outlay initially meant to stimulate diverse sources of Green Capex, we continue to see resilient levels of US power sector Green Capex -- we estimate $2.0 trillion in 2023-32," Singer wrote in a note to clients.

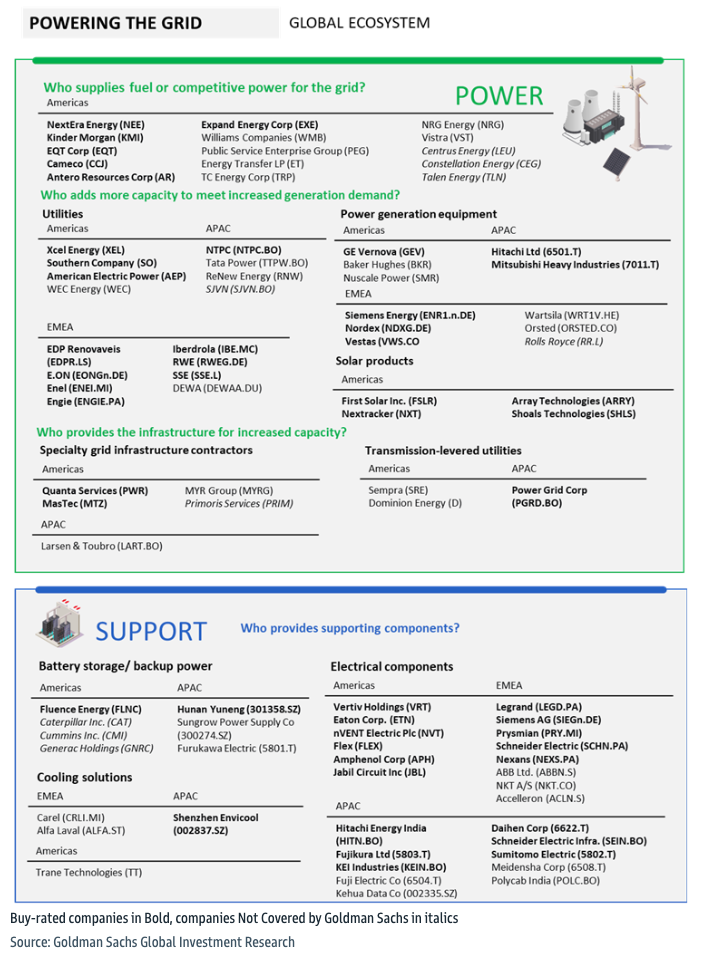

He flagged investment opportunities across the power and water infrastructure supply chain, where the "Reliability Imperative" will continue to funnel capital allocations:

- Meet rising power demand growth -- which our Utilities team expects will continue to grow 2.5% per year through 2030 in the U.S.

- Replace aging infrastructure.

- Enhance resiliency to extreme temperatures/weather events.

Singer outlined the green energy stocks to own:

With power continuing to gain share in Green Capex -- investment towards decarbonization, infrastructure and clean water Sustainable Development Goals -- and our outlook for robust deployment of renewables in the shorter term, natural gas in the medium term and nuclear in the longer term, we continue to see investment opportunities throughout the power and water Reliability supply chain. This includes Buy-rated First Solar, GE Vernova, MasTec, Quanta Services, Xcel Energy, Xylem levered in part to the U.S. market....

....MUCH MORE

Here's Goldman's graphic: