For the last year we have been referring to the AI phenomena as a bubble, perhaps not so much in financial terms but rather in terms of the psychology, the speculative frenzy. It's true in Nvidia's case, the stock could be cut in half and still be discounting the future with a 2-3% discount factor i.e. 33 to 50 times free cash flow.

However! Despite this we have been pitching a "Ride the Bubble" approach to the stock for over a year (we have an almost full decade with this one but it was in the last thirteen months that we thought it bubblelicious). Here's a July 1, 2023 post:

Here's the version hosted at MIT:

This paper presents a case study of a well-informed investor in the South Sea bubble. We argue that Hoare’s Bank, a fledgling West End London bank, knew that a bubble was in progress and nonetheless invested in the stock: it was profitable to “ride the bubble.” Using a unique dataset on daily trades, we show that this sophisticated investor was not constrained by such institutional factors as restrictions on short sales or agency problems...

The two most important parts of the paper "II. Hoare’s Trading Performance" and "III. Causes of Success" are definitely worth a couple minutes....

NVDA closed the day previous (Friday) to that post at $423.02. Pre-market June 17, the stock is changing hands at a split-adjusted $1317.00.

A couple more examples after the jump but for now two articles that mitigate against the bubble description. First up, from The Next Platform, May 23, 2024:

Nvidia’s Enormous Financial Success Becomes . . . Normal

For the past five years, since Nvidia acquired InfiniBand and Ethernet switch and network interface card supplier Mellanox, people have been wondering what the split is between compute and networking in the Nvidia datacenter business that has exploded in growth and now represents most of revenue for each quarter.

Now we know.

Each quarter, Nvidia chief financial officer Collette Kress puts out a commentary that accompanies the financial results for each thirteen week period, which gives out some color on what sold and by how much. As the entire world knows, Nvidia just reported its numbers for the quarter ended in April, which is its first quarter of its fiscal 2025 year, and the numbers were stellar as expected. And inside of that commentary, Kress revealed the actual revenues for its Compute and Networking Groups as distinct from each other and also distinct from its Graphics group.

The actual data for Q1 and Q4 of fiscal 2024 and Q1 of fiscal 2025 shows that the compute business is perhaps a bit stronger than many had expected and the networking business is a bit weaker. But both are clearly strong, and will continue to strengthen as fiscal 2025 rolls on. The generative AI market is growing so fast that even with intense competition there will be no way to blunt the market momentum of the CUDA platform that Nvidia has created over the past two decades and that has an incredible advantage over alternatives in HPC and AI.

But, as we have said before, we think that we are experiencing peak Nvidia right now, and maybe the party will continue out into fiscal 2026. But eventually, competition will come and the generative AI hype and hope will settle down and AMD, Intel, the Arm collective, and others will get their share of this market. Until then, this is Nvidia’s time to make hay while the grass is tall and the sun is bright,

And boy, is Nvidia ever making hay in the datacenter.

Nvidia has two different and almost identical ways of breaking down its datacenter business.

Some compute and networking products are sold outside of the datacenter, but not very much, and some products sold into the datacenter are based on gaming cards, so the Datacenter division has slightly different revenues from the Compute and Networking group....

....MUCH MORE

And from The Motley Fool via Nasdaq, February 25:

This 1 Number May Ensure Nvidia's Artificial Intelligence (AI) Chip Dominance

Nvidia (NASDAQ: NVDA) stock has soared over 435% since the beginning of 2023 as companies flock to the tech giant for its top-performing suite of artificial intelligence (AI) chips. Its top and bottom lines have exploded, rising at triple-digit rates quarter after quarter. In the fiscal 2024 fourth quarter, revenue reached a record high $22.1 billion, and net income rose to $12.3 billion.

But even amid this good news, investors have worried about one thing: competition. Nvidia faces challenges from fellow chip designers like Advanced Micro Devices and even some of its partners like Amazon Web Services (AWS). But before you worry too much about rivals dethroning this market giant, it's important to look at one particular number -- one that may ensure Nvidia's AI chip dominance going forward.

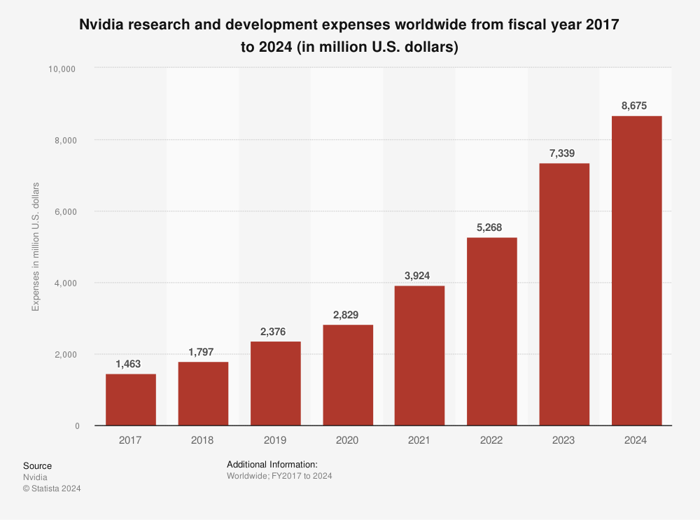

I'm talking about research and development (R&D) spending. As you can see below, Nvidia's R&D expenses have climbed over the years, reaching $8.7 billion in fiscal 2024. That's up nearly 500% in just seven years, indicating Nvidia has been focused on driving innovation over that period....

....MORE

All this brings to mind the slightly wistful story told by Adam Smith (George Goodman) linked in 2012's "Adam Smith on Oil Shale (Now with Voodoo Beach Bunnies)":

....The Great Winfield had made his point. Memory can get in the way of such a jolly market, that malaise that comes with the instantly gone, flickering feeling of déjà vu. We have all been here before.

“The strength of my kids is that they are too young to remember anything bad, and they are making so much money they feel invincible,” said the Great Winfield.

“Now you know and I know that one day the orchestra will stop playing and the wind will rattle through the broken window panes, and the anticipation of this freezes us. All of these kids but one will be broke, and that one will be the multi-millionaire, the Arthur Rock of the new generation. There is always one, and maybe we will find him.”...MOREHere are the Voodoo Beach Bunnies:...

We reiterated the ride the bubble pitch a few more times, despite some trepidation.

January 19, 2024 at $594.91 "AI: Lessons From The South Sea Bubble".

February 6, 2024:

The stock is down $11.87, so a little less than half yesterday's up-move. $681.45 last after trading as low as $663.00 (down $30.31 and almost the entire Monday $31.72 up-move.) Unfortunately there is a gap on the chart at $660 so it didn't completely fill. Nervous-making....

By-the-bye, that $660 ($66, new style) is the "cut in half" number.

Earlier this morning the stock got to $889.68 and we are still pitching the "ride the bubble" approach—up $220 since the last mention, Feb. 6—but that could change anywhere between today and the end of the NVDA GTC conference (Mar. 21)....

If interested in some of our history with the big dog there are links embedded in January 2024's "Nvidia expands its reach in China’s electric vehicle sector" (NVDA).