The stock is down $11.87, so a little less than half yesterday's up-move. $681.45 last after trading as low as $663.00 (down $30.31 and almost the entire Monday $31.72 up-move.) Unfortunately there is a gap on the chart at $660 so it didn't completely fill. Nervous-making.

From Barron's (Updated Feb. 6, 2024 2:10 pm ET / Original Feb. 6, 2024 5:08 am ET

):

Nvidia Stock Drops. It Can’t Go Up Every Day.

Nvidia shares have fallen back after pushing past $700. The chip maker's rally looks to be being hit by profit taking, despite it striking more deals with partners to embed its hardware in data-center equipment.

Dreamstime

Nvidia stock has fallen back after pushing past $700 as the chip maker’s rally gets hit by profit taking despite striking a deal with Cisco Systems to embed its hardware in data-center equipment.

Nvidia shares were down 2.7% at $ 674.77 in early trading, reversing gains that it had sent it above $700 for the first time in the premarket.

Nvidia stock closed up 4.8% on Monday at $693.32, setting a new record closing high. The stock was boosted on the day by positive opinions from analysts at Goldman Sachs and Raymond James, who back Nvidia to continue its strong run.

The chip maker said Tuesday that it would partner with networking company Cisco Systems to sell infrastructure for data centers. Nvidia’s graphics processing units—the favored choice for training artificial-intelligence systems—will be included with Cisco’s server computers.

“Working closely with Cisco, we’re making it easier than ever for enterprises to obtain the infrastructure they need to benefit from AI, the most powerful technology force of our lifetime,” said Nvidia CEO Jensen Huang....

....MUCH MORE

If you recall, Cisco was one of the belles of the dotcom ball 1996 -2000.

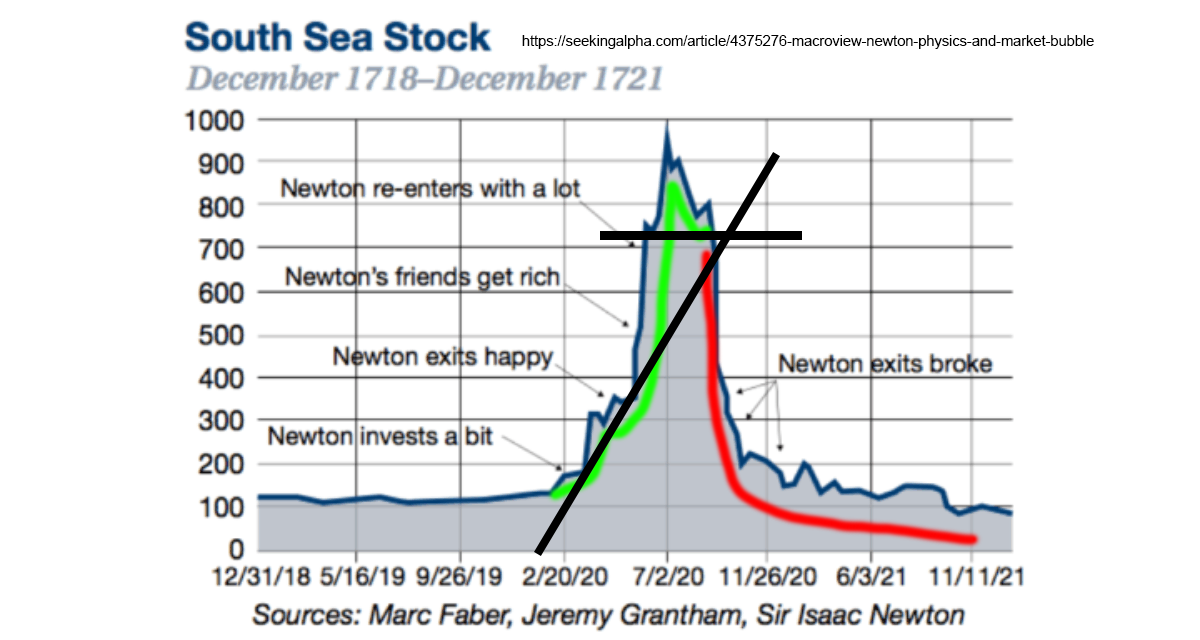

No worries. If interested here is a followup to January 19's "AI: Lessons From The South Sea Bubble" with its "Ride the Bubble message.

The author of this piece, Andrew Odlyzko is something of a polymath. An MIT trained mathematician with an interest in financial history.

And supercomputers.

From the Museum of American Finance's Financial History, Winter 2018:

A famous anecdote tells of Sir Isaac Newton realizing large gains in the early stages of the South Sea Bubble, but then losing all that and more by buying back in at the top. On the other hand, the fact that the author of Robinson Crusoe was also associated with that episode of extreme investor exuberance is little known. And that is a pity, since Daniel Defoe’s words, as well as Newton’s actions, are very illuminating about an important aspect of bubbles that deserves much more attention. This is the social network element, involving information dissemination among investors. What did they know, how did they know it, how accurate was what they thought they knew and how did they interact with each other?....MUCH MORE (4 page PDF)

The South Sea Bubble of 1720 had all the essential ingredients that make investing today challenging: political turmoil, rapid globalization, business innovation, new communication technologies with an abundance of “fake news” and novel financial products that befuddled investors. Those securities might seem simple to us, but this has to be considered in proper historical context. The public was less educated than today, and there was far less of both finance theory and of general information about business and the economy.

On the eve of the South Sea Bubble, Britain was beginning to enjoy the fruits of the peace that came after the long and debilitating War of the Spanish Succession. It was widely ranked with Holland as a world leader in technological and commercial development. International trade was booming, but not without controversy. Weavers were rioting against the imports of inexpensive Indian textiles, and one of Defoe’s many jobs was writing a newspaper set up by the weavers to push their case for protection. Politics was extremely partisan, with widespread suspicions and accusations of treason. Some were well-founded, as there had been a major Jacobite invasion in 1715, and a smaller uprising in 1719, both aiming to restore the Stuart dynasty.Today the traditional press is in decline, and social networks and related upstarts are beginning to dominate.

We are forced to grapple with the issues of “echo chambers” and “filter bubbles,” which produce the “post-truth” phenomenon of different groups having wildly divergent perceptions of what reported events mean. This is often blamed on the overabundance of information. However, similar phenomena can be found three centuries ago, in an era of information scarcity. This can be observed in politics, as well as in reactions to the South Sea Bubble. Like today, information systems were being revolutionized. The press was undergoing rapid development, following the removal of some of the shackles of government censorship two decades earlier. London was full of a variety of publications, as entrepreneurial publishers strove to find profitable niches, often by catering to political parties, or the government, that paid them secret subsidies. Yet the commercial newsletter sector, distributing large numbers of hand-duplicated copies, continued to thrive and served as an essential feed for the press, especially for the provincial press that was in its infancy, with just a handful of papers....

We've visited Professor Odlyzko a few times over the years including one time on the same topic:

"Sir Isaac Newton: Scientific Genius, Investing Fool"

And another on how biases can get you even if you wrote the book on them:

The Time Charles ('Popular Delusions...') MacKay Thought 'This Time it's Different'

In network theory he challenged the valuation of networks—he thought the theory gave valuations that were too low, something later important in valuing Facebook, Twitter etc.

Here he is as co-author of a paper on same, this version at IEEE Spectrum: