From ZeroHedge, June 11:

The blowout in European bond yields extended for a second day as French bonds tumbled, driving the biggest two-day jump in yields since the pandemic, amid rumors that Macron was preparing to announce his resignation, which has been swiftly denied by a person close to him. The French president is set to hold a press conference on Wednesday to set out his campaign.

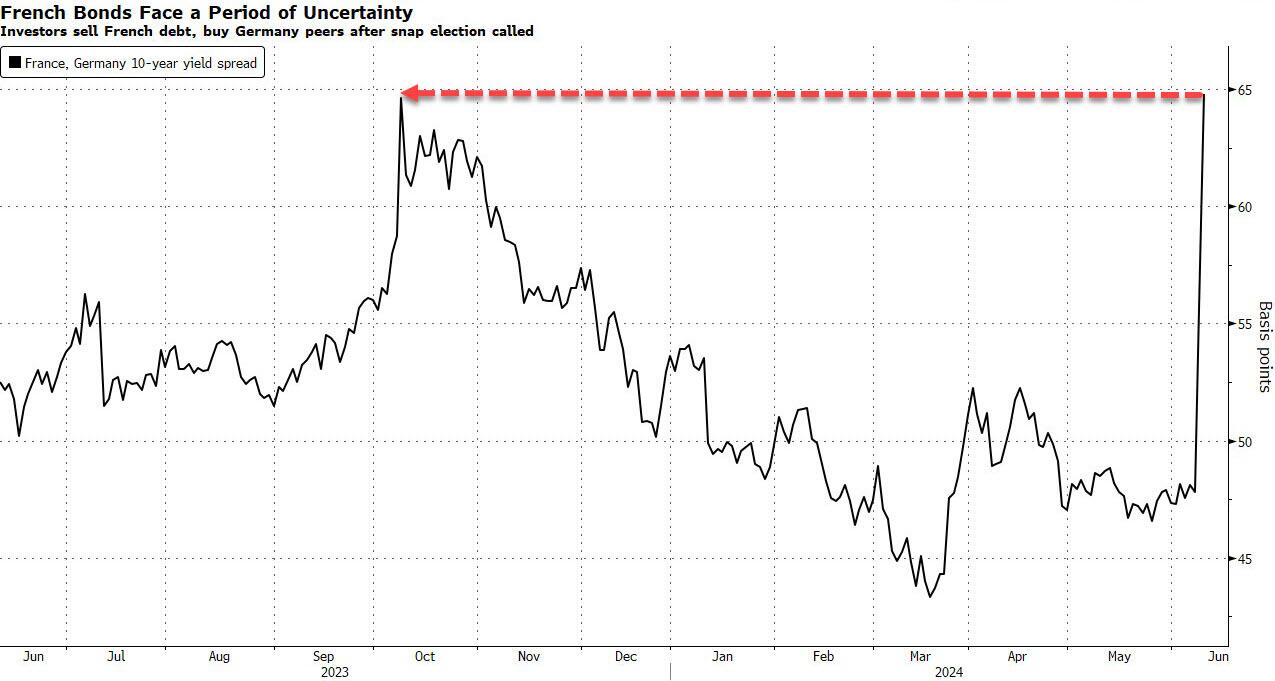

While Macron's resignation rumors were quickly quickly denied according to Bloomberg, speculation over his future spurred a sharp selloff in French government bonds with the yield on 10-year French bonds surging as much as 10 basis points Tuesday, and widened the spread over equivalent German bonds to the highest level since March 2020 on a closing basis.

Meanwhile, Italian bonds, viewed among the region’s riskiest given the government’s debt pile, were swept up in the rout for a second day with the spread over bunds jumping to 150 basis points.

Over the weekend, Macron shocked the world after calling a snap election to curb the political rise of Marine Le Pen, whose National Rally party won widespread support in the EU elections over the weekend. The first round of the vote on June 30 risks becoming the ultimate showdown over Macron’s trademark economic policies, which had largely reassured investors and businesses since he took office in 2017....

....MORE

June 10 via ZeroHedge:

Rabobank: "'Time For Some 3D Chess': Here's Why A Battered Macron Just Called Snap Elections"