The first thing to do is get the Fed out of the Mortgage business. While there might have been an excuse for the Fed buying Agency MBS's in 2008 - 2009 there was absolutely no reason (besides politics) to not only maintain the position but add to it. A huge policy error.

As former Philadelphia Fed Head Plosser* might have said, "This is nuts":

And from Wolf Street, March 11:

Treasury QT will naturally slow in June 2025 when the Fed runs out of T-bills. Fed governors have teased us with interesting options.

The Fed has started laying out some basic principles about how QT might evolve in the future. So far, the Fed’s QT has shed $1.43 trillion in assets, including 1.14 trillion in Treasury securities. So it’s time to look at how the Fed’s Treasury holdings will mature over the next few years, because that determines the maximum possible pace of the QT roll-off since the Fed does not sell them outright.

As the pile of Treasury securities on its balance sheet shrinks – currently down to $4.63 trillion – fewer securities will mature each month. We can see where this is going because the New York Fed posts the Fed’s portfolio of securities online, including purchase price, CUSIP numbers, and maturity dates.

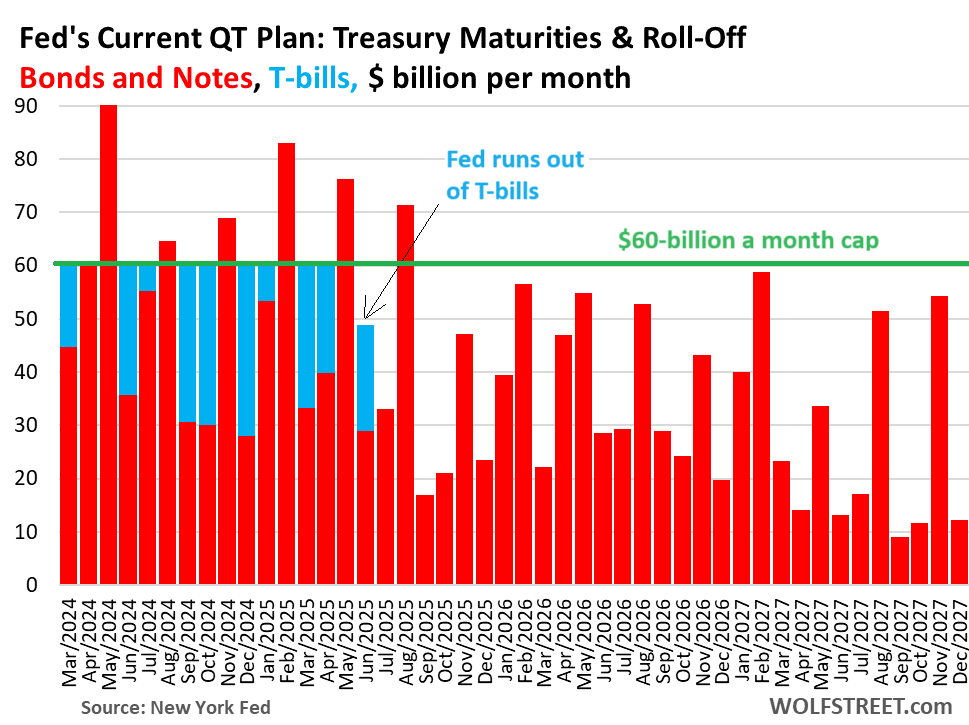

The current QT Plan. When it designed its QT plan in 2022, the Fed capped the maximum Treasury roll-off at $60 billion per month. Here is the visual depiction of the amounts in Treasury notes and bonds that will mature every month going forward (red columns), the $60-billion cap (green horizontal line), and the use of T-bills to get to the $60 billion cap until the Fed runs out of T-bills (blue bars), based on the current QT plan.

Making up the shortage to the $60-billion cap. When fewer than $60 billion in Treasury notes (2 to 10 years) and bonds (20 and 30 years) mature in one month, the Fed makes up the difference by letting some of its Treasury bills (1-12 months) roll off to get to the $60 billion cap.

For example, this month, $45 billion in notes and bonds will mature (first red column in the chart above), which is below the $60-billion cap (green line), and the Fed will let about $15 billion in T-bills roll off (first blue column) to bring the total roll-off to $60 billion.

In April, about $60 billion in notes and bonds mature and roll off. The Fed will not use any T-bills because the roll-off is already at the cap.

In May, $90 billion in notes and bonds mature. The Fed will let $60 billion roll off, and it will replace the other $30 billion that matured with new securities that it buys at auction. It will not use any T-bills.

QT will naturally slow in June 2025 because the Fed will run out of T-bills, as indicated in the chart above, and it will have no more T-bills to fill the gap to the cap, and the amounts of maturing notes and bonds left in the declining pile also decline.

The Fed has $209 billion in T-bills left, down from $326 billion at the beginning of QT in June 2022. It used $117 billion of T-bills so far to make up the shortages in months when fewer than $60 billion in notes and bonds matured. We discussed the details here last week, under the subheading, “How Treasury bills fit into QT.”

The first months when the Treasury roll-off will be substantially below the cap will be June 2025 ($48 billion maturing), which is the month the Fed runs out of T-bills, and July 2025 ($33 billion maturing).

August 2025 ($71 billion maturing) is the last month when the Treasury maturities exceed $60 billion, as we saw in the chart above.

After August 2025, maturities will be below $60 billion every month, and over time, they’re shrinking further as the pile of Treasuries shrinks....

- Former Philadelphia Fed President Charles Plosser: "Why The Fed Should Only Own Treasuries"

- Fed Purchases Of Mortgage Backed Securities Have Destroyed The Housing Market

- The Mortgage Backed Securities Trap The Federal Reserve Set For Itself, In One Chart

- "How and Why the Fed Should Tweak QT"

- Atlanta Fed Head Raphael Bostic On Mortgage Backed Securities: "We are going to have to actively try to sell them."

"Powell Ought to Pivot to Bond Sales"

The Federal Reserve Board has acted as if they are terrified by QT and they haven't really explained why. This is exemplified by their decision to simply let the MBS portfolio run off rather than selling into the market, a strategy that doesn't work for reasons we've looked at previously.Here's a first rate examination of the issues from The Institutional Risk Analyst (also on blogroll at right):....