From Robert Bryce's substack (Energy, power, innovation, and politics), February 12:

Industrial electricity use in the EU is collapsing. US policymakers "Have no excuse for not looking at Europe and learning." Plus: screenings in Dallas, Tulsa, Fairfax, & Austin.

The headline on a February 9 Bloomberg article concisely sums up Europe’s unfolding disaster: “Germany’s days as an industrial superpower are coming to an end.” The article says, “Manufacturing output in Europe’s biggest economy has been trending downward since 2017, and the decline is accelerating as competitiveness erodes.”

Germany is once again, the “sick man of Europe.” But it’s not just Germany. All across Europe, industrial capacity is shrinking. Last month, Tata Steel announced it would close its last two blast furnaces in Britain by the end of this year, a move that will result “in the loss of up to 2,800 jobs at its Port Talbot steelworks in Wales.”

In January 2023, Slovalco announced it was permanently closing its aluminum smelters in Slovakia after 70 years of operation. The company, Slovakia’s biggest electricity consumer, said it was shuttering its smelters due to high power costs.

Europe drove itself into the ditch. Bad policy decisions, including net-zero delusions, the headlong rush to alt-energy, aggressive decarbonization mandates, and the strategic blunder of relying on Russian natural gas that’s no longer available, are driving the deindustrialization. How bad is it? Mario Loyola, a research fellow at the Heritage Foundation, wrote a sharp January 28 article in The Hill about Europe’s meltdown. According to European Commission data, industrial output in Europe “plummeted 5.8% in the 12 months ending November 2023,” he wrote. “Capital goods production was down nearly 8.7%. Investment in plants and equipment has plummeted.”

The result of all that lousy policy: staggering increases in electricity prices. Loyola notes that European electricity prices “have settled at triple their pre-pandemic levels.” Energy analyst Rupert Darwall recently reported that large businesses in Britain now pay up to five times more for juice than in 2004.

Electricity use is one of the most reliable barometers of economic vitality. Indeed, electricity is the world’s most important and fastest-growing form of energy. Economic growth drives electricity use and vice versa. Healthy economies need juice and lots of it. In ailing economies, electricity use declines. Last year, according to a new report from the International Energy Agency, global power demand grew by 2.2%. The Paris-based agency expects global electricity demand to rise by an average of 3.4% annually through 2026, and that “demand will be driven by an improving economic outlook, which will contribute to faster electricity growth both in advanced and emerging economies.”

China and India continue their torrid growth. The IEA estimates China’s electricity demand grew by a whopping 6.4% in 2023. The agency expects China’s power demand to increase by 1,400 terawatt-hours through 2026, an amount of energy that “is more than half of the EU current annual electricity consumption.” Power demand in India jumped by 7% in 2023, a slight decrease from the 8.6% growth in 2022. The IEA said, “Continued rapid economic expansion and robust demand for space cooling were the main pillars of growth” in India. And as I noted in these pages in December, the bulk of new power demand in China and India is being met by burning coal. (Power demand in the U.S. fell by 1.6% last year, a reduction the IEA blamed on milder weather, reduced manufacturing, and “strikes in the automotive industry and overall inflationary pressures.”)

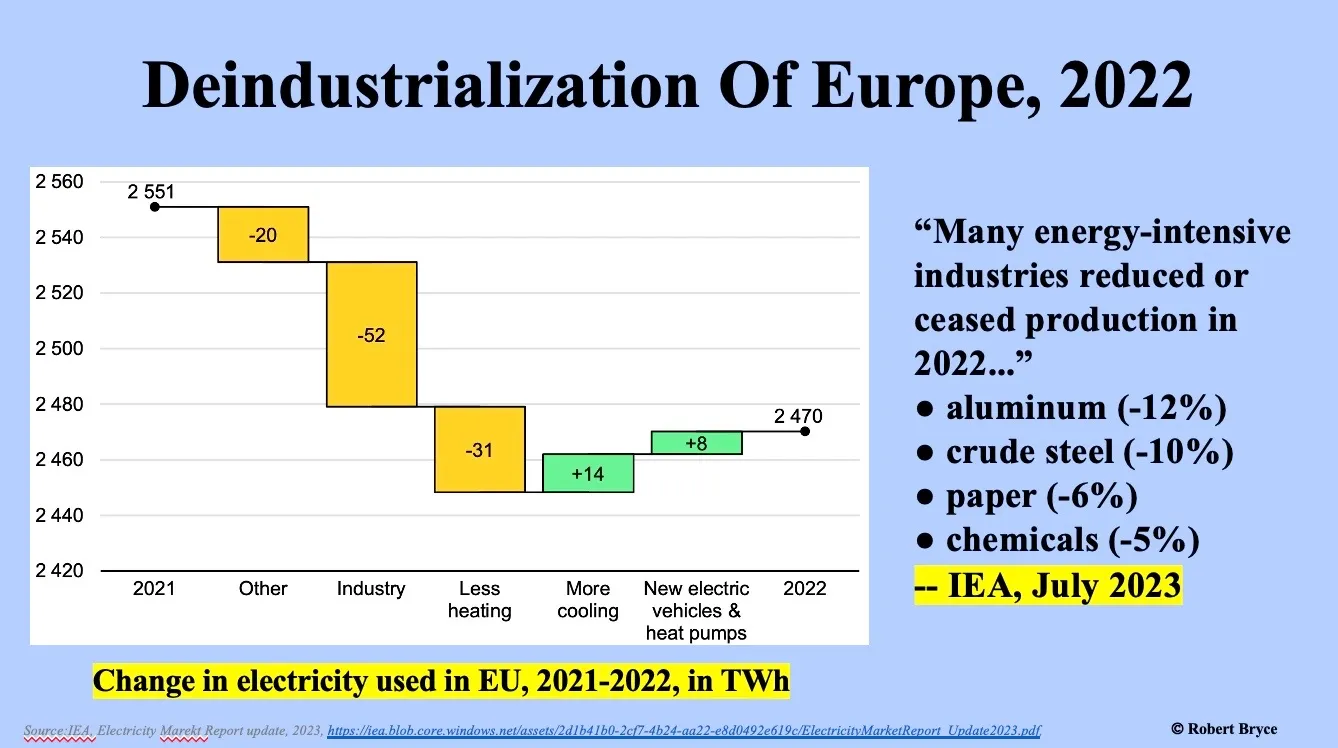

The soaring growth in China and India provides a stark contrast to the situation in Europe, where electricity use declined by 3.2% last year. The IEA notes the drop in electricity use follows a 3.1% decline in 2022 and that power demand in the EU has “dropped to levels last seen two decades ago. As in 2022, weaker consumption in the industrial sector was the main factor that reduced electricity demand.” The plunge in the EU’s industrial electricity use is nothing short of stunning. In 2022, industrial power demand in the EU dropped by 5.8%. The IEA estimates it declined by another 6% in 2023.

The deindustrialization of Europe and the IEA report are top of mind this week as I prepare slides for my keynote speech at the National Association of Regulatory Utility Commissioners meeting in Washington, D.C., on February 26. These five charts illustrate the deindustrialization of Europe and why it will likely continue.

Figure 1

According to the IEA, electricity demand in Germany “declined by a remarkable 4.8% in 2023...demand reduction is especially prominent in energy-intensive industry, which faced a decrease in production of 13% during the first six months of 2023.” That reduction in electricity use reflects the ongoing drop in Germany’s industrial output. This (somewhat fuzzy) chart uses a screen grab from the Bloomberg report mentioned at the top of this article.

Figure 2

....MUCH MORE

Recent visits to Mr. Bryce's substack:

- Energy: "The Power Of Power Density"

- "The Iron Law Of Power Density, Part 2"

- "Juice: Power, Politics & The Grid..."

Juice: Power, Politics & The Grid Is Out!

Our five-part docuseries on the fragilization of the electric grid is on YouTube. It’s free. And it’s terrific.

That last post announces the documentary Mr. Bryce put together and referred to in the sub-heading at the top of this page as the "screenings."

Finally we happened to catch the Bloomberg story and linked here:"Germany’s Days as an Industrial Superpower Are Coming to an End"