That seems rather exuberant.*

From Barron's, February 2:

Bitcoin Gets a Bold New Price Call From Cathie Wood’s ARK

Dreamstime

Bitcoin and other cryptocurrencies climbed on Friday as sentiment improved across wider markets amid strong earnings from tech companies. It’s a bullish trend—but not nearly as bullish as a new price call for Bitcoin from Cathie Wood’s ARK Investment Management, which lays out a case for the token going stratospheric.

The price of Bitcoin gained 2.5% over the past 24 hours to $43,150, remaining near two-week highs and above the psychologically-important $40,000 mark. But the largest digital asset remains off its recent peak above $48,000—its highest levels since early 2022, reached last month amid the trading frenzy around the U.S. approval of spot Bitcoin exchange-traded funds (EFTs).

“Bitcoin is clearly in a consolidation phase after the run-up and drawdown with these newly launched ETFs,” said Phillip Shoemaker, executive director of blockchain group Identity.com. “If you look at the inflows of capital, these Bitcoin ETFs have clearly attracted a lot of interest. Longer term, this is going to be a bullish setup for Bitcoin and, in turn, I expect that the passively invested money going into these ETFs will help to dampen some of the volatility.”...

....MUCH MORE

*The risk is that long before the 21 million coins hit that (implied) $42 Trillion valuation some politician is going to think saaayyy, that's a lot of money and the rules will get changed.

Let me tell you a homely little story along those lines.

....When the Billionaire Hunt brothers were attempting to corner the silver market in January 1980 the head of one of the world's largest grain traders said "Those boys don't know what deep pockets are".The "commercials" had been shorting into the Hunt bros. buying and the grain trader was at the top of the "commercial" heap.On January 21 the COMEX went "liquidation only".On January 22 the CBOT went "liquidation only".On Tuesday the 22nd silver closed at $34, down 27% from its close the previous Friday.The Hunt's still had enormous paper profits but any attempt to book them would smash the markets even further.Prices declined to $17 by March, down 66% from the January high and the Hunt's were receiving calls of $60 Million per day in variation margin. On March 27 the price dropped from $21.62 to $10.80 and one of their brokers, Bache was in violation of net capital requirements and another, Merrill Lynch was on the brink.As the attorneys got involved over the next few years, oil prices headed south, destroying the value of Daddy's creation (and the brother's piggybank) Placid Oil.Bunker Hunt filed for bankruptcy in September 1988 as did his brother and Placid.At the time the grain trader said "Those boys don't know what deep pockets are" it is probable that the various branches of the Hunt families comprised the wealthiest "family" in America.

I told that story in 2010's "Wheat prices ease after Russia predicts stable exports" and "...Speculators ‘Hunt What’s Moving" and have repeated variations of it over the years.

The point is deadly serious, you had better know what you are up against when venturing into the big kids' sandbox. Our first inductee into the Climateer Hall of Fame was deadly serious as well:

...As always, heed the wise words of our first inductee into the Climateer Hall of Fame:

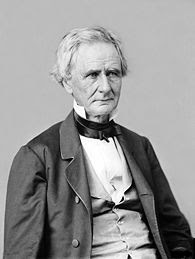

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"The honest politician is one who

when he is bought, will stay bought."