From Simon White, Bloomberg macro strategist, via ZeroHedge,Thursday, Aug 10, 2023 - 06:45 AM:

It might look like it’s been defeated, but US inflation is poised to begin accelerating again soon. Stocks and bonds are unpriced for this outcome.

Markets are most sensitive at economic turning points. That’s because they have a tendency to linearly extrapolate trends. But when the data unexpectedly turns, the market is wrong-footed and has to quickly readjust.

We may not see it in July’s US inflation data due out today, but we are on the cusp of one of these turning points. Markets are linearly extrapolating the disinflation trend and are not priced for an inflation revival. Financial assets – stocks and bonds – will be vulnerable when it is clear a turning point is approaching.

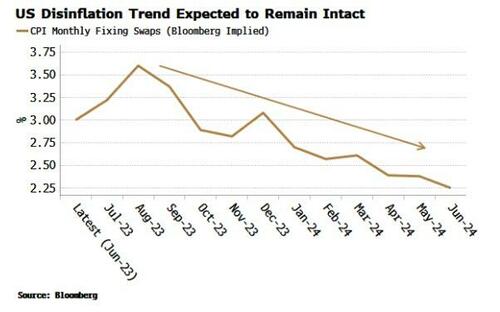

What markets are anticipating for inflation’s path is a subjective exercise. But we do have one very good guide in CPI fixing swaps. These fix to monthly year-on-year CPI prints and are traded by inflation dealers who are highly incentivized to study the minutiae of the inflation basket and come up with a precise estimate for each month’s CPI – skin in the game.

Over the next 6-12 months fixing swaps are the most reliable read on the path of CPI, and they currently expect CPI to fall back to 2-2.5% over the next year.

Fixing swaps are in theory tradable by anyone with enough capital, so if the market in aggregate expected inflation to significantly deviate from the current expected downwards trend, it’s reasonable to expect it would show up here.

It doesn’t; but the market is quite possibly missing an approaching turning point. To see this we have to understand the reasons why inflation slowed in the first place. Surprisingly, the Fed has had little direct impact on declining price growth since its tightening cycle began last year (and there are plausible reasons why, discussed here and here).

Instead, outside of the idiosyncrasy of used cars, most of the net fall in the headline and core inflation rate has been driven by commodity prices, and by global disinflationary pressures, principally from China.

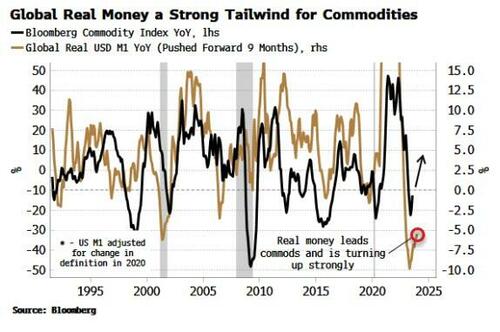

But after a year of falling, commodities have started to climb, especially oil. It is benefiting from a number of tailwinds, foremost among them buoyant liquidity conditions. Global real M1 growth is one of the simplest measures of liquidity and it continues to rise; oil and other commodities should do likewise.

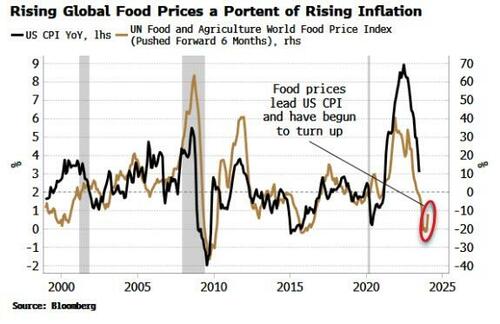

Global food prices have begun to rise again too, after many months of falling.

This typically leads US CPI by about six months.

Overall, two-thirds of exchange-traded commodities have risen over the last month, while the CRB Industrials index – made up of non-futures traded commodities such as tallow, burlap and rubber – has also lifted convincingly off its lows.

Deflation in China, though, has been the principal reason why global and US inflation has slowed by as much as it has. If China had been able to recover more forcefully from the pandemic, commodities would be higher, CPI and PPI would be positive - not in deflationary territory as they are now - and US inflation rate (and Europe’s too) would not have come down as quickly as it did....

....MUCH MORE

Rabobank's Michael Every Is Back And He's Saying Things Like This....

....It’s no surprise then that a market-implied inflation expectation measure, the US 5-year 5-year forward breakeven inflation rate, has again surged to its highest level in over a year at 2.53%, and isn’t far off its mid-2022 peak of 2.57%. More short term, US inflation is going to rise again y-o-y on a headline basis as soon as this Thursday, where CPI is already seen up from 3.0% to 3.3% with only a 0.2% m-o-m print; the base effects then get even less helpful even before higher energy and food prices hit again.....

And as I said on the occasion of the April CPI release, May 10:

I don't think we've seen the high inflation print for this decade, much less this century.

Buy farmland and learn a marketable skill.

The high print so far this decade was the 9.1% registered for the 12-months ended June 30, 2022.

And a reminder, from "Crestmont Research on Inflation, P/E's and Market Returns":

Here's another way to look at the relationship between inflation and P/E's. Note that both the highest inflation and deflation rates correspond with the lowest multiples accorded the earnings:

...MORE

Finally, to reiterate:

A subject near and dear. The sweet spot for P/E ratios is 1.00- 2.00% annual CPI inflation. As you move away from that in either direction multiples drop off pretty fast, to the point that equities are not an optimal investment. You won't believe what the best investments for inflation in the 8-12% and greater than 100% ranges are. I'll write about them if we ever go Weimar....