From ZeroHedge, June 13:

"Not Enough For A June Hike": Wall Street Reacts To Today's CPI Report

The inflation crisis is now behind us.

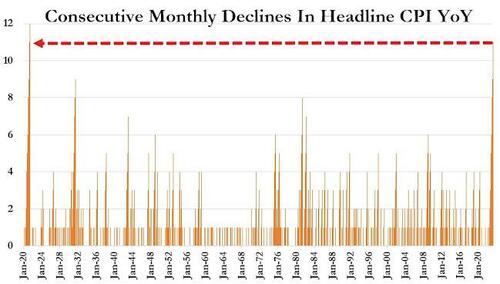

That was the (initial) response from the market to today's cooling inflation report, where annual inflation declined for an 11th straight month (thank you base effect)...

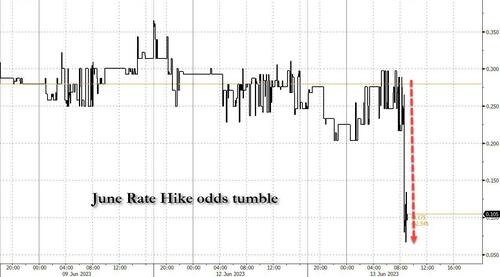

... and which still saw core CPI rise 0.4% which annualizes to around 5%, yet which was enough to convince traders that there will be no rate hike tomorrow (odds collapsed from 25% to below 10%), and odds of a July hike also dropped sharply from 90% to below 70%.

And while it is distinctly possible that the initial euphoria may fizzle after Timiraos gets his marching orders and publishes his pre-CPI guidance...

*****

...here is the early reaction from several strategists and economists:

Anna Wong, Bloomberg chief US Economist

“May’s CPI likely won’t alter the FOMC’s inclination to temporarily pause its rate-hike campaign at the June 13-14 meeting. Details of the CPI print show the sort of progress on disinflation the Fed wants to see: Housing rents – expected to drive disinflation over the rest of the year — continue to edge down. The sturdy reading for core goods was driven mainly by used cars, while prices of new cars and a broad set of other goods saw moderating inflation.”

Ben Jeffery, rates strategist at BMO

“Not a strong enough read to warrant the Fed deviating from its telegraphed intention to skip tomorrow’s meeting, and the knee-jerk bull steepening represents a relief move now that the event risk is passed.”

....MUCH MORE