From Goldman via ZeroHedge:

....In a recent piece from Goldman "Analyzing recent puzzles on China trade data" (available to pro subs in the usual place), the bank wrote in late May that despite weakening external demand, "China’s exports have beaten consensus expectations for four consecutive months now" (but not five months as the latest trade data showed).

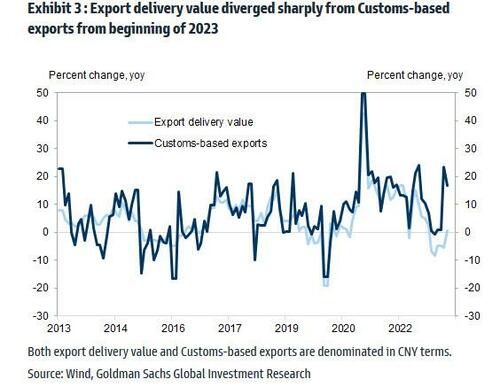

But, as we have observed frequently in the past, Goldman cautions that different trade-related data seem to send conflicting signals and some trading partners’ reported imports from China appear inconsistent with China’s exports to these countries. This has prompted "many client questions on the reliability of Chinese trade data" according to the bank's strategists. Here is Goldman's punchline:

Our "outside-in” measure does not show systematic divergences between China’s import data and trading partners’ exports to China in Q1. However, trading partners’ data released so far suggest significantly lower year-over-year growth than China’s export data in March.

A chart showing just how glaring the trade discrepancy has become:

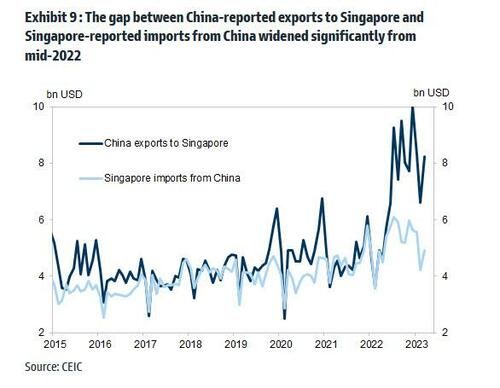

Nowhere is the trade discrepancy more obvious than in bilateral "trade" with Singapore: here, the gap between China-reported exports to Singapore and Singapore-reported imports from China has become laughable.

Goldman then writes that "some of the discrepancies may be related to re-exports and transshipment, but disguised capital outflows are also a potential explanation."....

....MUCH MORE

USD/CNY 7.1285