Following on this morning's "The 6-month US Treasury yield has moved up to 5.22%", we jump into the middle of this post from ZeroHedge, March 8:

Capital Markets Have Reached The 'Singularity'

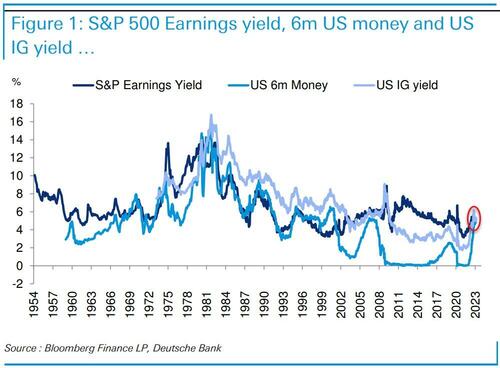

....While we all know you should never "cross the streams", it appears we have reached the capital market equivalent of the 'singularity': rates, equities, and credit yields have all converged.

For the first time since 2001, 6-month US money closed above the earnings yield (1/PE) of the S&P 500.

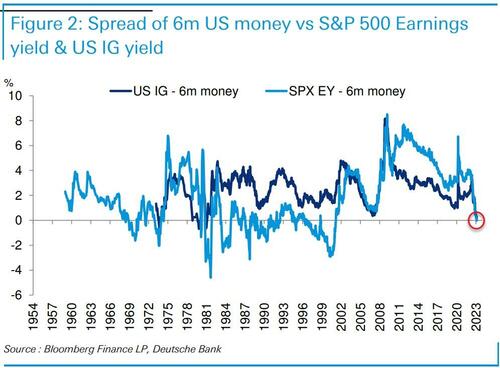

Additionally, investment-grade (IG) credit yields are still above 6 month money as they have also been selling off, but the gap has narrowed substantially in recent months. This hasn't inverted since 1980 but has got close in recent weeks.

Deutsche Bank's Jim Reid explains why this matters:

Earnings yields were below 6m money for long periods in the 1980s and 1990s without it impacting equity returns too much until the peak inversion around the dotcom boom/bust.

One might argue that for most of the 1980s and 1990s, collapsing yields and real yields meant that both bonds and equities could rally in unison.

For credit though, this type of curve spread has been a good lead indicator of credit spreads. As this curve gets flatter, the higher the probability is of spreads widening over the next 18 months and visa-versa.

Intuitively, when yields on short-end money are competitive with longer duration risk assets, there should be more circumspect investment behaviour with animal spirits slowly draining away....

....MUCH MORE

I know a lot of commentary has been focused on the 2-year yield but the implications of the action in the 6-month bill is probably more interesting