A deep dive from Energy Musings, March 21:

It was not the Ides of March – a day Shakespeare’s soothsayer warned Julius Caesar about, but rather Friday, March 10th in Silicon Valley. That day had a similar history – especially for cleantech startups. On that “Black Friday,” Federal Deposit Insurance Corporation (FDIC) officials seized the assets of tech’s “artery for finance,” the Silicon Valley Bank (SVB), the nation’s 16th largest bank. Days before, the bank’s CEO Gregory Becker told a technology investment conference in San Francisco that the outlooks for technology and his bank were “bright.” At the same time, investment rating firm Moody’s called for a meeting to tell SVB management it was considering downgrading the credit rating to “junk” status. That call had set off a scramble to raise new capital to help stem a wave of depositor withdrawals and shore up SVB’s balance sheet. The day before Black Friday, the volume of withdrawal requests exceeded the cash and funding available to SVB, leaving it no option but to surrender to the FDIC.....*****....As a key investor and funder of tech startups, SVB followed its customers and was active with clean and sustainable technology startups. According to Bloomberg, SVB was “leading or participating in 62 percent of financing in U.S. developments,” referring to community solar developments. About 5.6 gigawatts of community solar power have been installed in the U.S. This figure is projected to double over the next five years according to the Solar Energy Industries Association. SVB also noted, “it had more than 1,550 customers in the broader climate technology and sustainability sector, and it has committed $3.2 billion in innovation projects in the field.” Plans were to expand that commitment to $5.0 billion by 2027.

According to data firm Infralogic, SVB made about $1.2 billion of project finance loans to U.S. renewable-energy projects in 2022. That made SVB the sixth-largest lender in the space. The reason regional bank stocks have been slammed by investors is that many of them were also big lenders to renewable-energy projects and cleantech startups. KeyBank was the second-largest provider of U.S. renewable project finance loans last year. Zions Bancorp and East West Bank were also active in that lending space.

SVB has a report on its website titled “The Future of Climate Tech 2022.” The headline in the Executive Summary section is “Climate Tech Goes Mainstream.” When talking about the opportunities for climate technology, the bank wrote: “In order to achieve ‘net-zero,’ new technologies need to be developed and scaled, including sustainable aviation fuels (SAFs), carbon capture and sequestration (CCUS) systems and ‘green’ cement.” These are developing markets, but their emergence has been propelled by government subsidies.

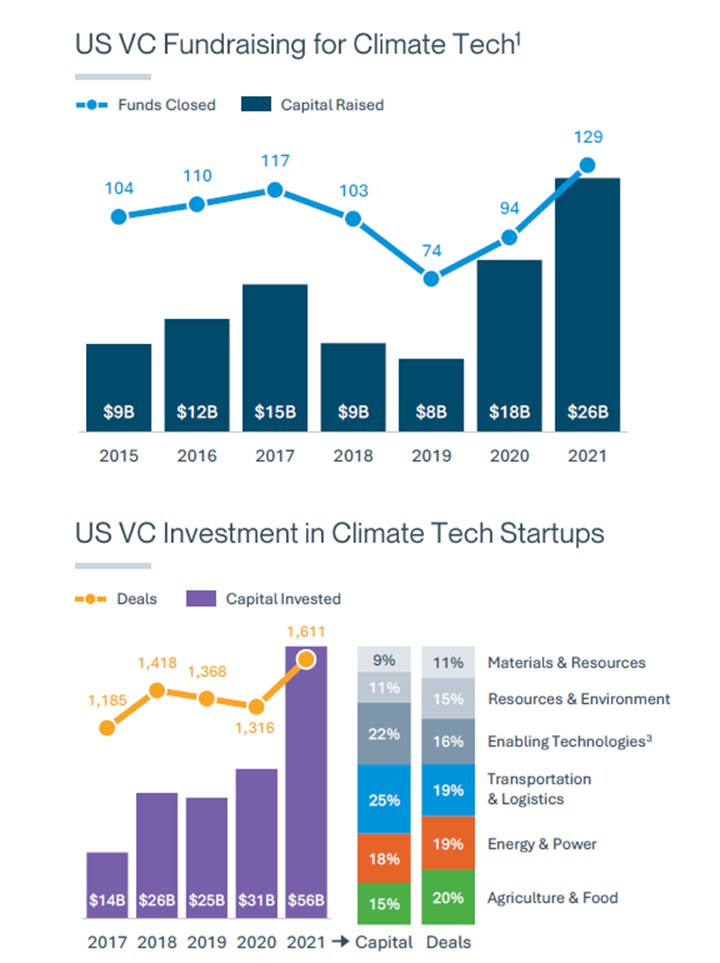

The SVB report went on to discuss the success climate tech was experiencing. It wrote that “US venture capital investment in climate tech companies increased 80% between 2020 and 2021, reaching $56B. The energy and power sector experienced the fastest growth, increasing 180% year-over-year.” Without a doubt, this rapidly growing sector would include batteries, wind, solar, pumped storage, and geothermal energy, to name other prominent markets.

We thought it interesting that the report contained the following comment: “A cautionary note: the climate tech sector does not come without its challenges. Timelines for companies to scale are typically longer, talent is in short supply, infrastructure is lagging plus inflation and supply-chain pressures are increasing the cost of operations.” Add to that now financing disruptions.

The chart below from the report shows recent year totals of VC fundraising and investing in clean tech ventures. Notice the cyclicality of fundraising, but the surge in new funds closed in 2021. On the investment side, there has been a steady rise in amounts and deals with a spike in 2021. The columns to the right of the yearly investment totals show Transportation & Logistics accounted for the most money invested, but Agriculture & Food represented the largest number of deals.

Exhibit 2. Venture Capital Fund Raising And Investing In Clean Tech

Source: SVB

The SVB report commented on VC investing trends by noting that Transportation & Logistics requires substantial capital to build vehicles and infrastructure. The report pointed to Tesla having begun business in 2003 but did not produce its first electric vehicle until 2009. Tesla needed to raise just under $1 billion, with equity representing about 55% of the total and debt the balance, to fund the enterprise....

....MUCH MORE

Also in this edition of Energy Musings

New offshore projects continue to be proposed while the head of the U.S.’s leading renewable energy utility company warns his CERAWeek audience that “offshore wind is a bad bet.” READ MORE

The Cost Of Getting To Net Zero By 2050

States are mandating utilities reduce their carbon emissions to reach net zero by 2050. An analysis of Wisconsin’s plan shows its consumers will paying $248 billion (2022$) more. READ MORE

SVB And The ESG And Woke Attacks

Critics blame SVB’s ESG and DEI focus for its failure. They point to the directors’ backgrounds and associations. Their skills instead raise questions about the lack of management oversight. READ MORE