(otherwise known as The Beta Boys)

From ZeroHedge:

After Powell's words sparked panic-buying - and dramatic easing of financial conditions - some are wondering if The Wall Street Journal's Nick Timiraos' report this morning is an attempt tp jawbone back the market's dovish perception.

Federal Reserve officials have signaled plans to raise their benchmark interest rate by 0.5 percentage point at their meeting next week, but elevated wage pressures could lead them to continue lifting it to higher levels than investors currently expect.

...

brisk wage growth or higher inflation in labor-intensive service sectors of the economy could lead more of them to support raising their benchmark rate next year above the 5% currently anticipated by investors.

Timiraos comments come right after the Fed's pre-meeting 'blackout' began over the weekend.

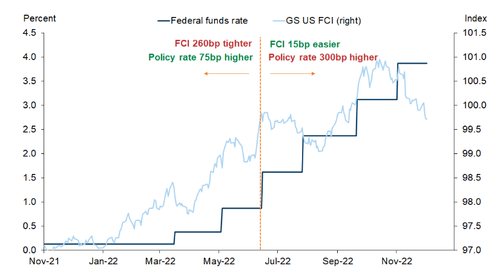

Financial conditions have dramatically eased in recent weeks... basically unchanged since the July FOMC (despite 150bps of tightening)...

While US financial conditions are now easier than they were BEFORE the Fed deployed four consecutive blasts of 75bps, they have eased dramatically in recent weeks. Goldman's Mike Cahill warns:

"this is a big challenge for the Fed. it demonstrates why slowing the pace + guiding to a higher terminal rate is pretty counterproductive. and, also why I’m personally skeptical of the idea that there’s this big lagged policy effect about to drag on the economy -- most of the FCI tightening happened in Q2 2022, and on our models we are already moving through the peak negative impulse from that.”

So, if one of the huge questions for next year is calibrating the “long and variable” lag effects of the hikes that have already come to pass, this would suggest the Fed needs to keep the pressure on."

Timiraos' comments pushed terminal Fed rate expectations higher...

....MUCH MORE