As pointed out in November 24's "Copper: What's Your Timeframe?" it really, really matters how far ahead you are looking.

Two from Mining.com, December 6:

Glencore says this time is different for coming copper shortage

Glencore Plc added its voice to a chorus of miners warning of coming copper shortages, arguing that a “huge deficit” is looming for the crucial industrial metal.

Chief Executive Officer Gary Nagle said that while some people were assuming that the industry would lift supplies as it had in previous cycles to meet a forecast increase in demand driven by the energy transition, “this time it is going to be a bit different.”

He presented estimates showing a cumulative gap between projected demand and supply of 50 million tons between 2022 and 2030. That compares with current world copper demand of about 25 million tons a year.

“There’s a huge deficit coming in copper, and as much as people write about it, the price is not yet reflecting it,” Nagle said.

Copper miners and analysts have been warning of growing deficits starting in the mid-2020s....

....MORE

And from Reuters via Mining.com:

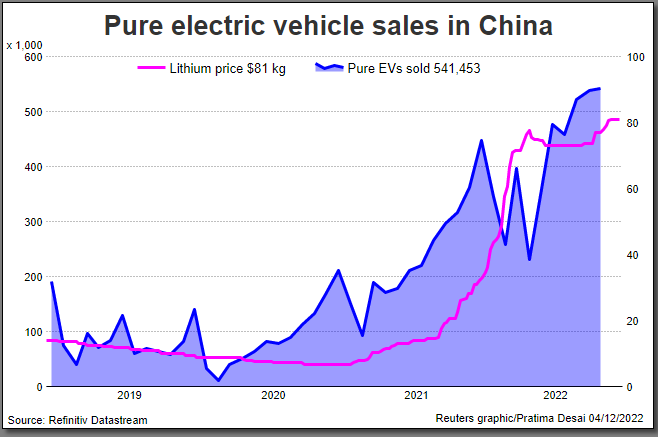

Lithium price to retreat from record as electric car sales slow

Healthy demand from battery manufacturers and shortages have propelled lithium prices to records, but rising supplies and China removing subsidies for electric vehicles mean a retreat is on the cards.

Battery grade lithium prices trading near $85,000 a tonne are more than double the levels seen at the start of 2022 and four times the levels seen in September 2021.

China, which bought one of every two electric vehicles sold last year, is expected to remain by far the top single country for electric vehicle sales for many more years. But the pace of demand growth is slowing....

....MUCH MORE