A few stories on the flattening of Lithium's ascent.

First up, the headliner from Bloomberg via Mining.com, December 7:

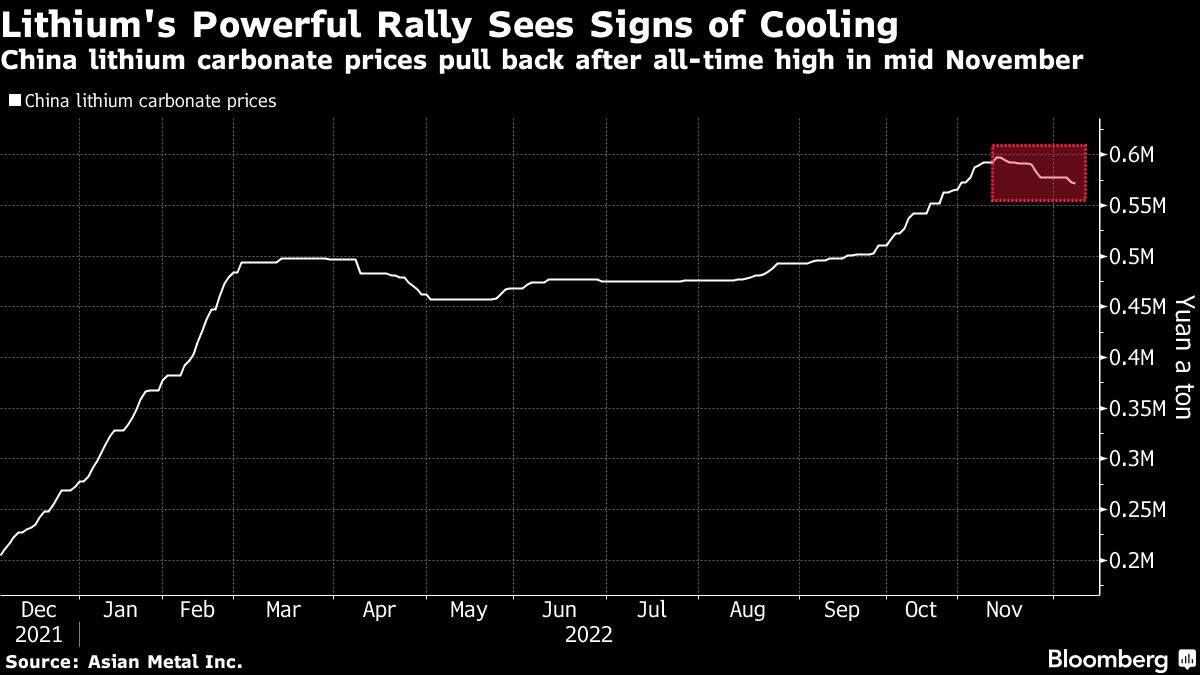

Red-hot lithium prices are getting a little less expensive, just as China’s electric-car giant BYD Co. flags that the market could swing back into surplus next year.

The battery material in China has continued to retreat from the all-time high hit last month as signs of demand weakness weigh on the market. Lithium carbonate fell 0.2% to 571,500 yuan ($82,000) a ton on Wednesday, although prices are still around double where they were at the start of the year.

BYD’s Executive Vice President Stella Li told Bloomberg in an interview on Tuesday that she sees new mines coming on stream next year, calling lithium prices “unreasonable.”

Lithium has enjoyed an extraordinary 1,200% gain over two years as supply has struggled to match rampant demand for electric vehicle batteries. That’s pinched manufacturers, which have been forced to raise prices. BloombergNEF’s annual lithium-ion battery survey showed a 7% jump in average pack prices in real terms this year — the first increase since the survey began....

....MUCH MORE

Not just "unreasonable", unsustainable. Because battery costs are such a large proportion of the cost of an electric vehicle you are actually seeing some demand destruction in the end product.

From ZeroHedge, December 9:

Tesla To Suspend Shanghai Factory Output Later This Month, Reports Say

Numerous reports surfaced Friday morning of Tesla "suspending" Model Y and Model 3 production at its massive Shanghai factory later this month due to upgrades at the plant and waning consumer demand.

Model Y and Model 3 production lines are expected to be suspended in the last week of December, according to Bloomberg, citing people familiar with the matter. They said Model 3 production could resume in early January, though Model Y output disruptions could be prolonged. Another person said Model 3 production could be suspended again later in the month for the Chinese New Year. They added that this would allow for more upgrades and equipment maintenance to produce an enhanced version of the model.

In a separate report, Reuters cited two people with direct knowledge and an internal memo about the automaker's plan to suspend Model Y production at the plant between Dec. 25 and Jan. 1.

The two people said the suspension of the assembly line would result in a 30% reduction in Model Y production for the month. They added this type of production halt isn't a common practice for the plant.

"The Shanghai factory, the most important manufacturing hub for Elon Musk's electric vehicle company, kept normal operations during the last week of December last year," Reuters said.

Earlier this week, Bloomberg said that slumping Chinese demand would result in the factory reducing production by 20% from full capacity. And almost immediately, a report from Shanghai Securities Journal called it "false information." ....

....MORE

And finally, from OilPrice, supply coming on line, December 8:

New Supply Could Help Bring Lithium Prices Back Down To Earth

....Goldman Sachs commodity analysts share the expectations of BYD’s Li and expect the supply of lithium to catch up with demand sometime next year, pushing prices sharply lower.

According to them, as quoted by the Motley Fool, lithium carbonate prices could fall from over $59,000 per ton this year to just $11,000 per ton in 2024, while lithium hydroxide could drop from $67,240 per ton this year to $12,500 per ton in 2024.

The bank said it expected demand for the battery metal to rise to 1.3 million tons of lithium carbonate equivalent by 2025, but supply will expand to 1.7 million tons of lithium carbonate equivalent during the same period.....

....MUCH MORE