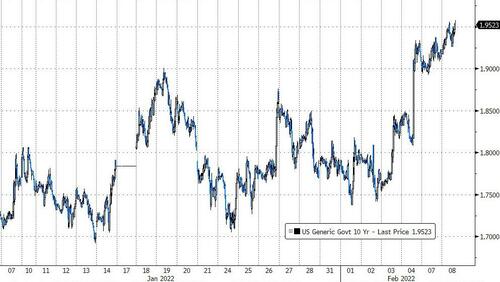

Although it reminds me of Gaddafi and the "Line of Death"*, this really is the level for treasury yields.

From ZeroHedge:

Yields on 10-year Treasuries climbed to as high as 1.96% on Tuesday, the highest since November 2019. Australia’s benchmark yields soared 13 basis points, while the Japan equivalent approached a level that the central bank has indicated it will defend.

Price action since the start of the year supports a narrative that convexity hedging flows have so far been absent.

That makes sense, with the surge higher in yields built on a strong macro backdrop and a hawkish central bank pivot.

But, as Bloomberg's Ed Bolingbroke notes, this could be about to change with 10-year yields at 1.95% - a level where mortgage bond funds would be compelled to sell Treasuries to protect their portfolios against the effects of rising yields, according to strategists.

That's according to Citi, who in a closing note Friday flagged that their trading desk saw “no strong fingerprints of convexity-related paying today but they suspect a breach of 1.95% in 10’s might spur some.”....

....MUCH MORE

On Aug. 19, 1981 the U.S. Sixth Fleet was in the Gulf, the Libyans sent up their Air Force,

two F-14's from the Nimitz shot them both down and Robin Williams got a bit out of it:

...Here's a man who had the audacity to go:Here's the 1986 performance, Live at the Met:

"This is the line of death. You cross it, you die." {Pause}

"Okay, you cross this line, you die." {Pause}

"Okay, you cross this line, you die."

"This line, you die."

"Okay, you're knocking on my door,

I'm not coming out. Naaaaah"