But if you've been with us a while you knew that. Wide-open spaces under a roof, since 2019, that's us.

From The Motley Fool via Nasdaq:

These 2 REITs Are Getting Humongous Rent Increases

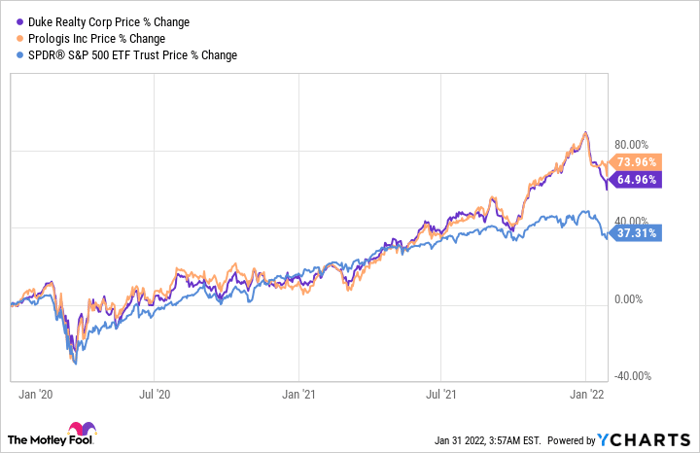

News headlines with the word inflation in them are everywhere right now. So, too, are stories about supply-chain disruptions. So it isn't too shocking that industrial real estate investment trusts (REITs) like Prologis (NYSE: PLD) and Duke Realty (NYSE: DRE) that have a heavy focus on warehouse space have been able to increase the prices they charge tenants. Here's a look at how good things are for this pair today and what that could mean for the future.

If you are feeling it, so are they

Go to the grocery store and it won't take long for you to realize that prices are heading higher. That's inflation at work, but it doesn't just take shape at the end of the line with consumer prices. Price increases have been happening from base ingredients all the way through to the transportation of products to the stores that sell them. A vital real estate cog in this process is warehouse space.

That's the specialty of Prologis and Duke Realty, both of which are laser focused on owning logistics assets. Think warehouse and distribution space located in key transportation hubs and ports in both cases. The big difference between the two is that Prologis has a global portfolio while Duke Realty's assets are located largely in the U.S.

Both of these REITs have reported fourth-quarter 2021 earnings, and the one number that stands out the most is rent increases. Prologis was able to hike rental rates on leases that were renewing by 33%. Duke Realty was able to hike its rates by even more, pushing through an average 40.8% rental increase. Although these leases are probably coming off of a low base set years ago, the change is still humongous and shows just how in-demand distribution-related property is right now....

....MUCH MORE

"...CBRE Just Bought A Nearly $5 Billion Logistics Property Portfolio"Have I mentioned warehouses and logistics?*

Buying Warehouses In Europe and China (many links)

It was rather lonely in 2019 when we were pitching warehouses and cold storage facilities but by December 2020 we were posting stuff like:

Real Estate: "Logistics market is hot, but is a bubble forming?"

It's always nice to see a sector you've been babbling about for a couple years finally referred to as a bubble.

Big Money Still Buying Warehouse Assets: Canada Pension Plan Investment Board Enters Into $1.1 Billion J.V.

"Stuffing Ourselves | Amazon, the Postal Service, and the Tyranny of Logistics" (AMZN)

Maersk Goes Big On Warehouses: Buy's Li & Fung's Logistics Unit For $3.6B