Two from Wolf Street. The headliner was posted yesterday after the PPI release:

Massive price increases now building up in the pipeline.

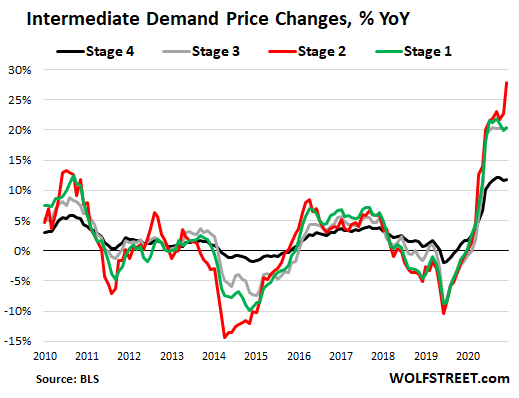

A lot of price increases at various stages of production are coming down the pipeline that haven’t flown into consumer prices yet. These are input costs for industries that will try to pass them on to the next company in line, which will try to pass them on until the consumer gets to eat them. We’ll go up that pipeline in a moment.

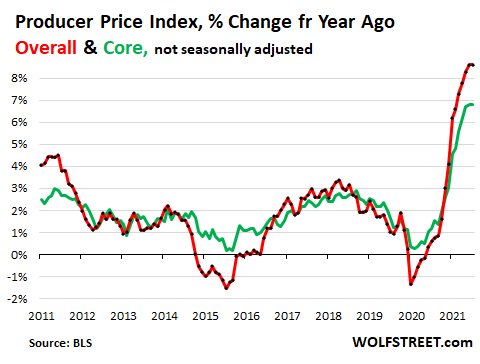

At the front of the pipeline: Producer Price Index for Final Demand.

The PPI Final Demand covers the input prices for consumer-facing industries whose prices then enter into the Consumer Price Index. The PPI Final Demand jumped by 0.6% in October from September and pushed the year-over-year increase to 8.6%, same as in September, the biggest such jumps in the data going back to 2010 (red line).

The Core PPI Final Demand, without food and energy rose by 0.5% for the month and by 6.8% from a year ago, same as in September, the highest readings in the data, according to the Bureau of Labor Statistics today (green line).

Time of the year for “hedonic quality adjustments” to kick in:

The price index of new vehicles fell in October from September because the new 2022 models were entered into the index with “hedonic quality adjustments” as they always are at this time of year. The wholesale value of the hedonic quality adjustments for the PPI amounted to $86.84 per car and to $186.22 per light truck, according to the BLS. These hedonic quality adjustments are going to reduce CPI for new vehicles.

These quality improvements include changes in the infotainment systems, power trains, and standard and optional equipment packages.

In other words, the once-a-year price increases of the new model-year vehicles were reduced by those amounts, which is why we have the amazing WOLF STREET F-150 and Camry price index, which shows actual prices versus the CPI for new vehicles going back 30 years.

In terms of the PPI, tor year-over-year comparisons, there is always the “base effect,” meaning that the level of the index last year impacts that year-over-year percent readings. And there is always the cumulative nature of inflation. The chart below shows the PPI and Core PPI as index values, which avoids the base effects and shows the cumulative nature of inflation. Note how the curve has steepened over the past 12 months:....

*****

In the three production stages furthest up the pipeline – Stages 1-3, red, green, gray – prices have all jumped between 20% and 28% year-over-year. These are massive price increases now building up in the pipeline; and they will flow to some extent and in some form into future consumer prices.....

....MUCH MORE

Either it gets passed along and we enter year two of transitory PPI:

source: tradingeconomics.com

or it doesn't get passed along and corporate margins collapse from their current all-time-highs and equities priced to that perfection follow suit.

And also at Wolf Street, this time going back to October 27:

Which is exactly what we were talking about in the introduction to "CONSUMER PRICE INDEX – OCTOBER 2021"

The tables are still not showing the acceleration in housing costs which are documented. Because shelter is almost one-third of the CPI weightings this is a giant discrepancy. Today's report had the monthly gain in shelter costs at 0.5% and the 12-month increase at 3.5%.