From CB Insights:

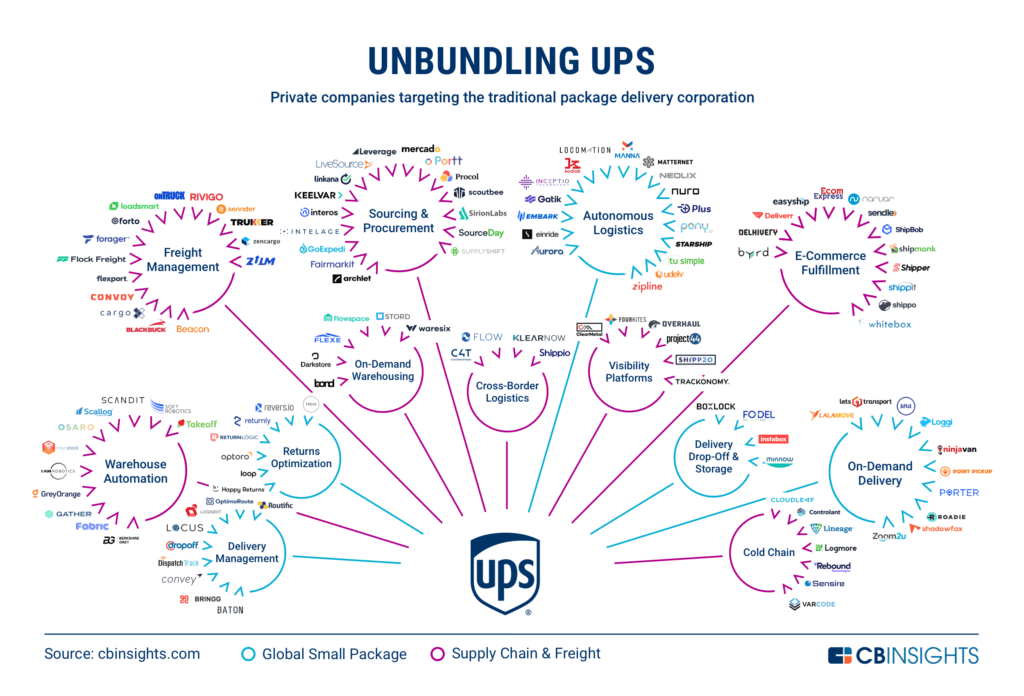

From package delivery to supply chain & freight services, here's how UPS is being unbundled.

UPS — and the traditional shipping & logistics space at large — is being disrupted across many of its core functions and revenue streams.

As the world’s largest package delivery company, UPS has established a strong foothold in shipping and logistics, expanding its business internationally and offering additional supply chain and freight services such as freight forwarding, logistics & fulfillment, and customs brokerage.

The company competes most directly with FedEx and USPS in the US, but more recently, Amazon, one of its largest customers, has emerged as a competitor. The online retailer has launched its own shipping and delivery network that delivers more than half of its packages (Amazon Flex), on top of building out its own fleet of cargo jets, designing electric delivery vehicles from the ground up, and acquiring new warehousing space to speed up delivery.

Covid-19 has drawn further attention to these startups.

The pandemic’s disruption to global supply chains exposed a number of vulnerabilities and inefficiencies up the supply chain, creating opportunities for new tech-based solutions. Further, unprecedented consumer demand for e-commerce, which is expected to persist, overwhelmed legacy shipping and logistics infrastructure, generating demand for technology that can streamline fulfillment and delivery.

Investors are taking note, as funding to supply chain & logistics startups in 2020 reached record highs at $1.7B across 683 deals.

Below, we take a look at how startups and companies are unbundling UPS, from logistics and delivery to freight and supply chain management.

Category breakdownWe outline the technologies and services unbundling UPS based on the company’s business segment reporting, which is comprised of the following:

- Package delivery: The company’s Global Small Package operations, which brought in $60.7B in revenue in 2019 (82% of total revenue) and completed 5.5B deliveries globally, provide delivery services for letters, documents, small packages, and palletized freight via air and ground services. These services are supported by shipping, visibility, and billing technologies.

- Supply chain & freight services: The company’s Supply Chain & Freight segment, which brought in $13.4B in revenue in 2019 (18% of total revenue), offers adjacent services such as freight forwarding, logistics, and other supply chain management capabilities.

The breakdown within each business segment is structured based on the shipping journey.

Package delivery

UPS’s global small package business is primarily oriented around the shipping and delivery of small packages and letters. Companies working on automating, streamlining, and optimizing delivery services are targeting this piece of UPS’s business.

Autonomous logisticsA number of autonomous driving startups are focused on logistics applications, such as long-haul trucking and last-mile delivery, both central to UPS’s ground delivery services.

Long-haul truckingUPS is already testing out autonomous long-haul trucking with autonomous trucking startup TuSimple, which is developing a Level 4 autonomous system of trucks capable of operating without a driver.

A number of other companies are focused on self-driving technology for the trucking ecosystem.

- Similar to TuSimple, Aurora and Kodiak Robotics are developing autonomous driving systems that would completely replace a human truck driver, or at least enable remote operation (i.e. Level 4-5 autonomy).

- Other companies like Einride focus on building the vehicles themselves, designing fully autonomous, all-electric trucks and vans for logistics applications.

Clients can view a deeper analysis of some of the emerging providers in autonomous trucking in this report.

Last-mile deliveryUPS is also working with several companies on testing autonomous last-mile delivery, including a prescription drone delivery partnership with CVS and drone startup Matternet (announced in April 2020) and an autonomous delivery partnership with Alphabet’s autonomous driving subsidiary Waymo (announced in January 2020).

Companies here are developing a wide variety of vehicles for autonomous last-mile delivery, including ground-based vehicles, sidewalk robots, and drones.

- For example, ground-based autonomous last-mile startups Nuro and Starship Technologies develop vehicles built specifically for carrying general merchandise and food, including perishables. These vehicles can travel on streets alongside cars or on sidewalks.

- Similar to Waymo, companies like Pony.ai that originated as robotaxi companies have pivoted to delivery given strong demand due to the pandemic.

- In addition to Matternet, drone startups such as Zipline are experimenting with drone-based delivery, mainly for prescriptions and personal protective equipment (PPE).

We assess several of the main players in autonomous last-mile delivery in this client-only report.

Delivery management

Given the high costs and complexities associated with last-mile delivery, some companies are focused on solutions that drive efficiencies in the last leg of the shipping journey.

Delivery management software has emerged as a viable tool, as it combines dynamic routing, real-time tracking, fleet management, and order pooling to streamline last-mile delivery.

UPS operates its own internal driver route planning program, called ORION, which it recently updated to feature dynamic routing — software that recalculates routes based on real-time traffic levels and other external factors.

On-demand delivery

- Notable startups developing more comprehensive delivery management platforms include Bringg and LogiNext.

- Other companies such has DispatchTrack and OptimoRoute focus on leveraging AI to optimize routes.

Similar to Uber for passenger rides, a number of startups have emerged in the delivery space that are developing platforms to better match supply (drivers) with demand (shippers).....

...MORE