Much is written about the Black Swan, famously described by Nassim Taleb in his 2001 book, Fooled by Randomness,and smartly summarized by Malcolm Gladwell in The New Yorker’s April 22, 2002 publication.

As a reminder, the Black Swan is a metaphor that describes an event that comes as a surprise, has a major impact on markets or society, and is often considered painfully obvious with the benefit of hindsight.

This begs the question of why we often ignore, to our detriment, the more commonplace White Swan.Daniel Kahneman won the 2002 Nobel Prize in economics for shining a bright light on how cognitive bias leads to poor decision making. Seemingly by nature, people overly worry about low probability events and diminish their concern for truly risky behaviors. For example, many people are terrified of being bitten by a shark or struck by lightning, but then hop into a taxi and fail to snap on their seat belt.

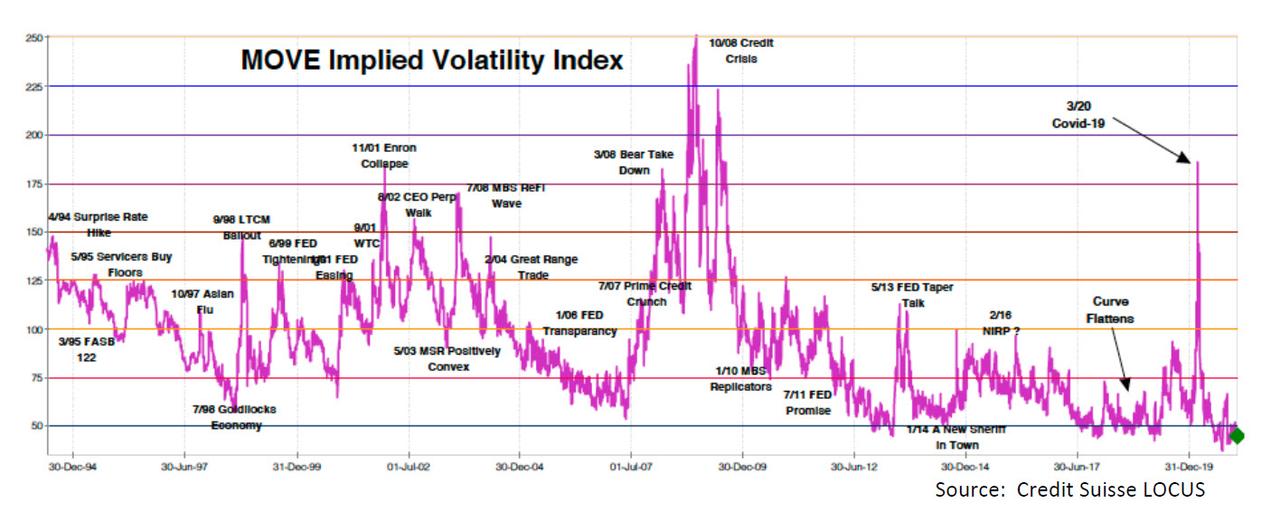

As the calendar rolled into 2020, the -platycodon line-MOVE Index was under 50 while the more widely watch VIX Equity volatility index was kissing 12. There are no reasonable statistics to comprehend such levels, they are just too low. And of course, my in-box was bulging with investors wanting me to reveal the next “surprise” that would shock the market out of its doldrums. I could only reply that if I knew, it would (by definition) not be a surprise.

Notwithstanding that Bill Gates offered a TED Talk in 2014 on the risk of a Global pandemic, and that a dozen such science fiction movies were available on Netflix, indeed COVID-19 was a Black Swan surprise.

What is no longer a surprise is the Government’s proposed Monetary and Fiscal solutions to the havoc that COVID has wreaked....

....MUCH MORE

HT that Harley's latest was out: ZH. I had looked last week but was a couple days early.

Also please note change of address via the Associated Press: "Harley Bassman, 'The Convexity Maven,' Joins Simplify Asset Management"

Our boilerplate introduction to Mr. Bassman:

...Wall Street loves to make convexity sound complex (I suppose it’s so they can charge higher fees?). We speak Greek (calling it “gamma”), employ physics as a metaphor (analogizing to it “acceleration”), and use mathematical definitions (since it is the second derivative of the asset’s price change)."Pish. Posh." is a technical term only used by market professionals for those situations where one has decided to go full Alinsky rule #5:

Pish, posh. An investment is convex if the payoff is unbalanced for equally opposite outcomes. So if there’s the potential to earn a profit of two on a bet versus a maximum loss of one, the bet is positively convex. If you can lose three versus making two, it is negatively convex. That’s it. The rocket scientists are called upon to help (fairly) price the cost (value) of such possible outcomes. This is why the expansion of derivative trading in the 1990’s resulted in a hiring spree of physics PhD’s....

#5 Ridicule is man’s most potent weapon. It’s hard to counterattack ridicule, and it infuriates the opposition, which then reacts to your advantage...

The Convexity Maven is nothing if not a professional. Here is part of his mini-bio at MacroVoices:

Harley S. Bassman

Harley Bassman created, marketed and traded a wide variety of derivative and structured products during his twenty-six-year career at Merrill Lynch. In 1985 he created the OPOSSMS mortgage options product that facilitated risk transmission between MBS originators and financial institutions. In 1988, he assumed responsibility for trading and marketing IO/PO and other levered prepayment securities. Soon after this, he started purchasing RTC auctioned MBS Servicing rights and repackaged them for the securities market as BIGS - Beneficial Interests in GNMA Servicing. Later, he started a GNMA servicing conduit becoming one of the Top 20 originators in 1992. As managing and hedging prepayment risk became a priority focus for the financial markets, Mr. Bassman created PRESERV, Merrill's trademarked Prepayment Cap product. Merrill was a leader in this product category writing protection that covered the risk on tens of billions of notional mortgage servicing rights. Later, Mr. Bassman managed Merrill's initial venture into off-balance sheet mortgage trading.

In 1994, Mr. Bassman assumed responsibility for OTC bond options.

Within a year, Merrill was the leader in this product sector. A wide variety of products were offered including vanilla and complex options on MBS spreads and the Treasury yield curve.

To help clients more fully appreciate Volatility as a primary risk vector, he created the MOVE Index. Similar in form to the VIX Index, it is now the recognized standard measure of Interest Rate Volatility.And so much more, all those cutesy Merrill acronyms can be blamed on him and his team.

From 1995 to 2000 he focused on creating hedge strategies for MBS servicers and portfolio optimization techniques for Total Return and Index investors.

Mr. Bassman became the manager of North American MBS and Structured Finance trading in 2001. During his tenure, he created SURF, (Specialty Underwriting and Residential Finance), a self-contained Sub-Prime mortgage conduit. He supervised the issuance of Merrill’s first Sub-Prime securities. He also transitioned the structuring business to a new technology platform....