Weather is the variable that produces the most dramatic moves with supply more important to price volatility than demand which has tended to uptick in a more monotonic (read volatility-reducing) fashion.

The world has had a three-decade run of near perfect weather for industrial scale agriculture which has foiled long term bulls but there are indications the major producing regions may be close to a regime change in the weather.

Historically, the conditions that have reduced supply the most were cool/damp in northern Europe and the ENSO-induced crop failure in India in the late 1800's, exacerbated by British Colonial rule, the effect of which was popularized by "Late Victorian Holocausts".

See also last month's "Simultaneous harvest failures in key regions would bring global famine, says the Met Office", if interested.

From The Macro Tourist;

EMBARRASSING AG PROBLEM

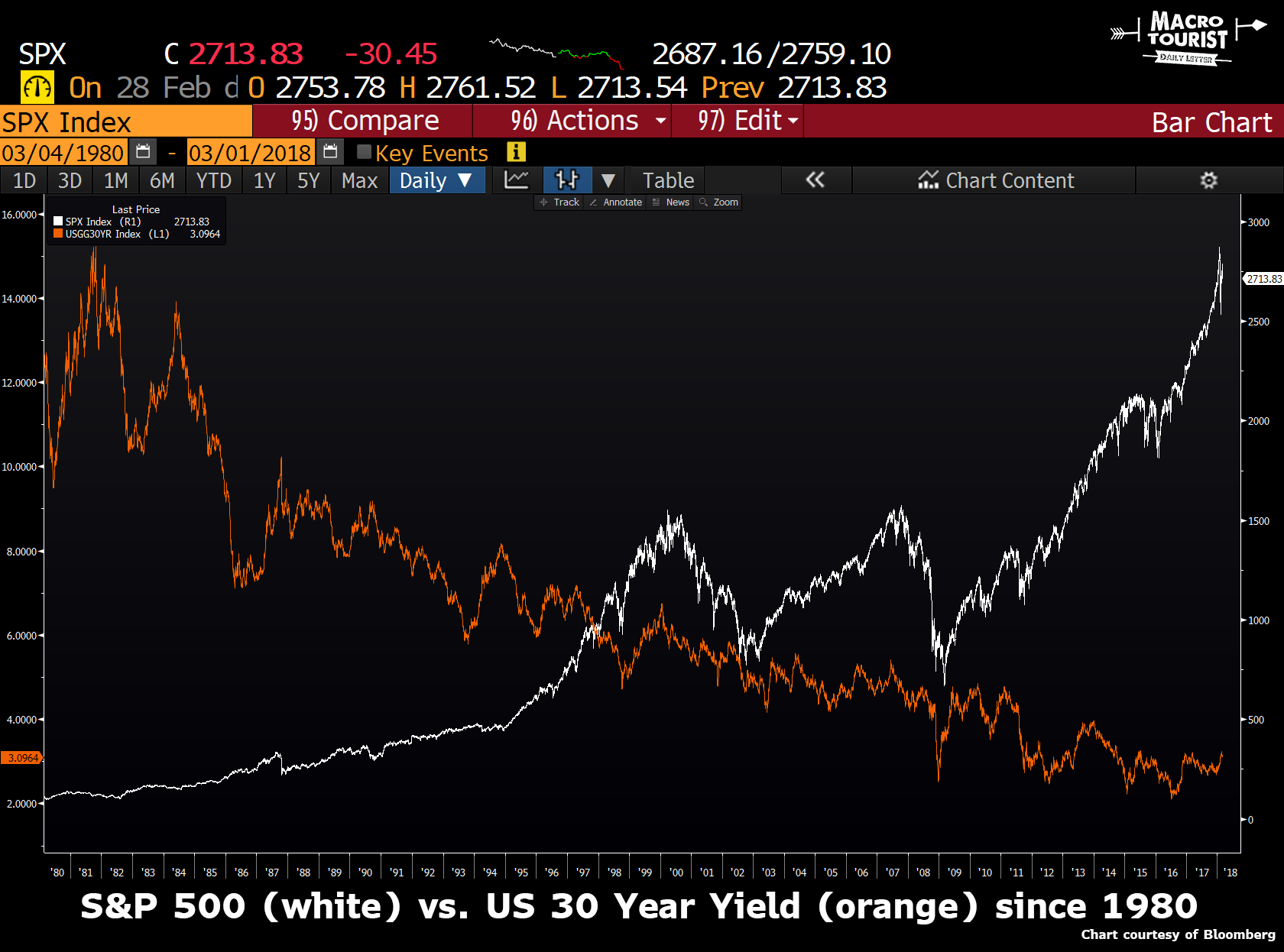

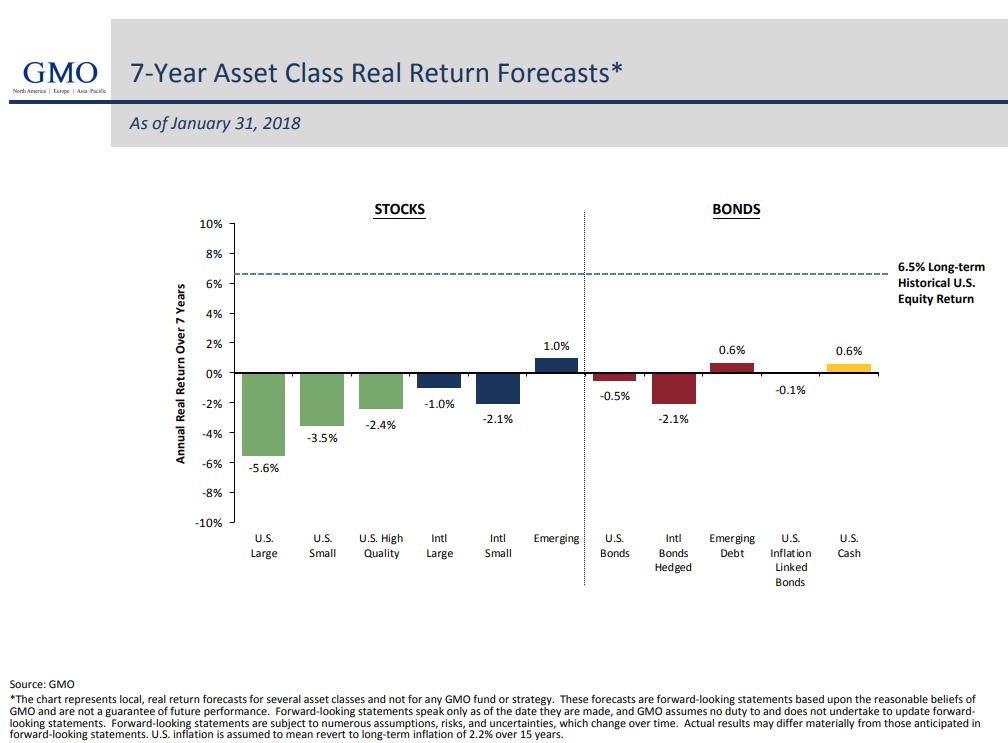

Stock markets up on a stick. Valuations stretched. Bond yields near sixty year lows. Real returns basically zilch.A decade of global financial repression has forced investors everywhere out the risk curve. Nothing is cheap. There is a reason that top quantitative research shops like GMO have forecasted future returns that look like this:

Cries of that awful acronym TINA ring through the halls of investment houses as clients take a big gulp and write blue tickets - despite the lofty prices. After all, everything is dear and their retirement still needs to funded.

The last remaining cheap asset?

Everywhere you look asset prices are on their highs, but there is one asset that is as cheap as it has ever been. No, it’s not sexy, and neither is it easy to buy, but if it were, it would probably be insanely overpriced, so let’s take those attributes as positive.

I am of course talking about grains.

You might say to yourself - but wait, it’s not like grain prices are ticking at all-time lows, so what do you mean?

And you would be correct. Over the past half century, grains have been lower many times.

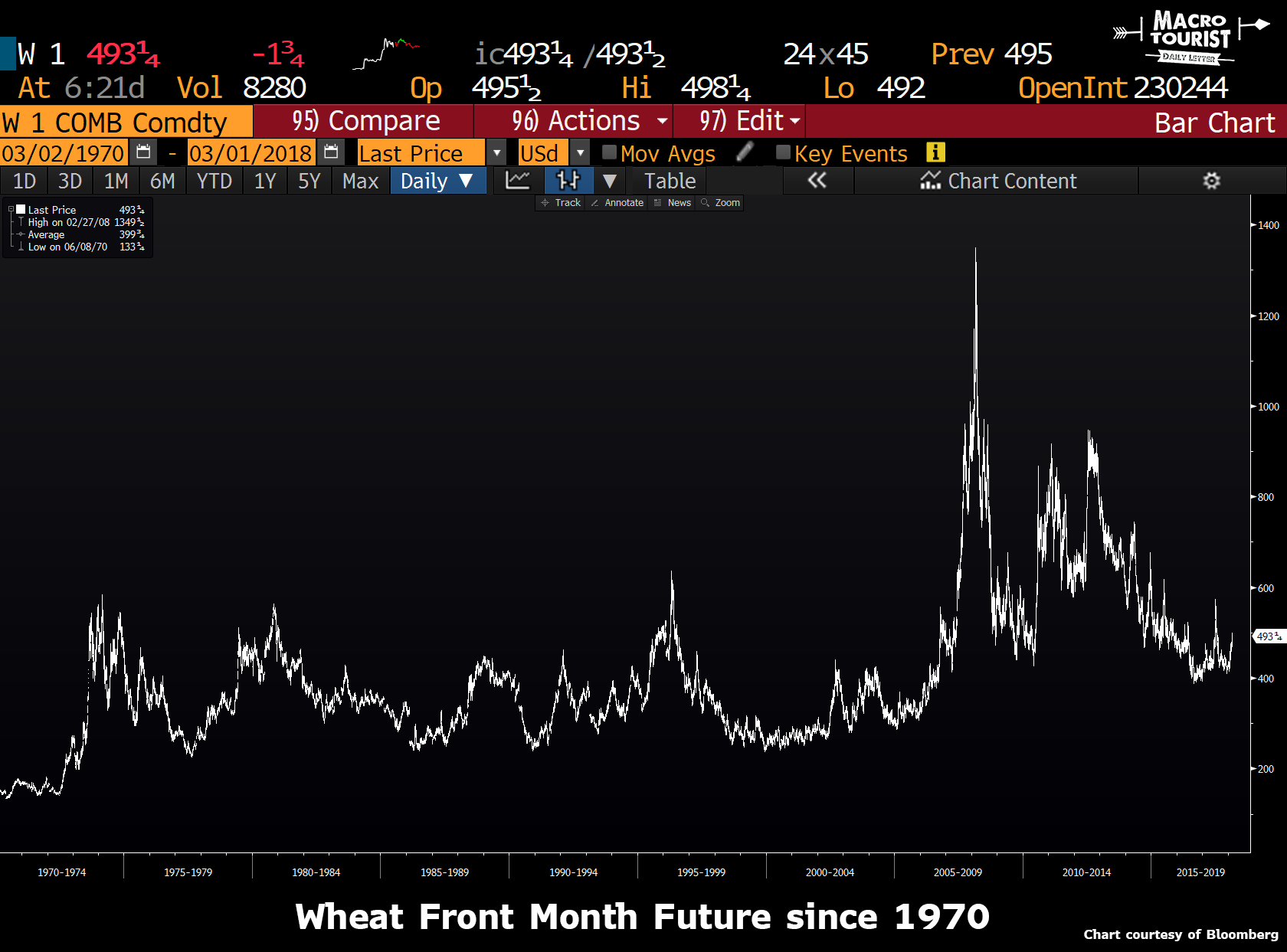

Wheat was less expensive in the 1990’s.

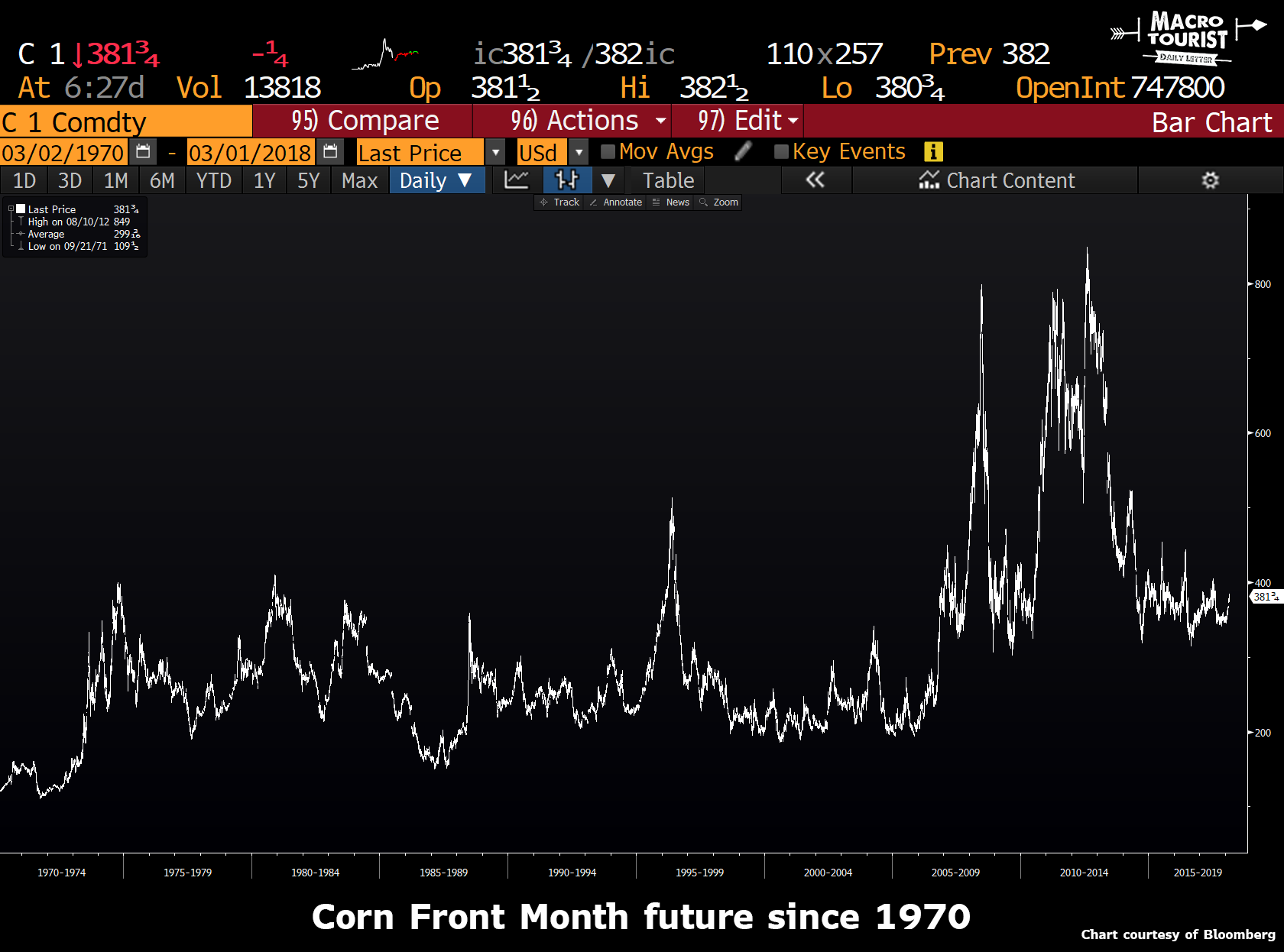

Corn is currently in the middle of the range.

And you might even argue that soybeans are relatively high compared to the last few decades.

But we need to recognize that these charts have a timeline measured in decades. Think about that for a second. What do you know that has basically gone sideways in price since 1970?

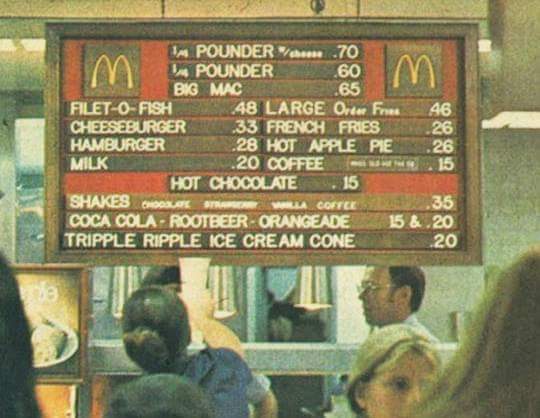

I don’t know about the prices at your McDonalds, but a Big Mac is a lot more expensive than 65 cents in my neck of the woods.

Quickly looking at the charts of wheat, corn and soybean without adjusting inflation is disingenuous. In real terms, the price of these commodities has collapsed over the past half a century.......MUCH MORE

Macro Tourist goes on to point out the 20% or so moves off the recent bottoms but that is not what we're talking about. While it beats working for a living the fortune-builders are somewhere out on the horizon although maybe coming into a bit of focus.

Related: the intro to 2016's "FEMA Contractor Predicts 'Social Unrest' Caused by 395% Food Price Spikes"

Contrary to the headline what follows isn't a 'prediction'. Rather, this is a simulation which posited drought as the pre-condition to initialize the parameters they used to game out the scenario.

The actual risk is the Pacific Decadal Oscillation going firmly into its negative phase and depending on ENSO phase (La Niña-El Niño) and the North Atlantic Oscillation phase lining up, creating very wet conditions in Ukraine and western Russia. This type of weather pattern has led to some of the most widespread crop failures in history. As noted in our intro to 2009's "Corn Prices May Enter Decade-Long Slump, Agency Says"

Watch that Pacific Decadal Oscillation. A New York Times archive search for the term "crop failure" returns 1950 hits, with a preponderance of stories written during the cool phase of the PDO. With the interconnectedness of the world's grain markets, a failure anywhere would raise prices everywhere....See PDO monthly values below the jump....