Jerome Powell, the new Fed Chair, was on Capitol Hill on February 27, and his testimony was, for the most part, predictable and uncontroversial. He told Congress that he believed that the economy had strengthened over the course of the last year and that the Fed would continue on its path of "raising rates". Analysts have spent the next few days reading the tea leaves of his testimony, to decide whether this would translate into three or four rate hikes and what this would mean for stocks. In fact, the blame for the drop in stocks over the last four trading days has been placed primarily on the Fed bogeyman, with protectionism providing an assist on the last two days. While there may be an element of truth to this, I am skeptical about any Fed-based arguments for market increases and decreases, because I disagree fundamentally with many about how much power central banks have to set interest rates, and how those interest rates affect value.1. The Fed's power to set interest rates is limitedI have repeatedly pushed back against the notion that the Fed or any central bank somehow sets market interest rates, since it really does not have the power to do so. The only rate that the Fed sets directly is the Fed funds rate, and while it is true that the Fed's actions on that rate send signals to markets, those signals are fuzzy and do not always have predictable consequences. In fact, it is worth noting that the Fed has been hiking the Fed Funds rate since December 2016, when Janet Yellen's Fed initiated this process, raising the Fed Funds rate by 0.25%. In the months since, the effects of the Fed Fund rate changes on long term rates is debatable, and while short term rate have gone up, it is not clear whether the Fed Funds rate is driving short term rates or whether market rates are driving the Fed.

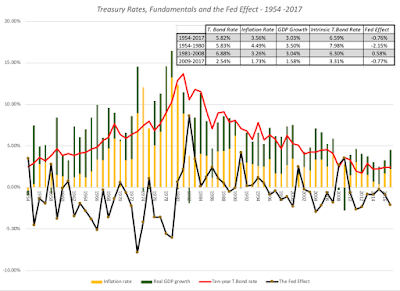

It is true that post-2008, the Fed has been much more aggressive in buying bonds in financial markets in its quantitative easing efforts to keep rates low. While that was started as a response to the financial crisis of 2008, it continued for much of the last decade and clearly has had an impact on interest rates. To those who would argue that it was the Fed, through its Fed Funds rate and quantitative easing policies that kept long term rates low from 2008-2017, I would beg to differ, since there are two far stronger fundamental factors at play - low or no inflation and anemic real economic growth. In the graph below, I have the treasury bond rate compared to the sum of inflation and real growth each year, with the difference being attributed to the Fed effect:

|

| Download spreadsheet with raw data |

You have seen me use this graph before, but my point is a simple one. The Fed is less rate-setter, when it comes to market interest rates, than rate-influencer, with the influence depending upon its credibility. While rates were low in the 2009-2017 time period, and the Fed did play a role (the Fed effect lowered rates by 0.77%), the primary reasons for low rates were fundamental. It is for that reason that I described the Fed Chair as the Wizard of Oz, drawing his or her power from the perception that he or she has power, rather than actual power. That said, the Fed effect at the start of 2018, as I noted in a post at the beginning of the year, is larger than it has been at any time in the last decade, perhaps setting the stage for the tumult in stock and bond markets in the last few weeks....MORE

The good professor would also like to remind us:

Damodaran Online: There is an App for that!