From Wolf Street:

Where will it go from here?

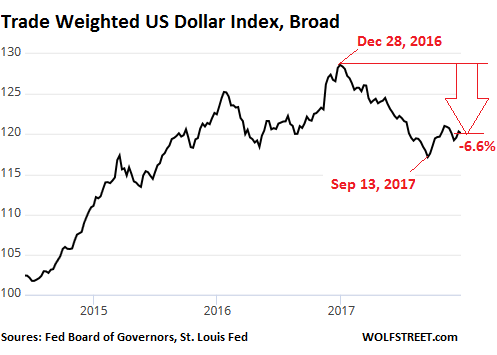

Today is another down-day for the US dollar, the third in a row, capping a nasty year for the dollar, the worst since 2003. In 2017, the dollar dropped 7% against a broad basket of other currencies, as measured by the Trade Weighted Dollar Index (broad), which includes the Chinese yuan which is pegged to the US dollar. It was worse than the 5.7% drop in 2009, but not as bad the 8.5% plunge in 2003.

Here are the past four years of the dollar as depicted by the Broad Trade Weighted Dollar Index, which tracks 26 foreign currencies. The index is updated weekly, with the last update on December 26, and has not yet captured the declines of past three days:

This broad Trade Weighted Dollar Index is a weighted average of the dollar against the currencies of major US trading partners: the Eurozone, Canada, Japan, Mexico, China, UK, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile, and Colombia.

Among the largest currencies, the euro rose the most, soaring 14.5% against the dollar in 2017 and is currently trading at $1.20. The Canadian dollar is up 7% against the dollar, the Japanese yen nearly 4%.

As per the narrower Dollar Index [DXY], the dollar fell 10.2% for the year. The DXY measures the dollar only against the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc, but not against the currencies of other major US trading partners, such as China and Mexico.

Thus the dollar has accomplished a feat in 2017: During a year when the Fed continued with clockwork regularity its efforts to raise interest rates “gradually,” and when it kicked off the QE Unwind, thus taking dollar liquidity out of the market, the dollar, instead of rising in response, had its worst year since 2003.

Front-running the Fed?

In the second half of 2016, the Fed signaled fairly clearly that it would get serious about raising its target range for the federal funds rate. In the fall of 2016, Fed governors started suggesting that the QE unwind would need to start in 2017. So when the Fed raised rates in December 2016 for the first time in a year and for the second time in 10 years, there was absolutely no surprise. Markets had expected it....MORE