From/via ZeroHedge, December 11:

Wall Street Reacts To CPI Report, Even As Markets Price In Certainty Of Dec Rate Cut

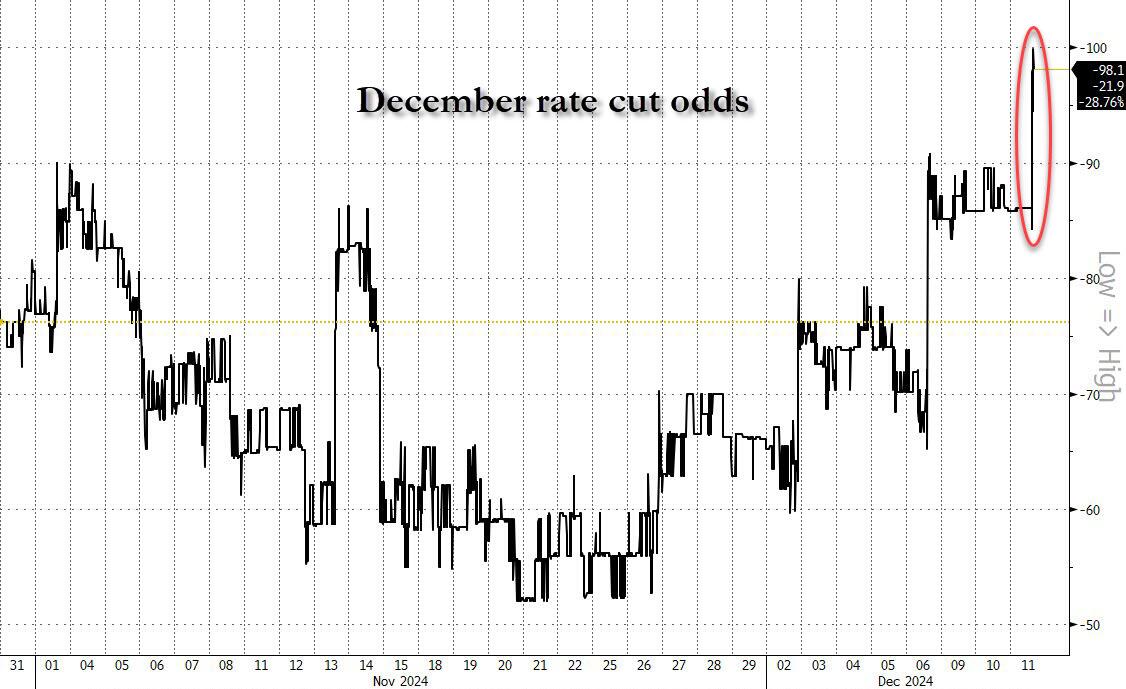

Today's CPI report - the final important economic report of 2024 - came on the screws with every Inflationary metric coming in as expected (if somewhat hotter when looked at a bit closer). Still, the market was relieved that the print did not beat estimates (as some whispers hinted), and for many this was enough to assure that the Fed cuts rates by 25bps next week before potentially pausing in January. Many... but not all.

As the following kneejerk reaction snapshots from a selection of Wall Street analysts, strategists and economists suggests, even today's print wasn't enough to assure everyone that a 25bps cut is a done deal, even if market implied odds are now up to 97.9%

Below we excerpt several key post-CPI soundbites:

Neil Birrell, Premier Miton Investors

"This report will give the Fed confidence. Investors will also take heart, as the lack of a surprise, good or bad, allows for more certainty in decision making in the short term.”

David Russell, head of market strategy at TradeStation:

“No news is good news. Inflation has stopped falling, but it isn’t enough of a problem to derail this bull market. Inflation and the Fed are becoming less of a catalyst. Attention could now shift to the incoming administration’s tariff policy.”

Brian Coulton, chief economist at Fitch Ratings:

“The decline in core goods prices – which was a big part of the overall disinflation story this year – looks to be over, with core goods prices rising 0.3% month-on-month as car prices jumped. Services inflation is coming down but only very slowly – as rental inflation proves stubborn – and, at 4.6%, remains far higher than pre-pandemic rates.”

Anna Wong, head of Bloomberg Economics:

“November’s sturdy core CPI reading will inflame worries among the FOMC minority that disinflation has stalled. True, housing-rent inflation finally stepped down — as market rents have long suggested — but goods prices have lost disinflation momentum. The current monthly inflation pace is consistent with an annual inflation rate above 3%, not with the Fed’s 2% target. The November CPI report likely implies that the Fed’s preferred price gauge, the core PCE deflator, may edge up to 2.9% for the last two months of 2024. We still think the FOMC is slightly more likely than not to cut rates again in at December’s meeting, but we don’t think it’s a done deal.”

Nick Timiraos, Fed Mouthpiece, WSJ

"Falling prices (deflation) of core goods over the last 18 months helped deliver a decent chunk of the disinflation we've seen. That has now ended, with higher car prices pushing up core goods 0.3% on the month (after +0.05% in October and +0.17% in September)."...

....MUCH MORE

Earlier: