Our best bet is "no worries" until the U.S. Presidential election in November.*

From Australia's MacroBusiness, March 14:

There are some great charts in this presention. Albert Edwards at Societe General.

Complacency is dangerous.

One only has to think of the fate of Julius Caesar on the Ides of March–which somewhat worryingly is this Friday.

Hence now that almost every market guru has walked back their recession call, wouldn’t it be just typical if the US economy now slides into recession?

Economists on my side of the fence are not renowned for forecasting recessions for one key reason:on the sell-side it is career threatening to get such a call wrong. So, when the most widely predicted recession in history failed to materialise last year, it was only human to chuck in the towel or at least cover your head with it. Even the Conference Board has now abandoned its own longstanding recession call-link.

The simple fact is that recent record highs in the equity market have buoyed the economic narrative. Yet despite one or two key data points coming insurprisingly robust–particularly non-farm payrolls and GDP–much else has looked frail.

The Chicago Fed National Activity Index (CFNAI) is one of the most comprehensive of all real economy measures, aggregating some 85 variables. Its below zero reading has been consistent with sub-trend GDP growth of around 1% for some time, in stark contrast to the c.3.5%H2 2023 GDP data published recently.

And I’m sure you have seen those charts indicating that a cyclical rebound is underway–most notably the US manufacturing new orders minus inventories ISM series (which I have highlighted myself). Add to the mix the cyclical recovery signalled by analysts in their optimistic earnings forecasts and surely any economist who still forecasts a recession must be a fool, mad or both, right?

All this is (dangerously) reminiscent of 2007,when all around were telling me I was wrong and should give up calling that much-delayed recession (pesky long and variable lags).

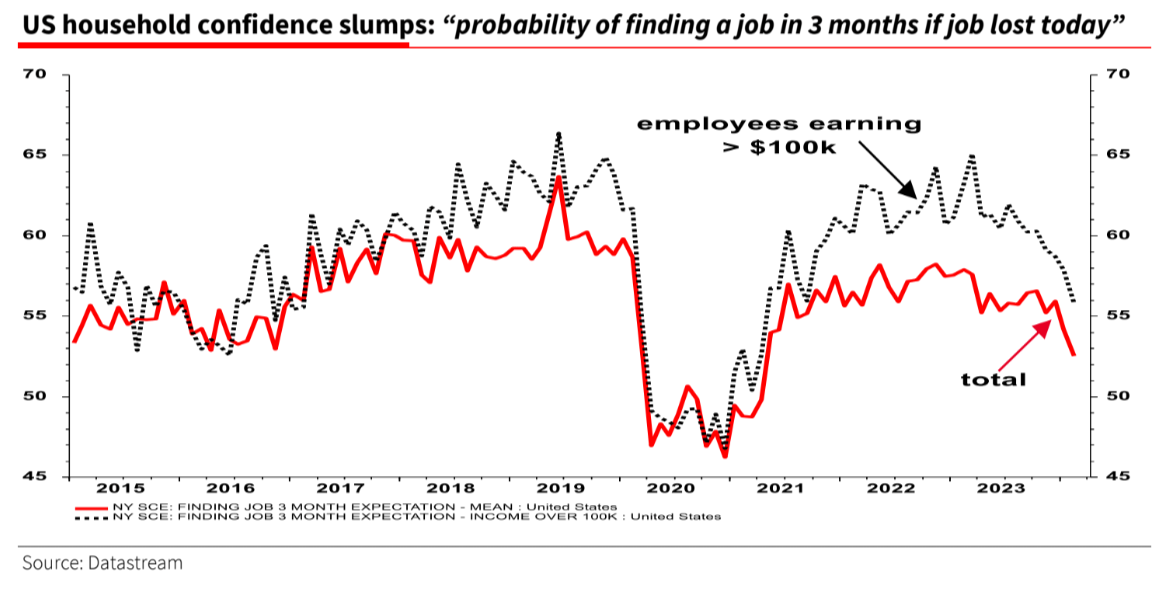

But then I can’t overlook charts like the one below from the NY Fed Survey of Consumer Expectations. This shows that confidence in getting another job quickly has slumped in just the last few months–especially among higher earners. Jobs growth might be a lagging indicator, but the magnitude of slump in the chart below simply isn’t consistent with a cyclical recovery. Something just doesn’t look right.

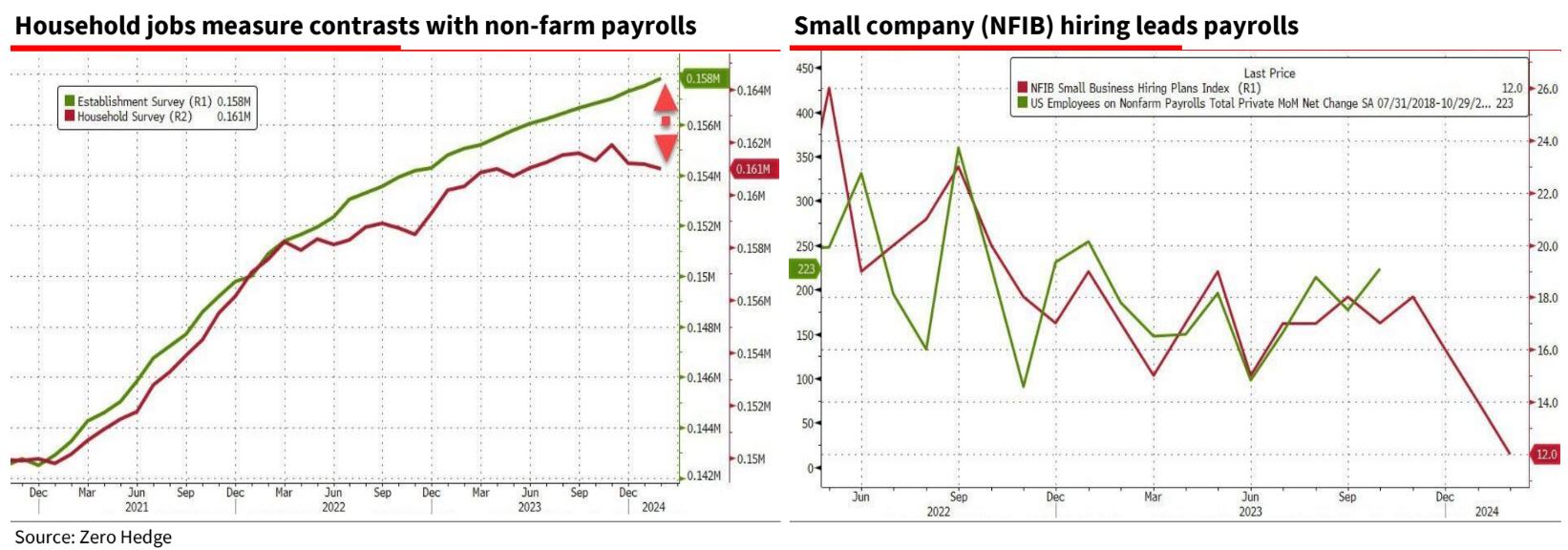

Imagine for a moment that non-farm payrolls suddenly prints a zero gain? Ridiculous you might think, but that is exactly what the alternative measure of USjobs growth, Household Employment, has been signalling for almost a year now. And if the NFIB Survey is anything to go by, there may be trouble ahead. The current ‘strong economy’ narrative would then likely collapse.

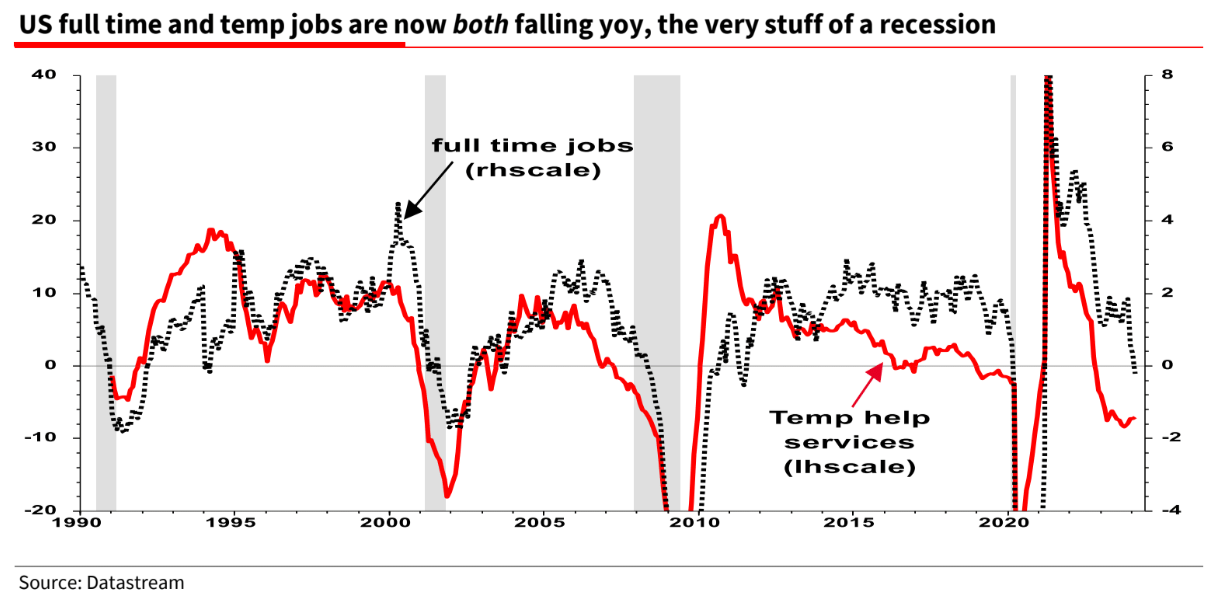

Optimists might be able to dismissa rare yoy decline in full time jobs (black line below) as inconclusive evidence of recession but add in the slump in temporary help wanted (red line), and the US jobs shoe is certainly dropping in plain sight–just take a look below.

....The biggest criticism you can lay on the guy is he didn't realize what he was up against re: the powers that be.

Plus that whole Albert-in-the-bathtub period was just stupid.

You do have to be careful you don't personally get into a David

Koresh/Jim Jones-Drink-the-Kool-Aid frame of mind when gazing upon the

dark side, whether Albert or Ambrose Evans-Pritchard or Jim Chanos. I

mean it's okay to play around with melancholy:

But be attuned to when to take Mr. Edwards with utmost seriousness.

On September 5, 2008 we posted "Meltdown"-Société Générale" which linked to Albert's research note of a couple days earlier:

A good call.

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America to avoid a Reg. T shut-down when markets re-opened.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia gobbled up.

Good times, good times.

So take what you can use and make dumb headlines with the rest