First up Mr. Edwards many years ago anticipating a pilgrimage to Mr. Morrison's grave in Paris:

People are doing #Meat20 . This is me at 20 on my last day at Bristol Uni in July 1981, with my then girlfriend who emigrated to Oz and became a Partner at Deloitte’s. Yes that really is my own hair. At a time of punk and two-tone I was a contrarian even then! Guess the album? pic.twitter.com/m0hEZXFBk4

— Albert Edwards (@albertedwards99) April 17, 2020

And from MacroBusiness Australia, March 22:

Albert Edwards: Japanifcation still the future

Albert Edwards at Societe General.

The looming fiscal crisis means we almost certainly haven’t seen the last of YCC.

I don’t pay for many subscriptions but do splash out on The Wall Street Journal, mostly to keep up with insightful articles by James Mackintosh (ex-FT). This week in The American Dream Accelerates Away From Those in the Slow Lane, he points out that, all of a sudden, low income households are facing extremely hard times, in contrast to the rest of the household sector. Such pressures are evident in a surge in consumer credit delinquencies and arrears, as well as profit warnings from companies that service those households.

The widening inequality chasm in this US election year will be a real issue for policy makers. What will the Fed do? Traditionally, the Fed would not pivot rates policy to cushion inequality, which is usually addressed by fiscal policy. But growing inequality has been a key issue ever since the 2008 Global Financial Crisis triggered a backlash against ‘The Establishment’ – most evident in the rise in popularism (although many, including myself, believe that the loose money/tight fiscal policy mix was primarily responsible).

Might the unfolding inequality crisis force the Fed to bow to intense political pressure to cut rates faster and deeper? I think that is entirely plausible. Indeed we on these pages have previously observed, somewhat cynically, that Powell’s recent ‘surprise’ December 2023 dovish pivot came exactly at a time when Donald Trump was pulling ahead in the polls. But it would be a diehard cynic who could contemplate that the Fed, as part of ‘The Establishment’, would balk at the thought of Trump winning in November and juice up the economy to try and lower the odds of such an outcome. (I am that cynic.)

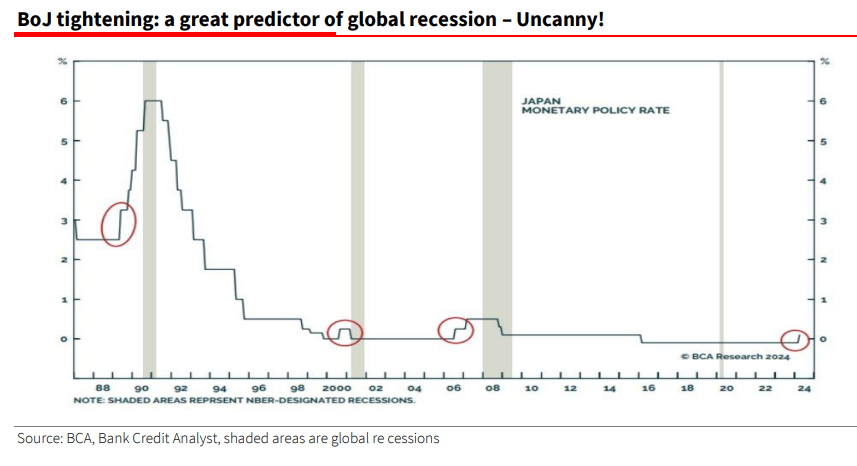

Market sentiment is now especially vulnerable to weak economic data because, as we pointed out last week, it seems everyone (and their dog) has left their recessionary worries far behind. But as my favourite bear, David Rosenberg, pointed out this week, recent weak retail sales, housing starts, and industrial production data might be setting us up for a negative US Q1 GDP print. Let’s see how the Fed reacts to that. And suppose you want one reliable predictor of a global recession. In that case, @PeterBerezinBCA notes that “In the history of modern finance, no single indicator has done a better job of predicting when the next global recession will start than when the Bank of Japan starts raising rates. Foolproof!”

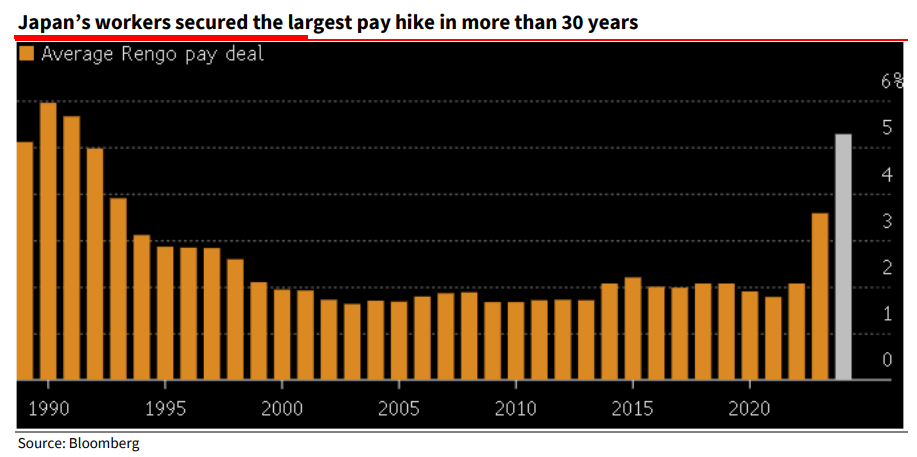

So, Japan has finally exited negative interest rates and Yield Curve Control (YYC). One thing that may have tipped the BoJ into action was that Rengo, Japan’s largest trade union confederation, announced last Friday that its members have so far secured pay deals averaging 5.28%, far outpacing the 3.8% squeezed out a year ago — itself the highest gain in 30 years.

Although this Rengo pay deal chart is eye-popping, a glance at the official whole economy wage data below shows underlying wage inflation rising only slightly above 1% yoy (red lines below)....

....MUCH MORE

This is the end

Beautiful friend

This is the end

My only friend, the end

Of our elaborate plans, the end

Of everything that stands, the end

No safety or surprise, the end

I'll never look into your eyes again...