How do you go about asset stripping a business like mining when you have to actually extract the resource from a hole in the ground? High-grading?

From PitchBook, February 21, 2024:

Mining has traditionally been a niche play for private capital, but as the energy transition fuels demand for rare minerals, the sector is getting more attention.

One firm that has been grabbing headlines is Appian Capital Advisory, a PE mining specialist that raised eyebrows by picking the UK’s former Deputy Prime Minister Dominic Raab as a strategic adviser on global affairs.

It is a controversial move for a sitting member of Parliament, but not unusual; PE has a track record of plucking policymakers both in the UK and abroad to advise on public affairs. Former finance minister George Osborne, for example, was an adviser to BlackRock. The Carlyle Group, meanwhile, has practically made it a business model. It comes at a time when a lot of governments are putting the control of strategic resources high on their agendas. It also makes a lot of sense.

The appointment coincided with an article from the Financial Times in which Appian’s chief exec, Michael Scherb, says London should ditch its aspiration of becoming a tech hub and instead focus on basic resources. It’s a tough sell, but you can see the logic.

Many of the assets within Appian’s portfolio involve commodities that are critical to the energy transition, such as lithium, copper, nickel and cobalt....

....MUCH MORE

I admit I have a rather jaded opinion of the typical private equity approach to business.

Here's the outro from another PitchBook post:

Private Equity: "having your industry compared to a Ponzi scheme is less than ideal"

.... My question going forward is: "Should times get really tough will we see a return to the asset stripping/bankruptcy bust-out model?"

Wait. Did I say that out loud? I meant "will we see a semi-permanent step-change to lower valuations that trap capital?"

Yeah that's it, that's what I meant.

And related:

From June 2019's The Hidden Risks In Shorting Dogs:

One of the scariest concerns when shorting non-frauds in a bull market is that the very things that make a company a laggard and seemingly offer a tempting short—or the short leg of a pair trade—are things that attract the private equity vultures. This is why, for 2 1/2 years when talking about the mess that American packaged foods had become, we would obliquely, and sometimes not so obliquely warn:

March 7, 2017

M&A In European Food

I'm not sure that consumer packaged goods is the area to be in, at least not in the U.S. and not based on names like Kellogg or General Mills.

For a quarter-century those manufacturers ratcheted prices as though they were tobacco companies but people find it easier to give up their Cheerios than their cigarettes.

The managements milked that approach for pretty much all it was worth so, as operating entities, they aren't all that attractive but someone will decide the only thing left to do is to asset strip or dividend recap the life out of the former cash cows.

Top o'the market to ya....

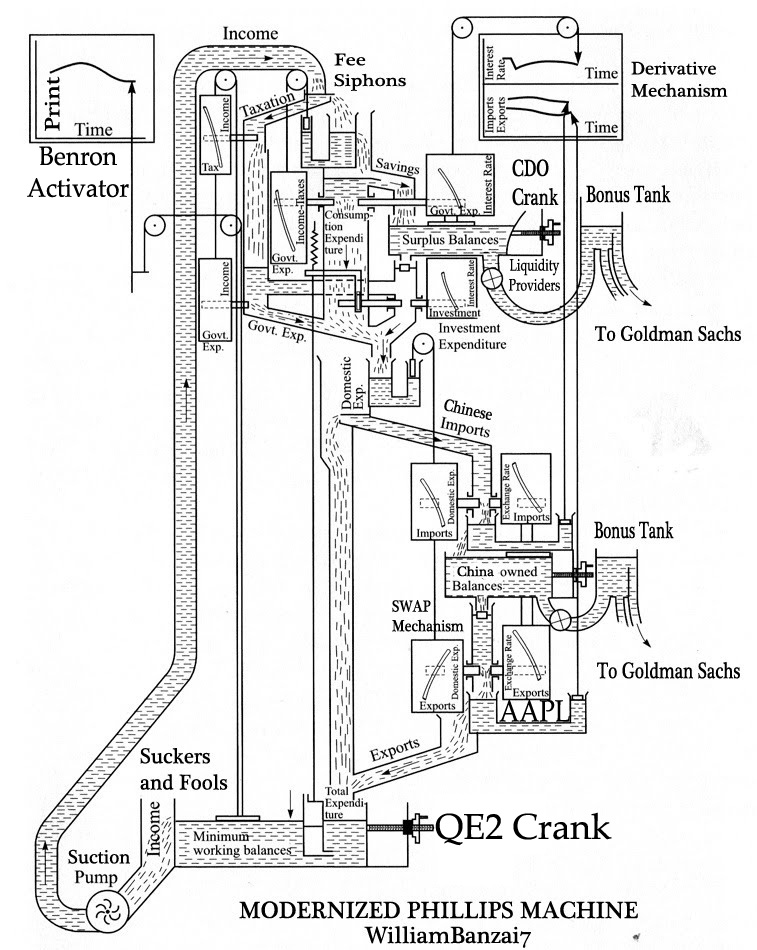

Speaking of the Private Equity model, here is sheer genius from William Banzai, last seen in

"...Since 2006, Private Equity Has Produced Only S&P 500 Returns While Reaping $400+ Billion in Fees"

The discussion of hydraulic models of the economy in this morning's "If The FT's Izabella Kaminska Doesn't Start Posting To Alphaville...." reminded me of William Banzai's take on the Phillips model but with bonus receptacles and fee siphons:

Compare/contrast with the original:

"The computer model that once explained the British economy (and the new one that explains the world)"

From the New York Times:

Two weeks ago, while visiting Cambridge University, I arranged to have lunch with my friend Allan McRobie. He’s a professor of engineering, so it seemed a bit strange that he kept insisting we meet at the department of applied economics. “There’s something there you’ve really got to see,” he said in his Liverpudlian lilt. “It’s utterly fab. Just brilliant. The Phillips machine — it uses water to predict the economy.”...MORE

See also Warren:

Berkshire Hathaway as Idealized Private Equity

We quoted Buffett on P.E. in last month's "How Vulture Capitalists Ate Toys 'R' Us", updated below....

****

The quote was:

And then there's 2011's "The Porn Shop Operators Strike Again: Harry & David files for bankruptcy";

``You can sell it to Berkshire, and we'll put it in the Metropolitan Museum; it'll have a wing all by itself; it'll be there forever,'' he says at the February meeting.

``Or you can sell it to some porn shop operator, and he'll take the painting and he'll make the boobs a little bigger and he'll stick it up in the window, and some other guy will come along in a raincoat, and he'll buy it.''

On why a business may prefer selling to Berkshire Hathaway rather than a private equity firm.

I know Warren is talking down the bidding pressure that PE firms might put on the price he has to pay for privately held businesses but looking at his comments on PE over the years it's more than that:

He actually loathes private equity and its practitioners....