Following on yesterday's "Copper Surges on Supply Threat as Iron Ore Shows Economic Risks" which highlighted the divergence between copper, approaching an 11-month high, and iron ore, collapsing on China's continued failure to launch its economy (to put it starkly, most of China's efforts have ended up going into the stock market*) we have another indicator of the current state of China's economy. From Bloomberg via Yahoo Finance, March 13:

China’s uncertain economic prospects are stressing the oil refiners that produce diesel, the fuel that powers much of the country’s industrial activities.

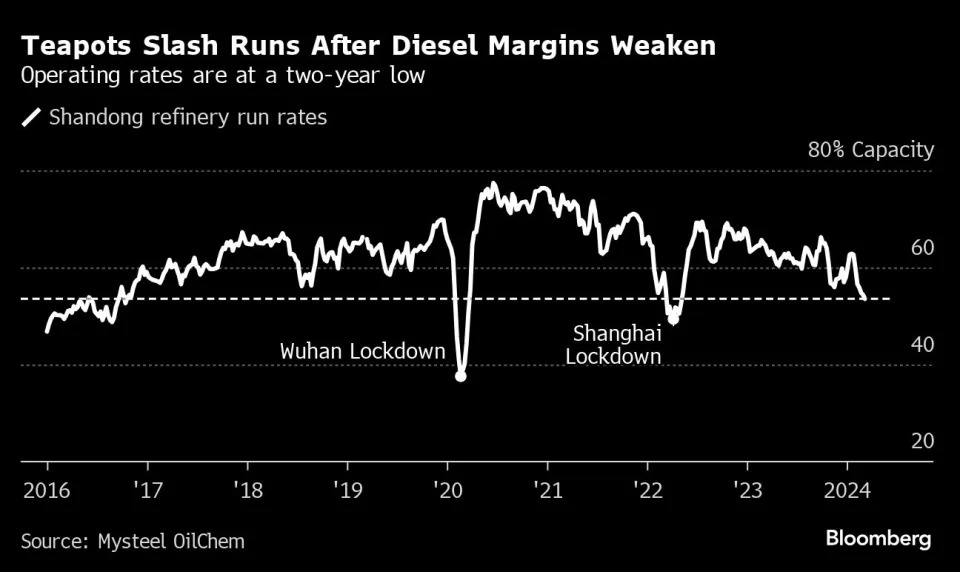

Operating rates at smaller, private refineries clustered in Shandong province — dubbed teapots — have fallen to a two-year low. Strip out the Shanghai lockdown and the start of the pandemic, and runs haven’t been this feeble since 2016. Diesel is the teapots’ main product.

The pressures on refiners are familiar across commodities markets, and revolve around a collapse in demand from the housing market. But Chinese manufacturing has also been in contraction since September, while policy support has been sluggish. The government’s annual policy-setting meeting that concluded this week hasn’t fostered much optimism that its 5% growth target for the year can be met without additional stimulus.

Trucks, diggers and power lifters all run on diesel, which is also often used by factories for backup generators. Prices have dropped to their lowest since July. By cutting production, teapots are trying to keep margins respectable — they’re hovering around their 10-year average, according to Mysteel OilChem — but volumes are being sacrificed as a consequence.

“Downstream demand for diesel, from mining to infrastructure, is seriously lagging expectations,” Zhang Xiao, an analyst at Mysteel OilChem, said at a briefing on Tuesday. Consumption from the logistics sector is the one exception, she said, although liquefied natural gas is rapidly displacing the fuel in trucking....

....MORE

The last couple times the teapots cut back Beijing said it was because of...aahhh..carbon, yep, that's it, carbon. But they didn't tear the smaller refineries down, just cut production or put them on care-and-maintenance until the next upturn.

We need a new Li Keqiang index.

*We've looked at the probable results of China's attempts to reflate a few times, usually coming down to the Cantillon effect. Here Mssr. C. and his effect show up in a June 2023 discussion of pork:

....The negative spin on the rate cut would be the one we used on Tuesday, that it's classic "pushing on a string" i.e. the problem isn't the cost of money but rather the lack of demand for money.In this sort of situation, if the money isn't going into domestic demand in will go into financial assets. In the West the Central Bankers say about that reality "We meant to do that, it's the Wealth Effect' whereas it's actually the Cantillon Effect where the people who get the money first get to take advantage of prices that haven't yet moved and are thus lower for them than for those who follow them in.

Unfortunately for us, this time it is tougher to distinguish between a real demand driven move and a speculative "close-your-eyes-and -bet-on-higher" than it was in January, for another very basic reason: We had the Chinese lunar New Year on January 22 to tip us off....

And then again four months later:

October 10, 2023

"China Considers Stimulus, Higher Deficit Spending To Counter Property Bust"

I smell

OscarCantillon.In which case the thing to do is determine who will get the money first and be that person. If it is not possible for you to quickly become a member of the Chinese nomenklatura determine how to make a portfolio bet on those who are already members of the privileged class. As noted a few years ago:

One of the rules of politics is "if your country goes communist you want to be as far up the apparatchik totem pole as you can get."

Preferably a commissar or above, putting you and yours closer to the commissary.

In a socialist paradise all pigs are equal but Hugo Chavez's daughter is a billionaire.

(actually $4.2 billion)