I smell Oscar Cantillon.

In which case the thing to do is determine who will get the money first and be that person. If it is not possible for you to quickly become a member of the Chinese nomenklatura determine how to make a portfolio bet on those who are already members of the privileged class. As noted a few years ago:

One of the rules of politics is "if your country goes communist you want to be as far up the apparatchik totem pole as you can get."

Preferably a commissar or above, putting you and yours closer to the commissary.

In a socialist paradise all pigs are equal but Hugo Chavez's daughter is a billionaire.

(actually $4.2 billion)

From ZeroHedge, October 10:

Wall Street analysts have recently cut China's 2023 and 2024 economic growth. The world's second-largest economy is at serious risk of missing Beijing's GDP growth target for the second consecutive year and expanding below 5% for three years straight years - something not seen since the death of Mao Zedong in 1976.

A multi-year property downturn looks increasingly likely as China's state-owned property developers now warn of widespread losses, fueling concerns that the housing crisis is expanding from the private sector to government-backed companies. Also, deflationary pressure has capped growth goals around 5%.

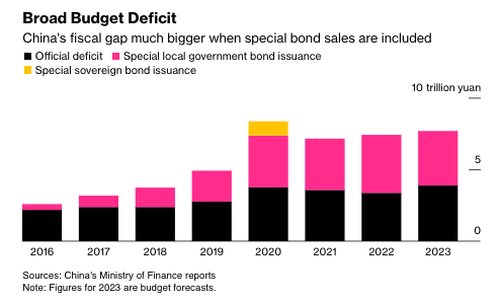

To counter the downturn, Beijing needs to deploy countercyclical policy tools. According to Bloomberg, citing people familiar with the matter, the government could soon announce a new wave of stimulus and expand the budget deficit above the 3% cap set in March. Another person said the official announcement about these new policies could come as early as this month but stressed talks are still ongoing.

"Policymakers are weighing the issuance of at least 1 trillion yuan ($137 billion) of additional sovereign debt for spending on infrastructure such as water conservancy projects," said the people.

Until now, the government has refrained from implementing extensive fiscal stimulus, even in the face of a worsening property downturn and increasing deflationary pressures. Maybe optically, Beijing wants more robust growth than the US amid rising tensions.

"The ad hoc issuance of additional debt from the central government could provide extra policy support and more resources to re-engineer a stronger and faster recovery," said Bruce Pang, chief economist at Jones Lang Lasalle Inc. "

Pang said, "China's recovery story could be a relay race" stimulated by infrastructure spending and then fueled by spending among businesses and households.

"The plans, led by the Ministry of Finance and the National Development and Reform Commission, are subject to final approval by the State Council and legislators," the people added.

According to Xiaojia Zhi, head of research at Credit Agricole CIB, the size of additional issuance under discussion is "modest," or equivalent to about 0.7% of GDP.

"But the message would be positive," Zhi said, adding that it's a "reasonable consideration" given soft private demand, tight local fiscal conditions, and the ongoing property sector downturn. "The central government's debt ratio remains low, and its balance sheet is still quite healthy."

Here's a summary of what Wall Street analysts are saying about potential new stimulus from China (list courtesy of Bloomberg):

Tommy Xie, an economist at Oversea-Chinese Banking Corp. Ltd.

- "I perceive this development as a constructive step toward addressing the issue of local government debt. While China's aggregate government debt-to-GDP ratio aligns with those of many developed economies, the country's distinct debt structure presents its own set of challenges."

- "The proposition to enable the central government to assume a larger portion of the debt emerges as a viable solution. This approach could alleviate the financial strain on local governments, fostering an environment where resources can be reallocated and optimized to stimulate growth and bolster economic sentiment."

....MUCH MORE

October 9:"Bondholders of China Evergrande fear it faces liquidation..."