Following on yesterday's "The Guy Who Wrote “An Inconvenient Fact: Private Equity Returns & the Billionaire Factory” Does Not Genuflect At The Alter Of Bain, Carlyle and Blackstone"

Sometimes it's hard to tell the difference between a bankruptcy bust-out/bleed-out fraud and private equity.

Also between private equity with its internal rate of return, IRR, and piracy with its eerily similar Arrgh, but that's a whole 'nother post.

From S&P Global, Market Intelligence, January 11, 2024:

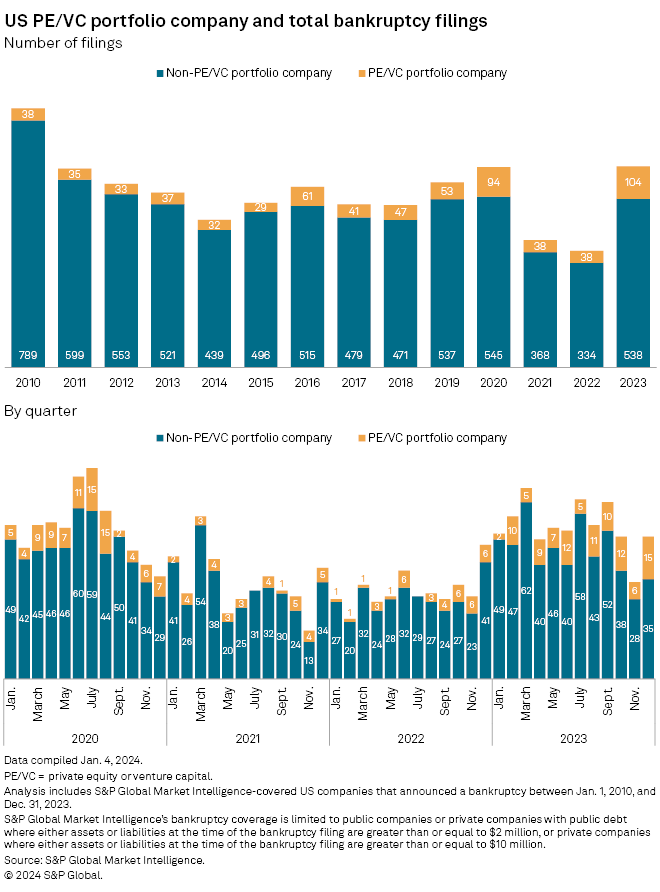

Bankruptcy filings by private equity- and venture capital-backed companies in the US surged to 104 in 2023, the highest annual total on record, according to S&P Global Market Intelligence data.

The total represents 174% growth over the 38 US portfolio company bankruptcy filings in 2022.

The overall bankruptcy rate for US companies also rose to 642 filings in 2023, a 73% increase over the prior-year total of 372, as businesses grappled with the combined effects of inflation, higher interest rates and the fading impact of pandemic-era stimulus spending.

"It's no secret that there's been economic headwinds after the Covid bump," said Kris Herrmann, a partner in the private equity group for law firm Proskauer, referring to the stimulus-fueled economic rebound after COVID-19 lockdowns in 2020. That stimulus may have allowed owners or financial sponsors of distressed businesses to "kick the can," Herrmann said, suggesting the full backlog of bankruptcies has yet to hit the courts.

"I wouldn't be surprised if, even when the economy kicks up again, you're still going to see some of those residual bankruptcies happening for those businesses whose time maybe should have run out three years ago," Herrmann said.

Sector focus

Portfolio companies of private equity and venture capital firms accounted for more than 16% of all US bankruptcy filings in 2023, their largest share of the annual bankruptcy rate going back to at least 2010, Market Intelligence data shows.

Fifty-five, or just over half of the 104 US portfolio company bankruptcies in 2023, were filed by healthcare and consumer discretionary businesses. That data point hints at specific economic pressures squeezing those sectors....

....MUCH MORE