If you can get on the right side of the really big moves: Rise of the American empire 1900 - 1999, Buying Japan at 2 to 4 times earnings in the 1950's - '60's, Riding the decline in interest rates 1980 - 2022, it makes the rest of this stuff a lot easier.

You don't need to be right on every detail, just on the broad outline stuff; and in simple binary terms: "short this or long this?" All of a sudden you'll be sidestepping problems you weren't even aware of, and getting lucky in ways that can't be planned but in hindsight look inevitable.

This may be one of those big trends.

From Bloomberg via ZeroHedge, January 30:

Authored by Simon White, Bloomberg macro strategist,

Born in the 90s and tested to destruction during the Great Financial Crisis, modern-day central bank independence is effectively over in all but name. Persistently large government deficits, central banks with trillions of dollars of sovereign debt and the political toxicity of elevated inflation make it impossible any longer for the Federal Reserve, ECB et al to set monetary policy fully independently from their government overseers.

Look no further than Wednesday to see monetary independence’s erosion and fiscal dominance’s re-ascendancy play out in microcosm. A rate-setting meeting would normally be top billing for the market, but the Fed is likely to be overshadowed by the Treasury’s refunding and auction-size announcement on the same day. The wind is changing.

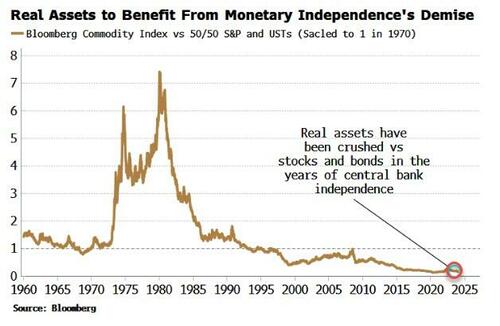

The market implications are far-reaching. Secularly higher inflation, the end of the nominal Fed put, a structurally weaker dollar, and the reversal of the relentless underperformance of real assets versus stocks and bonds are all themes poised to play out in the coming months and years.

Central banks’ independence is being challenged for two, linked, main reasons: high inflation and large fiscal deficits. Governments, since their dalliance with Modern Monetary Theory (MMT) in the late 2010s, have massively expanded their spending. The pandemic justified a war-like response in sovereign outlays, but large deficits have continued long after the emergency ended.

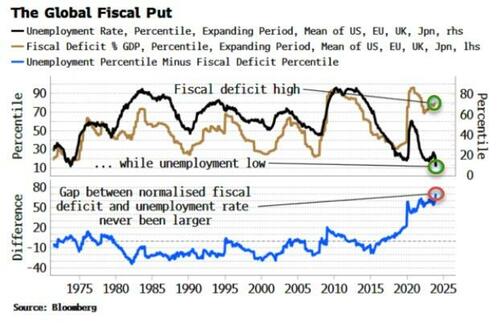

A “fiscal put” is effectively in place as Covid altered expectations for what governments should underwrite: not just unemployment in the event of a recession, but business solvency, consumption, even life itself.

This is not just a US phenomenon. Across much of the developed market, budget deficits have never been as high while unemployment has been as low.

As the chart above shows, the divergence began around 2016, and then rose as MMT-lite policies came into in vogue, before being turbo-charged by the pandemic. We are in an era of large, highly pro-cyclical government spending.

That is existential for central-bank independence.

Their political independence is under creeping threat from populist politicians. But it is their operational independence that is already fatally circumscribed. There are three key reasons why (these relate to the US, but similar arguments can be made for Europe, the UK et al):

The swelling amount of Treasury debt outstanding, driving a rapidly rising interest bill

The large size of the Treasury’s account at the Fed

The high proportion of shorter-term debt, i.e. bills

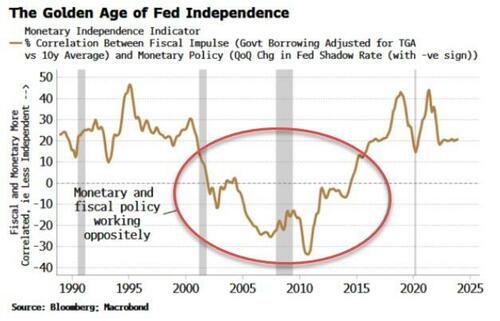

First, we need to quantify central-bank independence. Governments are inherently inflationary as large, voter-pleasing fiscal deficits typically lead to a structural rise in inflation. Thus the policy of an inflation-targeting independent central bank should be counter to fiscal policy overall through the cycle.

The Monetary Independence Indicator (MII) for the US, shown below, is the correlation between the change in government borrowing and the change in the Fed’s Shadow Rate (so as to include the effects of QE). As we can see, the golden age of Fed independence was from the late 1990s to the mid 2010s, when monetary policy acted contrary to its fiscal counterpart.

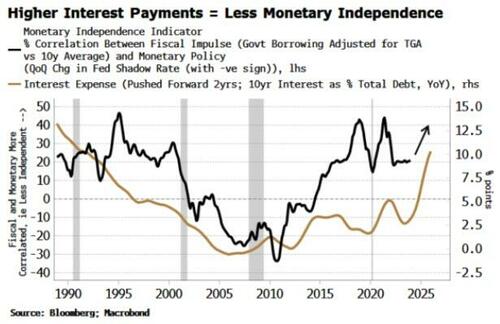

Since then, monetary independence has been slowly eroded and will be further compromised by the government’s bulging interest bill. Interest must be paid for either with more borrowing or higher taxes. Both of these are bad for liquidity by draining reserves out of the system or by reducing their velocity. The central bank ultimately must accommodate this by easing policy.

Overlaying US interest expense on to the MII shows that when the interest bill is high it leads to a rise in the latter, signifying the Fed is acting less independently, and vice-versa. Today’s rise in interest costs shows the Fed’s independence will be increasingly constrained.

The Treasury’s account at the Fed (the TGA) further inflames the outlook. Since the GFC and a monetary system of superabundant reserves (created by trillions of dollars of QE), the Treasury has used its Fed account more. But it was not until the pandemic its size grew to over $1.7 trillion.

At ~$830 billion it’s lower now, and the Treasury aims to keep it around $750 billion. But that’s still a huge lake of liquidity, and the Treasury either significantly adding to it – i.e. taking reserves out of the system and reducing liquidity – or drawing it down, boosting liquidity, has a consequential market impact.

The effect is not merely theoretical. The period of poor S&P returns in the 2022 bear market were accompanied by a worsening trend in reserves, driven by, among other things, a high and generally rising TGA....

....MUCH MORE