From Wolf Richter at Wolf Street, January 19:

Fed’s Balance Sheet QT, Liabilities: RRPs -$1.78 trillion from Peak, to $590 Billion, but Reserves Rise to $3.6 Trillion as Liquidity Drains and Shifts

As the Fed’s Quantitative Tightening hums along on autopilot, its assets have fallen by nearly $1.3 trillion as of its weekly balance sheet released on Thursday, and its liabilities have fallen in equal amounts. The dropping liabilities are a result of QT. Here we’ll discuss two of the Fed’s big four liabilities: ON RRPs and Reserves.

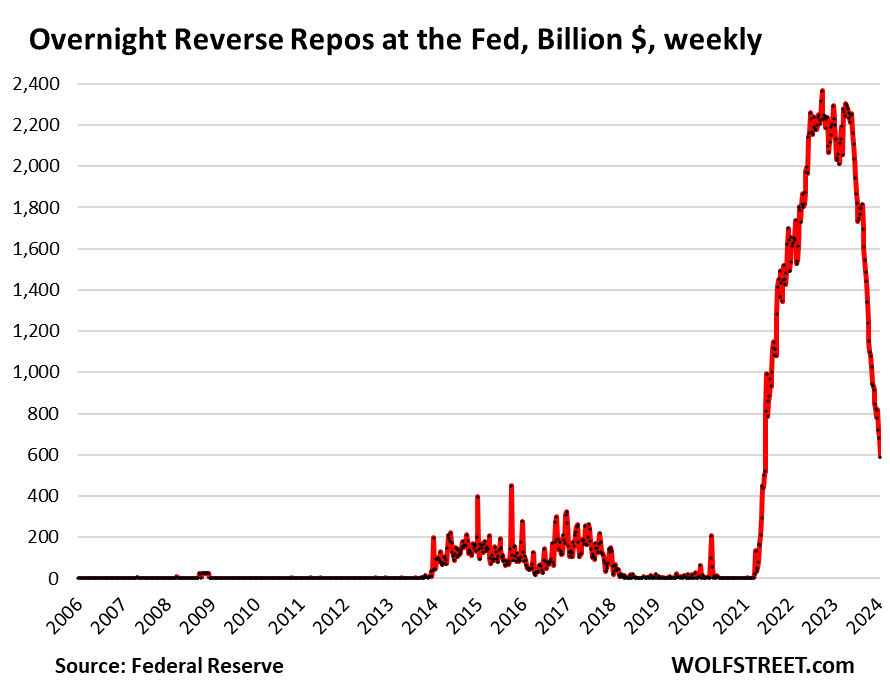

“Overnight Reverse Repos” (ON RRPs), where money market funds park their extra cash to earn 5.3%, have plunged by $1.78 trillion from the peak in September 2022, to just $590 billion, as QT is draining liquidity from the system. Most of the plunge has occurred since June 2023.

As the chart shows, ON RRPs are normally near $0 or at $0. Now they’re going back to their normal non-QE condition. But Wall Street gurus are having a cow about it, and some predicted that all kinds of mayhem would break out if it fell below $750 billion or whatever, which it did without breaking a sweat:

The spike of the ON RRPs resulted from mega-QE liquidity that overwhelmed money market funds (MMFs), which then temporarily lent the cash to the Fed via ON RRPs to earn some interest.

But starting in 2023, money market funds redirected this cash into buying T-bills, which paid more interest (around 5.5% currently at the short end) than the Fed’s RRPs (5.3%); and they engaged in the regular repo market, effectively lending cash to counterparties, especially via “term repos” such as two weeks or longer that earned more interest than the Fed’s 5.3%.

MMFs are now absorbing much of the huge flood of T-bills, and they’re lending to the regular repo market, and that’s what MMFs are supposed to do. The ON RRPs at the Fed were just an outlet for this QE tsunami of liquidity.

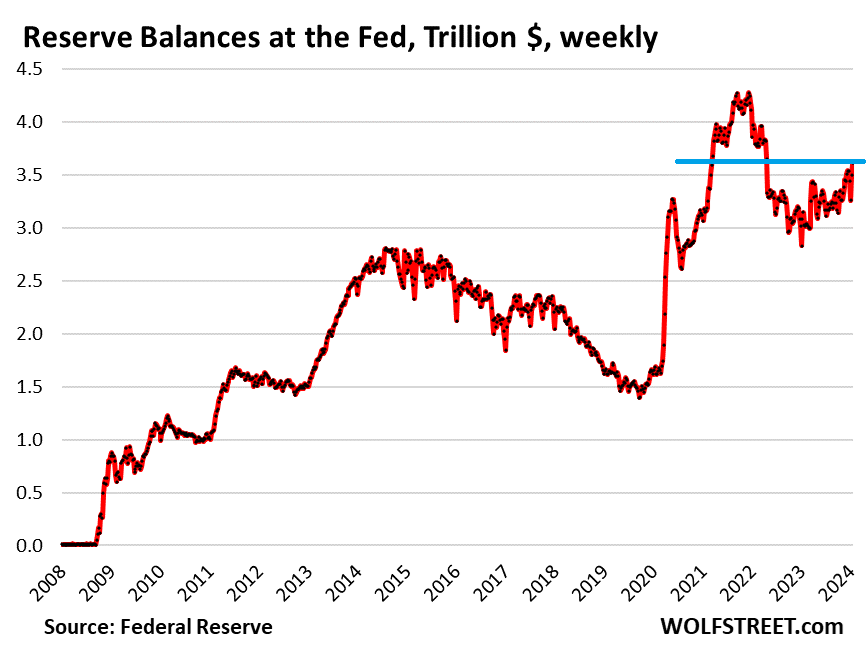

“Reserve balances,” where banks park their extra cash to earn 5.4%, have dropped by $664 billion from the peak in December 2021, to $3.61 trillion.

But they’d dropped a lot more in 2022. Then in 2023 and so far in 2024, they’ve re-risen, as huge amounts of excess liquidity started shifting around the financial system, including a portion of the liquidity that got drained out of RRPs.

That reserves would rise during QT – as they have in 2023 and so far this year – has been one of the big surprises to the financial world, which expected reserve balances to drop in parallel with RRPs.

Since November, reserves have been rising for an additional reason....

....MUCH MORE