From ZeroHedge, Friday, Dec 22, 2023, whose complete headline is:

Govt Wage Growth Hits Record High As Fed's Favorite Inflation Indicator Tumbles

One of The Fed's favorite inflation indicators - Core PCE Deflator - tumbled to +3.2% YoY (below the 3.3% exp and down from a downwardly revised 3.4% in October) - the lowest since April 2021.

Headline CPI also slowed more than expected, to +2.6% YoY in November (from +2.9% in Oct)

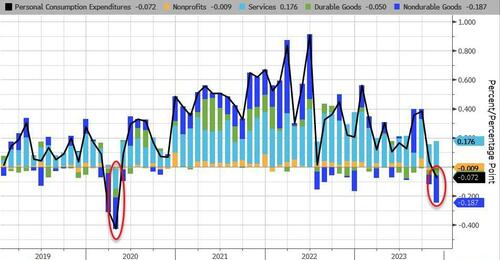

The headline PCE Deflator FELL 0.1% MoM - the first monthly decline since April 2020. The drop was all driven by Goods (durable and Non-durable)...

Source: Bloomberg

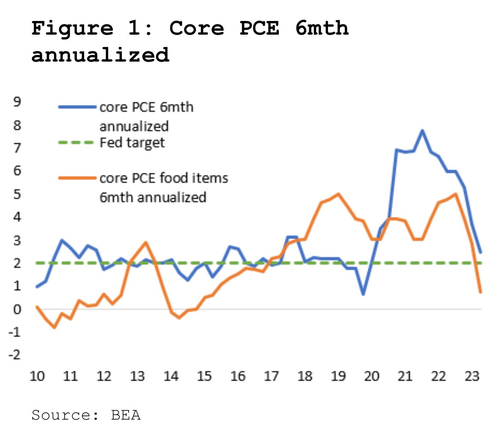

On a six-month annualized basis, 'mission accomplished'...

Even more focused, is the Fed's view on Services inflation ex-Shelter, and the PCE-equivalent shows that it has broken down from its 'sticky' levels to its lowest since March 2021...

Source: Bloomberg

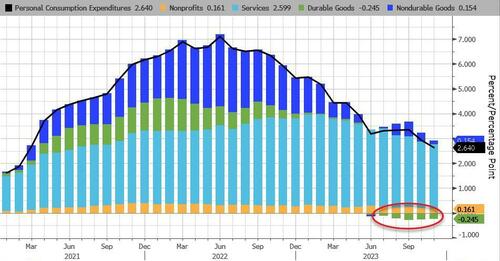

Year-over-Year Goods deflation continued for the 6th month in a row...

Source: Bloomberg

Both income and spending rose MoM in November, +0.4% and +0.2% respectively....

....MUCH MORE, chart mania.