A recovery in oil demand and production cuts will see stocks drawn down, putting pressure on tanker earnings in the second half writes Tim Smith from Maritime Strategies International.

Floating storage, driven by low oil prices and contango futures, has dominated the supply-side story so far in 2020 and will continue to do so across the remainder of the year and into 2021.

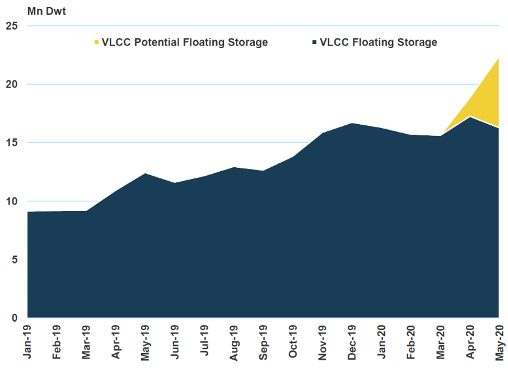

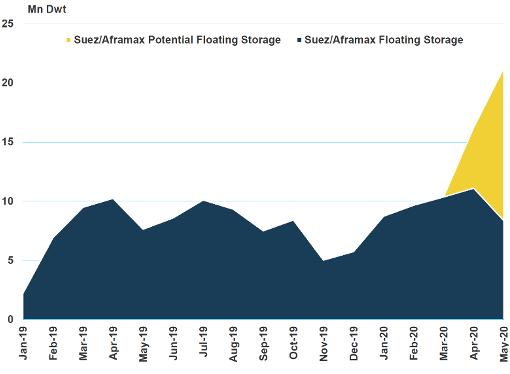

Since March, at least 71 VLCCs have been booked with an option to store crude and in May, we estimated around 23 Mn Dwt of VLCC tonnage is being used for commercial floating storage, this equates to roughly 9% of the current VLCC fleet.The number of Suezmax and Aframax vessels used for floating storage has rocketed in recent months. In May, we estimate Suezmax floating storage at ~8 Mn Dwt and Aframax floating storage at ~12 Mn Dwt, this translates to roughly 8.7% and 9.4% of their respective fleets.

The unprecedented volumes of oil required to be stored on tankers have resulted in increased floating storage opportunities for smaller vessel classes too.

Since March, at least 30 Suezmaxes and 25 Aframaxes have been booked for floating storage. We estimate floating storage will peak in July at 25 Mn Dwt for Suezmaxes and ~31 Mn Dwt for Aframaxes before falling to ~10 Mn Dwt and ~11 Mn Dwt respectively by the end of the year.

We believe oil demand should recover towards the end of the year as a degree of normality will return both for transportation and industry. As such refiners will begin to increase throughput and opt to purchase crude that is stored on floating storage enabling them to process the crude that will potentially be cheaper and faster to access depending on where it has been stored.....MUCH MORE

Although this analysis is based on tankers storing crude and fuel oil, it is important to note a large volume of refined products is also being storage on clean tankers. Since March, over 60 coated tankers have been chartered with an option to be used as floating storage.

Taking all of the above into consideration, in 2020 we expect 95 Mn Dwt to be omitted from the available fleet, which roughly equates to 15% of the tanker fleet in total. In 2021, we expect tonnage to total 50 Mn Dwt, roughly 8% of the fleet. The two largest fleet segments have a greater percentage of tonnage removed from the available fleet. This is predominately due to more floating storage opportunities available for larger vessels....