(it's complicated)

From Markets Now:

¿Dorada? Si! ¿Costa Dorada? Nunca. That’s the upshot of Monday morning in markets, which looks like this:

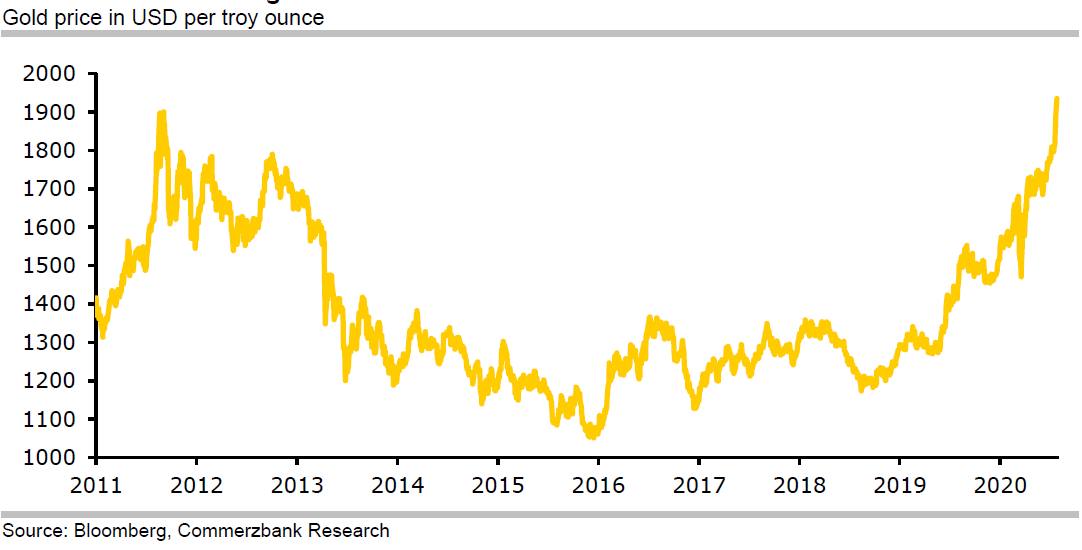

Let’s get the former out of the way first, since there’s only so much to say about gold hitting a record high. What’s to say is that real yields are near record lows and the dollar’s weakening so investors, having given up on the concept of real returns on capital, are throwing money at unproductive, macroeconomically worthless things like shiny metals. That’s it, pretty much, as deeper analysis tends to lapse into chartism and muttering about dark forces. Here, from Commerzbank, are a chart and some words:

One key driving force behind the upswing is the weaker US dollar, which on a trade-weighted basis has depreciated to its lowest level in almost two years. Given that the gold price in euros has also leapt to a record high of €1,660 per troy ounce, however, the price increase is also attributable to other factors........MUCH MORE