From Bloomberg, April 29:

Advice comes as Goldman sees upside risks to Fed rate forecast

JPM doesn’t share market ‘fixation’ on flattening, 3% 10-year

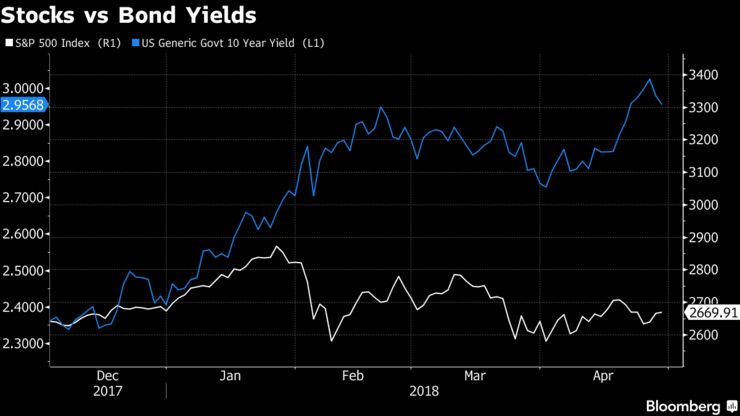

The moves in stocks lately are just strange -- but there’s still a logical approach to investing for the expected end of “easy money,” according to JPMorgan Chase & Co.

While markets and the strategists who follow them are struggling to figure out the impact of rising U.S. interest rates, the sideways path of equities -- given above-consensus earnings -- is a notable outlier among asset-class movements, the firm wrote in a note Friday.

“Equities’ tepid response to strong earnings is worrisome,” said the JPMorgan strategists, led by John Normand, head of cross-asset fundamental strategy. “As cash rate expectations rise to levels acknowledging restrictive policy by late 2019/2020, should equities now price the end of easy money? Such an early peak would have no precedent, so requires a shock.”

Here’s the sequence of late-cycle trades JPMorgan recommends:

- Late 2017 through 2018: Short duration, long breakevens and long oil while Fed policy is still accommodative

- 2018: Underweight credit versus equities to reduce beta to a very old business cycle

- 2018: A pairwise approach to FX rather than a blanket USD view

- 2019: Underweight equities, long duration, long gold and long the yen as Fed policy slows the economy and real rates collapse

The bank said that only one of the 10 largest bond sell-offs in the past 15 years has been associated with stock market weakness. And while they pin some of the reason for the February tumble in equities on higher Treasury yields, the strategists said that “this month, U.S. rates have risen only half as much as they did earlier this year, but stocks are still sidewinding despite bumper earnings.”...

...

MORE