[Climateer note: the story is also told abut U.S. Marine pilots]

Back to Macro Tourist:

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to stick with me, as the fate of the curve might end up being central to the next financial crisis. Yield curve talk is usually only exciting to propeller twirling bond geeks, yet there well might come a day when the 2-30 year Treasury yield spread is plastered across the front page of USA Today.

And it’s not just me that thinks yield curve steepening trades are the next little-noticed-financial-time bomb in-the-making. Business Insider has recently reported that the discreet monster macro hedge fund run by Alan Howard is launching a new fund set up to bet on a steepening yield curve.

The fund, called the Brevan Howard CMS Curve Cap Master Fund, will be led by senior trader Rishi Shah, who has been with the firm since 2010 in Geneva and New York, according to documents seen by Business Insider.The new fund will use what are called constant maturity swap curve caps to bet on both a steepening of the US yield curve and an increase in curve volatility.

In simple terms, the yield curve shows the difference between yields on short term government debt and long term government debt. The smaller the difference, the flatter the curve.

Interest rate policy and government bond buying have combined to both flatten the curve and reduce volatility.Brevan Howard is betting that’s going to reverse as central banks start to shrink their balance sheets and uncertainty over the leadership of the Fed circulates.Until I read about this fund, I had not heard of any hedge funds setting up single purpose vehicles to bet on a steepening of the yield curve. Sure over the past couple of years, there were plenty of guys warning about a repeat of the 2008 credit crisis. Whether it was Carl Icahn’s Danger Ahead, or any one of the hedge fund monthly letters to investors, there were no shortage of end-of-the-world deflationary collapse calls (and the corresponding funds to profit from this “inevitability”.) Yet there were precious few warning about inflation. Whereas most hedgies were advocating hiding in long-dated sovereign paper, Brevan Howard seems to be taking the exact opposite tack. All I can say is, come ‘on in - the water’s warm!

And here is a question for you. Do you think the best bet for the next financial crisis is a repeat of the last one? Or could it be that the little-talked-about more obscure risk that just a handle of smarter guys are setting up for is a better candidate? Well for me it’s no contest. Slick youtube presentations warning about Danger Ahead (that looks exactly like the Danger Behind!) are like an investor in 2007 warning about tech stocks because the 2000 DotCom crash was still ringing in their head. Sure, tech stocks went down in the Great Financial Crisis, but they weren’t the center of the problem like the previous time. So, all I can say is sold to them. I am going to go with smart shrewd guys like Brevan Howard that are willing to think about the next problem instead of focusing on the last problem.

But let’s face it, so far the yield curve steepening prediction has proved to be nothing but a world of pain.

Ever since the 2010’s scare that quantitative easing would cause run-away-inflation dissipated, the yield curve has been steadily flattening. US 5 year yields have been rising, while the 30-year yield has been declining.

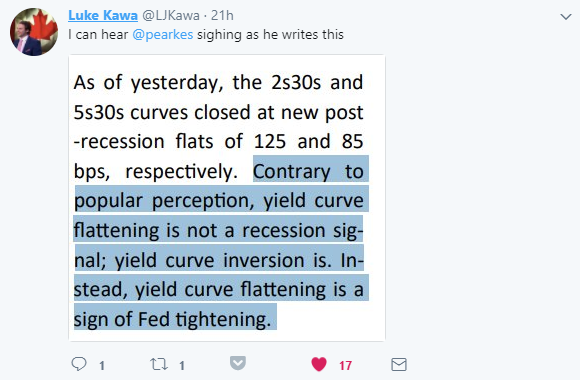

Yet what does this mean? Economic bears often use the flattening of the yield curve as a sign that the economy is about to collapse. But I must to admit to getting a chuckle from a recent twitter exchange between Bloomberg reporter Luke Kawa and George Pearkes from Bespoke Investments:

Yup, George is correct. Yield curves flatten as the Fed raises rates. If you think about it logically, it makes complete sense. Barring default, what’s a sovereign bond investor’s worst nightmare? Inflation. If the Central Bank raises rates, does that make inflation more or less likely? And given that, as the Fed raises rates, why should we be surprised when the long end outperforms?

Here is a chart of the 5-30 year US treasury yield spread over the last forty years....MUCH MOREGreat minds and all that. I happened to mention the curve in the post on Bluetooth-enabled buttplugs:

There go the dreams of a teledildonics empire, I guess it's back to a real perversion, treasury curve flatteners.The British pilot story - actually a variant - may go all the way back to the '60's with a WWII ref:

The British pilot of a jetliner who was having trouble finding a particular gate at Frankfurt airport. The Air Traffic Controller got frustrated and said "Ach! Haven't you been to Frankfurt before??" And the British captain said: "Twice, actually. But it was dark both times and we didn't land."