-

World’s biggest exporter wants to keep up supplies to Asia

-

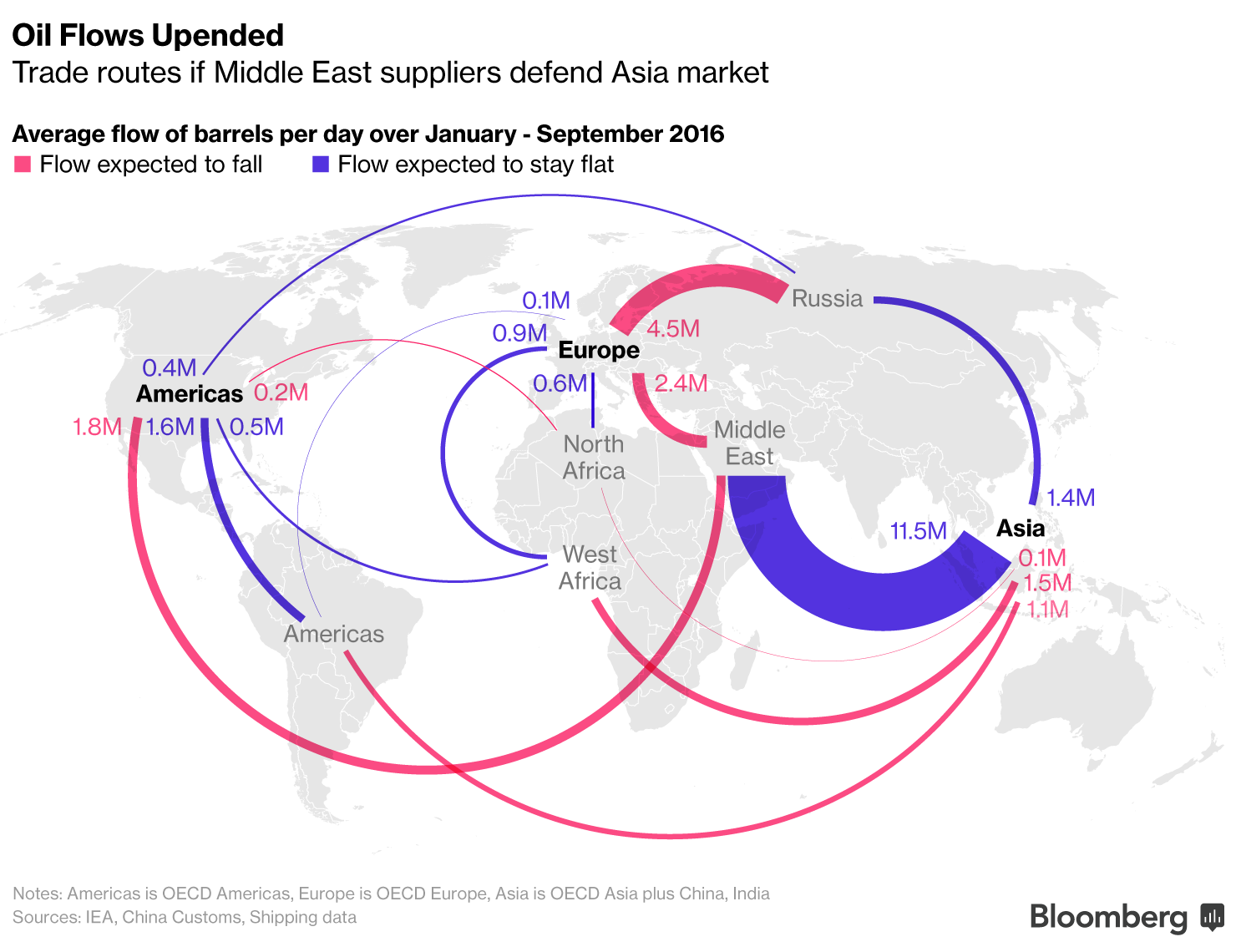

Plan to drain Atlantic Basin glut could alter global flows

OPEC’s quest to end a global crude glut already snapped a two-year slump in oil prices. Now attention is turning to how the group’s surprise decision to cut output will transform international trade flows of the world’s most important commodity.

The early signs are that Middle East suppliers will prioritize Asia, pushing competitors in Africa and the Americas to keep cargoes in the Atlantic region. Saudi Arabia has indicated it will initially maintain most flows to fast-growing Asia, while draining more heavily oversupplied Western regions. Kuwait is doing much the same.

“They want to keep their market share to Asia,” Olivier Jakob, managing director at Petromatrix GmbH in Zug, Switzerland, said of Middle East suppliers. “The routes they will restrict the oil flow most will be to the U.S. and Europe.”

Understanding how and where oil flows matters to almost everyone in the supply chain. Crude traders need to know as they exploit regional price gaps, tanker owners depend on the cargoes being transported over long distances, while many refineries are configured to run most effectively using specific varieties of crude.

Prioritizing Asia

If Middle East producers do indeed fight to keep their Asian market share, then higher proportion of crude pumped in West Africa, the North Sea, the Black Sea and the Mediterranean could stay within that region, according to Erik Nikolai Stavseth, a shipping analyst at Arctic Securities AS in Oslo.

“The Saudis’ prioritizing growing Asian nations and leaving Western buyers more to themselves is an obvious negative for crude tankers,” since it would imply shorter-distance shipping and fewer cargoes, said Stavseth. Supertankers are already bracing for their worst year since 2013....MORE