At Christmas 2016, the twenty-year battle is over. One side won, one side lost. I mean the twenty-year war between bricks-and-mortar stores and online venders.

This one-sided thrashing has been worse than that suffered by those perennial losers, the Washington Generals. (Note: I’m referring to basketball team that lost more than 16,000 games to the Harlem Globetrotters, not casting aspersions on all of those Trump cabinet nominees.)

I remember the exact moment I realized this war between online stores and bricks-and-mortar stores was on like Donkey Kong.

In December 1996, a pioneering technology journalist from The Economist announced that he had attempted to purchase all of his Christmas gifts online.

Whoa! That seemed crazy and cool. Reading that article in my little cramped studio apartment in Manhattan, I was fascinated by the idea that with a few clicks, Christmas shopping could come to me. No paper catalogues, no phone calls, just clicks. I hate shopping, and this experiment in 1996 seemed awesome, and very science fiction-y.

Of course, the joke is that the journalist at The Economist couldn’t do it. He was able to buy one Christmas gift only. Although many big companies had built websites by 1996, they were essentially non-interactive company brochures, with undeveloped and insecure methods of payment.

Much changed in 20 years. A consumer survey by a subsidiary of accounting firm Deloitte found that shoppers will spend equal amounts online as in-store in the 2016 holiday season, a new milestone for web sales.

That continues the upward trend begun two decades ago. And nobody thinks 50 percent will be the stopping point. The next retail frontier is how much shopping will be done on mobile devices, which the same Deloitte survey already pegs at 10 percent of all holiday sales in 2016, and growing.

I wish there was a way to efficiently invest in the idea that retail stores in malls will continue to get crushed by online stores. I mean, I’m sure there’s some ETF for this, but you shouldn’t take investment advice from a blogger, so I’m not going to look it up for you.And from Pew Research Dec. 19:

Just as I remember the launch of the 20 year war during Christmas 1996, I also remember the exact moment I decided brick-and-mortar stores were officially dead to me. In fact, it happened this past Summer....MUCH MORE

Online Shopping and E-Commerce

New technologies are impacting a wide range of Americans’ commercial behaviors, from the way they evaluate products and services to the way they pay for the things they buy

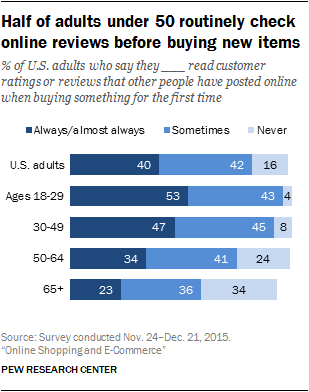

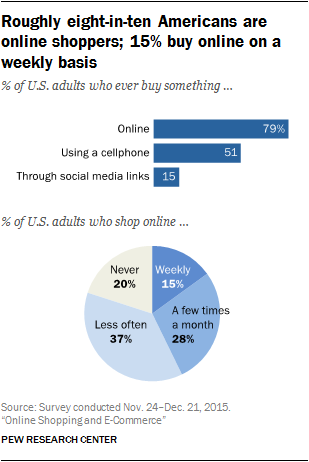

Americans are incorporating a wide range of digital tools and platforms into their purchasing decisions and buying habits, according to a Pew Research Center survey of U.S. adults. The survey finds that roughly eight-in-ten Americans are now online shoppers: 79% have made an online purchase of any type, while 51% have bought something using a cellphone and 15% have made purchases by following a link from social media sites. When the Center first asked about online shopping in a June 2000 survey, just 22% of Americans had made a purchase online. In other words, today nearly as many Americans have made purchases directly through social media platforms as had engaged in any type of online purchasing behavior 16 years ago.But even as a sizeable majority of Americans have joined the world of e-commerce, many still appreciate the benefits of brick-and-mortar stores. Overall, 64% of Americans indicate that, all things being equal, they prefer buying from physical stores to buying online. Of course, all things are often not equal – and a substantial share of the public says that price is often a far more important consideration than whether their purchases happen online or in physical stores. Fully 65% of Americans indicate that when they need to make purchases they typically compare the price they can get in stores with the price they can get online and choose whichever option is cheapest. Roughly one-in-five (21%) say they would buy from stores without checking prices online, while 14% would typically buy online without checking prices at physical locations first.Although cost is often key, today’s consumers come to their purchasing decisions with a broad range of expectations on a number of different fronts. When buying something for the first time, more than eight-in-ten Americans say it is important to be able to compare prices from different sellers (86%), to be able to ask questions about what they are buying (84%), or to buy from sellers they are familiar with (84%). In addition, more than seven-in-ten think it is important to be able to try the product out in person (78%), to get advice from people they know (77%), or to be able to read reviews posted online by others who have purchased the item (74%). And nearly half of Americans (45%) have used cellphones while inside a physical store to look up online reviews of products they were interested in, or to try and find better prices online.The survey also illustrates the extent to which Americans are turning toward the collective wisdom of online reviews and ratings when making purchasing decisions. Roughly eight-in-ten Americans (82%) say they consult online ratings and reviews when buying something for the first time. In fact, 40% of Americans (and roughly half of those under the age of 50) indicate that they nearly always turn to online reviews when buying something new. Moreover, nearly half of Americans feel that customer reviews help “a lot” to make consumers feel confident about their purchases (46%) and to make companies be accountable to their customers (45%).But even as the public relies heavily on online reviews when making purchases, many Americans express concerns over whether or not these reviews can be trusted. Roughly half of those who read online reviews (51%) say that they generally paint an accurate picture of the products or businesses in question, but a similar share (48%) say it’s often hard to tell if online reviews are truthful and unbiased.Finally, this survey documents a pronounced shift in how Americans engage with one of the oldest elements of the modern economy: physical currency. Today nearly one-quarter (24%) of Americans indicate that none of the purchases they make in a typical week involve cash. And an even larger share – 39% – indicates that they don’t really worry about having cash on hand, since there are so many other ways of paying for things these days. Nonwhites, low-income Americans and those 50 and older are especially likely to rely on cash as a payment method....MUCH MORE